High-deductible health insurance, or HDHP, is a type of health plan that offers lower premiums in exchange for a higher deductible. This means you pay less each month, but you’ll have to pay more out-of-pocket before your insurance kicks in.

It’s a popular option for people who are healthy and don’t expect to use their health insurance often. But is it the right choice for you?

HDHPs often come with a Health Savings Account (HSA), which is a tax-advantaged savings account that can be used to pay for healthcare expenses. This can be a great way to save money on healthcare costs, especially if you’re a savvy planner and like to take control of your finances.

What is High-Deductible Health Insurance?

High-deductible health insurance (HDHP) is a type of health insurance plan that has a higher deductible than traditional health insurance plans. This means that you will have to pay more out-of-pocket for your healthcare costs before your insurance coverage kicks in.

However, HDHPs typically have lower premiums than traditional plans.

Key Characteristics of HDHPs

HDHPs are characterized by several key features:

- High Deductibles:HDHPs have significantly higher deductibles than traditional plans. You must pay the entire deductible amount before your insurance coverage begins. For example, a typical HDHP might have a deductible of $1,400 for individuals and $2,800 for families.

- Lower Premiums:In exchange for the higher deductible, HDHPs typically have lower monthly premiums than traditional plans. This can be a significant benefit for individuals and families who are looking to save money on their health insurance costs.

- Health Savings Account (HSA):HDHPs are often paired with a Health Savings Account (HSA). An HSA is a tax-advantaged savings account that can be used to pay for healthcare expenses. You can contribute pre-tax dollars to your HSA, which can help you save money on taxes and healthcare costs.

Comparison with Traditional Health Insurance Plans, High-deductible health insurance

HDHPs differ from traditional health insurance plans in several key ways:

| Feature | HDHP | Traditional Plan |

|---|---|---|

| Premiums | Lower | Higher |

| Deductibles | Higher | Lower |

| Out-of-Pocket Expenses | Potentially higher, but can be mitigated with an HSA | Lower, but premiums are higher |

Benefits of Choosing an HDHP

There are several benefits to choosing an HDHP, including:

- Lower Premiums:HDHPs typically have lower premiums than traditional plans, which can save you money on your monthly health insurance costs. This is especially beneficial for individuals and families who are healthy and do not expect to use a lot of healthcare services.

- Tax Advantages:Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This can help you save money on taxes and healthcare costs.

- Flexibility:You can use the money in your HSA to pay for a wide range of qualified medical expenses, including deductibles, copayments, coinsurance, and prescription drugs. You can also use it for over-the-counter medications and other eligible expenses.

Drawbacks of Choosing an HDHP

There are also some drawbacks to consider when choosing an HDHP:

- High Deductibles:You will need to pay a significant amount out-of-pocket before your insurance coverage kicks in. This can be a significant financial burden if you have a serious medical condition or require frequent healthcare services.

- Limited Coverage:HDHPs often have limited coverage for certain services, such as preventive care and mental health services.

- Out-of-Pocket Maximum:Even though HDHPs have lower premiums, you may still have a high out-of-pocket maximum. This is the maximum amount you will have to pay for healthcare expenses in a given year.

How Does a Health Savings Account (HSA) Work?

The Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals with high-deductible health insurance plans (HDHPs) to set aside money for medical expenses. HSAs offer significant tax benefits and can help you save for future healthcare costs.

HSA Eligibility

You can only contribute to an HSA if you have a qualifying HDHP. This means your health insurance plan must meet certain requirements regarding deductibles and out-of-pocket maximums. The IRS sets these minimums annually. The IRS website is the best source of information on these requirements.

Eligibility and Enrollment for HDHPs

You’re ready to dive into the world of high-deductible health plans (HDHPs), but first, let’s make sure you qualify and understand how to sign up. Eligibility for an HDHP is based on a few key factors, and the enrollment process might vary depending on your situation.

Let’s break it down!

Eligibility Requirements for HDHPs

To be eligible for an HDHP, you must meet the following criteria:

- Not be covered by another health insurance plan. This means you can’t have a traditional health insurance plan, a health savings account (HSA), or a flexible spending account (FSA) at the same time as an HDHP.

- Not be enrolled in Medicare. Medicare is a government-funded health insurance program for people aged 65 and older or those with certain disabilities.

- Not be claimed as a dependent on someone else’s tax return. This means you must be the primary taxpayer for your own household.

Enrollment Process and Options

The enrollment process for HDHPs typically follows these steps:

- Determine your eligibility. Use the criteria above to make sure you qualify for an HDHP.

- Choose an HDHP plan. You can find HDHPs through your employer, the Health Insurance Marketplace, or directly from insurance companies.

- Enroll in the plan. Once you’ve chosen a plan, you’ll need to complete the enrollment process, which usually involves providing personal information and paying any applicable premiums.

Factors to Consider When Choosing an HDHP

When choosing an HDHP, consider these factors:

- Your health status. If you anticipate needing frequent medical care, an HDHP might not be the best option for you.

- Your budget. HDHPs typically have lower monthly premiums than traditional health insurance plans, but you’ll need to be prepared to pay a higher deductible if you need medical care.

- Your savings habits. HDHPs allow you to open a health savings account (HSA), which can help you save money on healthcare expenses. However, you’ll need to be disciplined about saving money in your HSA to make the most of this benefit.

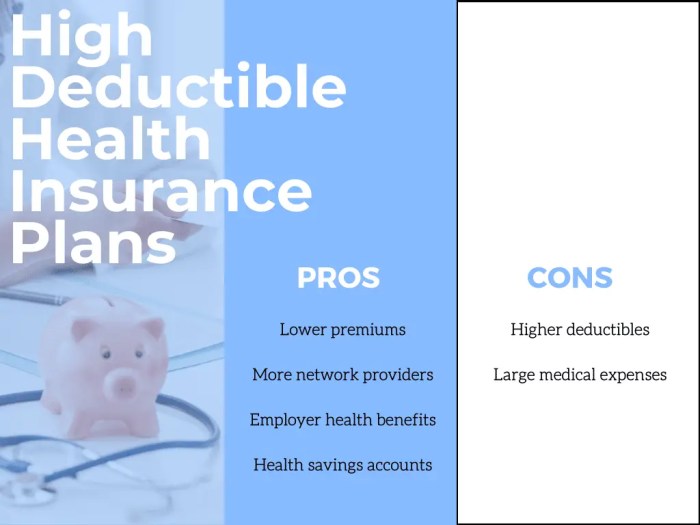

Advantages and Disadvantages of HDHPs

High-deductible health plans (HDHPs) are a popular option for individuals and families looking to save money on their health insurance premiums. However, it’s crucial to weigh the advantages and disadvantages before deciding if an HDHP is right for you.

Advantages of HDHPs

HDHPs offer several benefits, including lower premiums and potential tax savings.

- Lower Premiums:HDHPs typically have lower monthly premiums than traditional health plans. This can be a significant advantage, especially for individuals and families on a tight budget.

- Tax Advantages:HDHPs are eligible for a Health Savings Account (HSA). HSAs offer tax advantages, allowing you to contribute pre-tax dollars and withdraw funds tax-free for qualified medical expenses.

- Potential for Savings:If you are healthy and rarely use healthcare services, an HDHP can save you money. You’ll pay a lower premium, and if you don’t need to use your coverage, you’ll keep your HSA funds.

Disadvantages of HDHPs

While HDHPs offer advantages, they also come with potential drawbacks.

- High Deductible:HDHPs have higher deductibles than traditional health plans. This means you’ll need to pay a significant amount out-of-pocket before your insurance kicks in.

- Potential for High Out-of-Pocket Costs:If you have a serious health condition or require frequent medical care, an HDHP can result in high out-of-pocket costs.

- Limited Coverage:Some HDHPs may have limited coverage for certain services, such as preventive care or prescription drugs.

HDHPs for Different Individuals and Families

The suitability of an HDHP depends on individual circumstances.

- Healthy Individuals and Families:For healthy individuals and families who rarely use healthcare services, an HDHP can be a cost-effective option. They can save money on premiums and potentially build a tax-advantaged HSA.

- Individuals with Chronic Conditions:Individuals with chronic conditions who require frequent medical care may find an HDHP less appealing. The high deductible and potential for high out-of-pocket costs could be a significant financial burden.

- Individuals on a Tight Budget:HDHPs can be attractive to individuals on a tight budget due to lower premiums. However, they must be prepared to pay the high deductible if they need healthcare services.

Understanding Deductibles and Out-of-Pocket Maximums

High-deductible health plans (HDHPs) come with specific features that impact how you pay for healthcare. Two key elements are the deductible and the out-of-pocket maximum. Understanding these concepts is crucial for making informed decisions about your healthcare coverage.

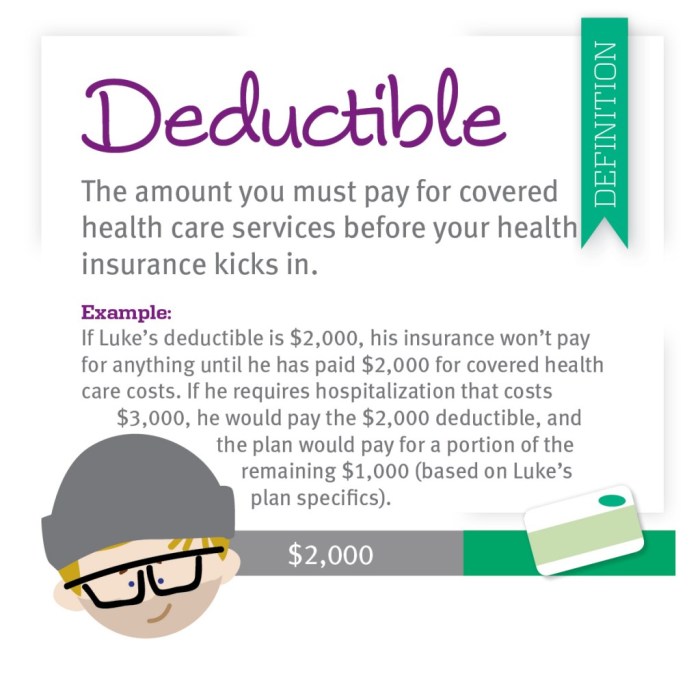

Deductibles

The deductible is the amount you pay out-of-pocket for healthcare services before your insurance starts covering costs. For example, if your deductible is $2,000, you’ll pay the first $2,000 of your medical expenses yourself. After you’ve met your deductible, your insurance will begin covering a percentage of your remaining healthcare costs.

High-deductible health insurance can be a great way to save on premiums, but it can also leave you with a hefty bill if you face a major medical event. If you’re on Medicare, you might want to consider Medicare supplemental insurance to help cover those out-of-pocket costs.

While it’s not a perfect fit for everyone, it can provide peace of mind knowing that you’ll have help with unexpected medical bills, even with a high-deductible plan.

Out-of-Pocket Maximums

The out-of-pocket maximum is the total amount you’ll pay for covered healthcare services in a year. This includes deductibles, copayments, and coinsurance, but it does not include premiums. Once you reach your out-of-pocket maximum, your insurance will cover 100% of your remaining healthcare costs for the rest of the year.

Examples of Deductibles and Out-of-Pocket Maximums

Here are a few examples to illustrate how deductibles and out-of-pocket maximums work in real-world scenarios:* Scenario 1:Imagine you have an HDHP with a $3,000 deductible and a $5,000 out-of-pocket maximum. You need surgery that costs $10,000. You’ll pay the first $3,000 (deductible) out-of-pocket.

After that, your insurance will cover the rest of the cost. Your total out-of-pocket expenses for the surgery would be $3,000.

Scenario 2

You have an HDHP with a $2,500 deductible and a $4,000 out-of-pocket maximum. You have several doctor’s visits and prescription costs throughout the year, totaling $3,500. You’ll pay the first $2,500 (deductible) out-of-pocket. After that, your insurance will cover the remaining $1,000, bringing your total out-of-pocket expenses to $3,500.

Scenario 3

You have an HDHP with a $1,000 deductible and a $6,000 out-of-pocket maximum. You have a major medical event, such as a hospital stay, costing $12,000. You’ll pay the first $1,000 (deductible) out-of-pocket. You’ll then continue to pay a percentage of the remaining cost (coinsurance) until you reach your out-of-pocket maximum of $6,000.

After that, your insurance will cover the remaining $6,000 of the medical bill.

Using an HSA for Healthcare Expenses

The Health Savings Account (HSA) is a powerful tool for managing healthcare costs. It allows you to set aside pre-tax dollars to pay for eligible medical expenses. Here’s how HSAs work and their advantages:

Using HSA Funds for Healthcare Expenses

HSAs offer flexibility in paying for medical expenses. You can use HSA funds for a wide range of eligible healthcare costs, including:

- Deductibles:You can use HSA funds to pay for the deductible portion of your health insurance plan before your insurance coverage kicks in.

- Copayments:HSA funds can cover copayments, which are fixed amounts you pay for services like doctor visits or prescriptions.

- Coinsurance:You can use HSA funds to pay for coinsurance, which is a percentage of the cost of medical services that you are responsible for.

- Prescription Drugs:HSA funds can cover the cost of prescription drugs, both generic and brand-name.

- Over-the-Counter Medications:While typically not covered by health insurance, certain over-the-counter medications can be eligible for HSA reimbursement if prescribed by a doctor.

- Dental and Vision Care:Some HSAs may cover dental and vision care, but this depends on your specific plan.

- Other Eligible Expenses:This includes medical equipment, mental health services, and long-term care.

Tax Advantages of Using HSA Funds

The primary benefit of an HSA is its tax advantages:

- Tax-Deductible Contributions:Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute.

- Tax-Free Growth:Earnings on HSA funds grow tax-free, allowing your savings to compound without being taxed.

- Tax-Free Withdrawals for Qualified Medical Expenses:Withdrawals from an HSA for qualified medical expenses are tax-free. This means you won’t have to pay any taxes on the money you withdraw to pay for medical bills.

Examples of Using an HSA

Here are some real-life examples of how HSAs can be used:

- Paying for a Deductible:Imagine you have a $2,000 deductible on your health insurance plan. You can use HSA funds to pay for the first $2,000 of medical expenses before your insurance starts covering costs.

- Covering Copayments:You need to see a doctor for a routine checkup. Your health insurance plan requires a $20 copayment. You can use your HSA to pay for this copayment.

- Paying for Prescription Drugs:You need to fill a prescription for a medication that costs $100. You can use your HSA to pay for the entire cost of the prescription.

- Saving for Future Medical Expenses:You can also contribute to your HSA and let the funds grow tax-free, allowing you to save for potential future medical expenses, such as a major surgery or long-term care.

Choosing the Right HDHP for Your Needs

Navigating the world of high-deductible health plans (HDHPs) can feel like deciphering a complex code. But fear not! Understanding the key factors to consider when choosing an HDHP can help you find the plan that best fits your unique needs and financial situation.

Comparing Plans from Different Insurance Providers

It’s crucial to compare plans from different insurance providers to ensure you’re getting the best value for your money. Every insurer offers a unique set of coverage options, deductibles, copayments, and out-of-pocket maximums.

- Compare deductibles and out-of-pocket maximums: Look for plans with deductibles and out-of-pocket maximums that align with your budget and expected healthcare needs. For example, if you are generally healthy and anticipate minimal healthcare expenses, a higher deductible might be suitable. Conversely, if you have pre-existing conditions or expect frequent healthcare visits, a lower deductible might be more beneficial.

- Evaluate coverage for essential services: Ensure the plan covers essential services you might need, such as preventive care, prescription drugs, and mental health services.

- Consider the provider network: Check if your preferred doctors and hospitals are included in the plan’s network. Out-of-network costs can be significantly higher.

- Review the premium costs: While HDHPs typically have lower monthly premiums compared to traditional plans, consider the overall cost of the plan, including deductibles, copayments, and out-of-pocket maximums.

Selecting an HDHP That Aligns with Your Needs

When selecting an HDHP, consider your individual health needs and financial situation.

- Assess your health status: If you are generally healthy and anticipate minimal healthcare expenses, an HDHP could be a cost-effective option. However, if you have pre-existing conditions or expect frequent healthcare visits, a traditional plan with lower deductibles might be more suitable.

- Consider your financial situation: Evaluate your ability to cover the deductible and out-of-pocket maximums. Consider your income, savings, and any potential financial emergencies.

- Explore the benefits of an HSA: An HSA can help you save for future healthcare expenses and potentially reduce your overall healthcare costs. However, remember that HSAs have contribution limits, and withdrawals for non-healthcare expenses are subject to taxes and penalties.

- Seek professional advice: Consult with a healthcare professional or financial advisor to determine the best plan for your individual needs. They can help you understand the complexities of HDHPs and make an informed decision.

Managing Healthcare Costs with an HDHP

High-deductible health plans (HDHPs) can offer significant savings on premiums, but they come with a higher out-of-pocket cost for healthcare services. This means you’ll need to be proactive in managing your healthcare expenses to avoid unexpected financial burdens.

Preventive Care and Early Detection

Regular preventive care is essential for managing healthcare costs, especially with an HDHP. By catching health issues early, you can often avoid more expensive treatments later. This can include:

- Annual physical exams and screenings

- Immunizations and vaccinations

- Dental checkups and cleanings

- Vision exams

Negotiating Medical Bills and Understanding Coverage

Understanding your insurance coverage and negotiating medical bills can help you save money.

- Review your Explanation of Benefits (EOB) carefully. The EOB Artikels the charges for your medical services and how your insurance plan covered them. It’s important to understand what you’re being charged for and whether the charges are accurate.

- Negotiate with providers. You can often negotiate lower prices for medical services, especially if you’re paying out of pocket. This may involve asking for a discount for cash payments or exploring payment plans.

- Explore options for financial assistance. Many healthcare providers offer financial assistance programs to patients who cannot afford their medical bills. You can also check with local community organizations or charities for assistance.

- Consider using a healthcare advocate. A healthcare advocate can help you navigate the complexities of the healthcare system and negotiate with providers on your behalf. They can also help you understand your insurance coverage and appeal denied claims.

Conclusive Thoughts

Choosing the right health insurance plan can be a daunting task. High-deductible health insurance can be a good option for some, but it’s important to weigh the pros and cons carefully. Consider your health history, your budget, and your risk tolerance before making a decision.

With a little research and planning, you can find the health insurance plan that best meets your needs.

FAQ Resource: High-deductible Health Insurance

What is the difference between a high-deductible health plan and a traditional health plan?

A traditional health plan typically has lower deductibles and higher premiums, while an HDHP has higher deductibles and lower premiums. Think of it like this: You pay more each month for a traditional plan, but you’ll pay less out-of-pocket when you need healthcare.

With an HDHP, you pay less each month, but you’ll pay more out-of-pocket when you need healthcare.

How much money can I contribute to an HSA each year?

The annual contribution limit for HSAs is set by the IRS and varies based on your coverage status. Check the IRS website for the most up-to-date contribution limits.

Can I use my HSA to pay for things other than medical expenses?

No, you can only use your HSA for qualified medical expenses. These expenses include doctor visits, prescription drugs, and hospital stays. You can’t use your HSA to pay for things like gym memberships or cosmetic surgery.