What are student health insurance plans? They’re a lifeline for students navigating the often unpredictable world of college life. Imagine this: You’re studying late one night, fueled by caffeine and ambition, when suddenly, -bam*, a nasty case of the flu hits you.

Without health insurance, that doctor’s visit and medication could leave a serious dent in your wallet. Student health insurance plans are designed to protect you from these unexpected medical expenses, providing peace of mind and a safety net when you need it most.

These plans offer a range of coverage options, from basic medical care to mental health services, prescription drugs, and even emergency care. They can be tailored to your individual needs and budget, giving you the flexibility to choose the plan that best suits your situation.

Whether you’re living on campus, off-campus, or even studying abroad, there’s a student health insurance plan out there for you.

What are Student Health Insurance Plans?

Student health insurance plans are designed specifically for students, providing coverage for medical expenses while they are pursuing their education. These plans are crucial because they ensure students have access to healthcare services, including preventive care, emergency treatment, and hospitalization, without the financial burden of high medical bills.

Student Health Insurance vs. General Health Insurance

Student health insurance plans differ from general health insurance in several key ways. The most significant distinction is that student plans are typically offered through the student’s university or college, while general health insurance is purchased individually or through an employer.Student health insurance plans are often designed to meet the unique needs of students, such as coverage for mental health services, immunizations, and travel emergencies.

They may also have lower premiums compared to general health insurance plans, as they cover a smaller population with generally lower healthcare utilization.

Student health insurance plans are designed to cover the unique needs of young adults, often offering lower premiums than traditional plans. But what about protecting your loved ones financially if something unexpected happens? That’s where life insurance comes in, and you might be surprised to learn about the cheapest life insurance policies available.

While student health insurance focuses on your immediate well-being, life insurance provides peace of mind for your future.

Types of Student Health Insurance Plans, What are student health insurance plans?

Student health insurance plans come in various forms, each offering different coverage and benefits. Here are some common types:

- On-Campus Plans:These plans are offered by the university or college and are mandatory for all students. They typically provide comprehensive coverage for medical, dental, and mental health services.

- Off-Campus Plans:These plans are available to students who live off-campus and are not covered by the university’s plan. They offer similar coverage to on-campus plans but may have different premiums and benefits.

- Student Specific Plans:These plans are tailored to meet the specific needs of students, such as coverage for international students or students with pre-existing conditions. They may offer additional benefits or features, such as travel insurance or coverage for specific medical needs.

Why Do Students Need Health Insurance?

College is a time of exciting new experiences, but it can also be a time of unexpected medical expenses. That’s why having student health insurance is essential. It can protect you from significant financial burdens and provide peace of mind, allowing you to focus on your studies.

Unexpected Medical Expenses

Students are particularly vulnerable to unexpected medical expenses. Think about it: you’re living away from home, perhaps for the first time, and you’re responsible for managing your own health care. You might not have a regular doctor or know where to go for care when you need it.

And, let’s face it, college life is often stressful, which can take a toll on your health.

Unexpected medical expenses can arise from various situations, such as:

- Accidents:A fall on campus, a bike accident, or a sports injury can all lead to expensive medical bills.

- Illness:From the common cold to more serious conditions, illnesses can strike at any time, requiring doctor visits, medications, and even hospital stays.

- Mental Health:The pressures of college life can lead to mental health issues like anxiety or depression. Seeking professional help is essential, but therapy and medication can be costly.

Types of Student Health Insurance Plans

Navigating the world of student health insurance can feel like entering a maze, but it doesn’t have to be overwhelming. There are various types of plans tailored to different needs and situations. Let’s explore the different options available to students, helping you find the right fit for your journey.

On-Campus Plans

On-campus plans are often offered by universities and colleges as part of their student services. These plans are typically designed to meet the basic healthcare needs of students attending the institution. They often provide coverage for:

- Doctor’s visits

- Hospitalization

- Emergency care

- Prescription drugs

- Mental health services

The coverage and benefits of on-campus plans can vary significantly depending on the institution. It’s essential to review the plan details carefully before enrolling.

Off-Campus Plans

Off-campus plans are health insurance options available to students who are not enrolled in a university or college or who choose not to participate in their institution’s on-campus plan. These plans can be purchased directly from insurance companies or through third-party brokers.Off-campus plans often offer more flexibility and customization options compared to on-campus plans.

They may also provide broader coverage, including:

- Dental care

- Vision care

- Travel insurance

- Wellness programs

However, off-campus plans can be more expensive than on-campus plans, and students should compare different options to find the best value for their needs.

Individual Plans

Individual plans are health insurance policies purchased by individuals, regardless of their student status. These plans offer the most flexibility in terms of coverage and benefits, allowing students to customize their plan based on their specific healthcare needs and budget.Individual plans often provide:

- Comprehensive coverage for a wide range of medical services

- The ability to choose your own doctor and hospital

- Potential for lower premiums if you are healthy and have a good medical history

However, individual plans can be more expensive than on-campus or off-campus plans, especially if you have pre-existing medical conditions.

State-Specific Plans

Some states offer health insurance plans specifically designed for students, known as state-specific plans. These plans are often subsidized by the state government, making them more affordable than other options.State-specific plans typically provide:

- Essential health benefits, including preventive care, prescription drugs, and mental health services

- Lower premiums compared to individual plans

- Eligibility requirements based on residency and income

The availability and specific features of state-specific plans vary depending on the state. Students should check with their state’s health insurance marketplace for more information.

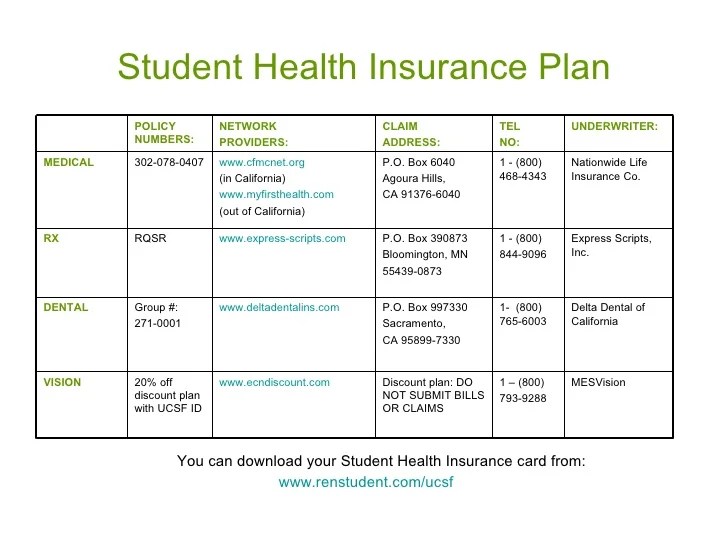

Key Features and Benefits of Student Health Insurance Plans

Student health insurance plans are designed to provide comprehensive coverage for a variety of medical needs, offering peace of mind and financial protection for students. These plans typically include a range of essential features and benefits that cater to the unique healthcare requirements of students.

Medical Expenses

Medical expenses are a significant aspect of healthcare, and student health insurance plans provide coverage for a wide range of medical services. This includes doctor’s visits, hospital stays, surgeries, and other necessary treatments.

- Doctor’s Visits:Student health insurance plans cover routine checkups, consultations with specialists, and diagnostic tests. The plan may have a co-pay or coinsurance requirement for each visit, depending on the specific policy.

- Hospital Stays:In case of hospitalization, the insurance plan covers the cost of room and board, nursing care, and other related expenses. The plan may have a daily limit on the coverage amount.

- Surgeries:Student health insurance plans typically cover a range of surgical procedures, including both inpatient and outpatient surgeries. The plan may have specific coverage limitations for certain types of surgeries.

- Other Medical Treatments:These plans cover a wide array of medical treatments, such as physical therapy, occupational therapy, and mental health services. Coverage may vary depending on the specific plan and the type of treatment.

Mental Health Services

Mental health is an integral part of overall well-being, and student health insurance plans recognize its importance. These plans provide coverage for mental health services, offering students access to professional support and treatment.

- Therapy Sessions:Student health insurance plans typically cover a certain number of therapy sessions per year. This includes individual therapy, group therapy, and family therapy.

- Psychiatric Evaluations:The plans may cover the cost of psychiatric evaluations, which are essential for diagnosing and treating mental health conditions.

- Medication Management:Student health insurance plans may cover the cost of prescription medications for mental health conditions, ensuring that students have access to the necessary treatment.

Prescription Drugs

Prescription drugs are an essential part of healthcare, and student health insurance plans provide coverage for a wide range of medications.

- Generic Medications:Student health insurance plans generally cover generic medications at a lower cost than brand-name drugs. This helps students save money on their prescriptions.

- Brand-Name Medications:Some student health insurance plans may cover brand-name medications, but there may be a higher co-pay or coinsurance requirement compared to generic medications.

- Prescription Drug Formularies:Student health insurance plans typically have a formulary, which is a list of medications that are covered by the plan. It is important to check the formulary to ensure that the medications you need are covered.

Emergency Care

Emergency care is crucial in situations where immediate medical attention is required. Student health insurance plans provide coverage for emergency medical services, ensuring that students receive timely and appropriate treatment.

- Emergency Room Visits:Student health insurance plans cover emergency room visits when necessary. The plan may have a co-pay or coinsurance requirement for emergency room visits.

- Ambulance Transportation:In case of an emergency, student health insurance plans typically cover ambulance transportation to the nearest hospital or medical facility.

Preventive Care

Preventive care plays a vital role in maintaining good health and preventing diseases. Student health insurance plans often provide coverage for preventive services, encouraging students to prioritize their well-being.

- Annual Physical Exams:Student health insurance plans may cover the cost of annual physical exams, which are essential for monitoring overall health and identifying any potential health concerns.

- Vaccinations:Student health insurance plans may cover the cost of vaccinations, including flu shots, measles, mumps, and rubella vaccines. Vaccinations help prevent the spread of contagious diseases.

- Cancer Screenings:Some student health insurance plans may cover cancer screenings, such as mammograms and colonoscopies. Early detection of cancer can significantly improve treatment outcomes.

Choosing the Right Student Health Insurance Plan

Navigating the world of student health insurance plans can feel overwhelming, especially when you’re juggling academics, social life, and a tight budget. But don’t worry, with a little research and planning, you can find the perfect plan to keep you healthy and financially secure.

Factors to Consider When Choosing a Student Health Insurance Plan

Choosing the right plan requires careful consideration of your unique needs and circumstances. Here’s a step-by-step guide to help you make an informed decision:

Coverage Needs

- Assess your health history and potential risks.Do you have any pre-existing conditions that require specific coverage? Are you prone to certain health issues? This will help you determine the essential coverage components.

- Consider the types of medical services you might need.Think about the possibility of doctor’s visits, prescription medications, mental health services, and emergency care. Ensure the plan you choose offers adequate coverage for these services.

- Evaluate the coverage limits and deductibles.Some plans have lower deductibles but higher premiums, while others offer higher deductibles with lower premiums. Determine what best fits your budget and risk tolerance.

Budget

- Compare premiums and out-of-pocket costs.Understand the annual premium, co-payments, and deductibles associated with each plan. Consider the overall cost over the duration of your studies.

- Explore student discounts and financial aid options.Some universities or colleges may offer discounts on health insurance premiums. Additionally, inquire about financial aid programs that can help with health insurance costs.

- Factor in the potential for unexpected medical expenses.While you may not anticipate needing extensive medical care, it’s wise to consider the financial impact of unexpected events and ensure your plan provides adequate coverage.

Availability of Plans

- Check if your university or college offers a student health insurance plan.Many institutions have partnerships with insurance providers, offering plans specifically tailored to their student population. These plans often provide convenient access to healthcare services within the university’s network.

- Explore off-campus options.If your university doesn’t offer a plan, or if you prefer more flexibility, research independent insurance providers that offer student health insurance plans. Compare their coverage options, premiums, and networks.

- Verify plan coverage areas.Ensure the plan you choose covers you in the geographic area where you’ll be studying. Some plans may have limitations or exclusions based on location.

Reviews and Ratings

- Read reviews and ratings from other students.Online platforms and student forums can provide valuable insights into the experiences of students with different insurance providers. Look for feedback on customer service, claim processing, and overall satisfaction.

- Consult with independent organizations.Organizations like the National Committee for Quality Assurance (NCQA) rate health insurance plans based on their performance and quality of care. Consider their ratings when evaluating different options.

- Reach out to the insurance provider directly.Ask specific questions about coverage, claims procedures, and customer support. This can help you gain a deeper understanding of the plan and its strengths and weaknesses.

Cost and Payment Options for Student Health Insurance

Understanding the cost of student health insurance and how it’s calculated is crucial for making informed decisions. The premium, or monthly cost, varies depending on several factors, including the coverage level, the insurance provider, and the student’s age and location.

Premium Calculation Factors

The cost of student health insurance premiums is influenced by a number of factors. These factors are used to determine the overall risk associated with insuring a student population.

- Coverage Level:Higher coverage levels, which include more comprehensive benefits and services, typically come with higher premiums.

- Insurance Provider:Different insurance companies have varying costs based on their administrative expenses, risk assessment models, and network of healthcare providers.

- Student’s Age:Younger students generally have lower premiums than older students, as they are statistically less likely to require extensive healthcare services.

- Location:Premiums can vary based on the cost of living and healthcare expenses in the student’s geographic area.

Payment Options

Students have a variety of payment options available to them, making it easier to manage their health insurance costs.

- Monthly Payments:The most common payment method is to pay a fixed monthly premium, typically deducted from a student’s bank account or charged to a credit card.

- Semester Payments:Some insurance providers offer the option to pay premiums on a semester basis, allowing students to spread out their costs over the academic year.

- Annual Payments:Students can sometimes choose to pay their premiums in one lump sum annually, which may result in a discount.

- Payment Plans:Some insurance providers offer payment plans that allow students to break down their premiums into smaller installments, making it more manageable.

Financial Assistance Programs and Scholarships

Financial assistance programs and scholarships are available to help students with the cost of health insurance. These programs can be a valuable resource for students facing financial challenges.

- State and Federal Programs:Several states and federal programs offer subsidies and tax credits to help individuals afford health insurance. These programs often have income and eligibility requirements.

- University-Based Programs:Some universities provide financial assistance or scholarships specifically for student health insurance. These programs may be based on need or academic merit.

- Private Organizations:Non-profit organizations and foundations may offer grants or scholarships to help students pay for health insurance.

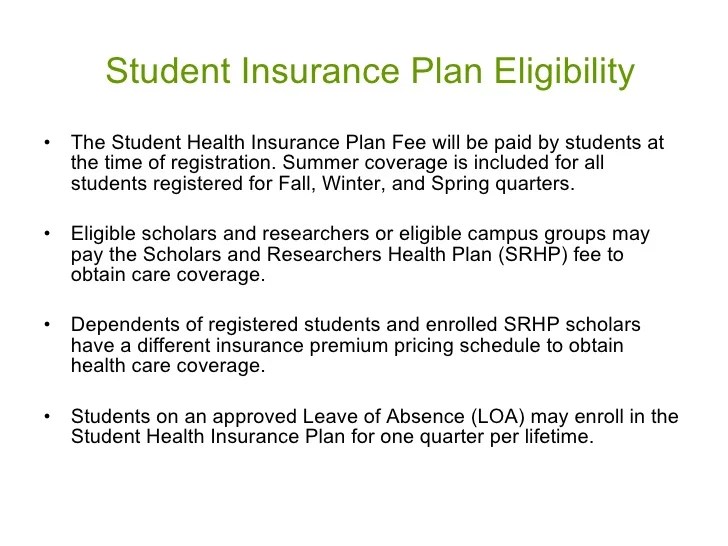

Enrollment and Coverage Details

Enrolling in a student health insurance plan is a straightforward process, but understanding the details is crucial for maximizing your coverage and ensuring a smooth experience. This section will guide you through the enrollment process, key dates, and essential information about coverage details.

Enrollment Periods

The enrollment period for student health insurance plans is typically during the academic year. You can usually enroll during the following periods:

- Open Enrollment:This period occurs at the beginning of each academic year, allowing students to choose their plan and make changes to their coverage.

- Special Enrollment:In some cases, students may be eligible for special enrollment periods outside the regular open enrollment period. This could be due to a change in residency, marriage, or the birth of a child.

It’s important to check with your school or insurance provider for specific enrollment dates and deadlines.

Required Documentation

When enrolling in a student health insurance plan, you will usually need to provide the following documentation:

- Proof of Identity:A valid driver’s license, passport, or other government-issued identification.

- Proof of Residency:A utility bill, lease agreement, or other document showing your current address.

- Student Status:A copy of your student ID card or enrollment confirmation from your school.

- Financial Information:Information about your payment method, such as credit card details or bank account information.

Coverage Start and End Dates

Your student health insurance coverage typically starts on the first day of the academic year and ends on the last day of the academic year. However, this may vary depending on the specific plan and your school’s policies.

It’s essential to understand the start and end dates of your coverage to ensure you have adequate protection throughout the academic year.

Student Health Insurance and International Students: What Are Student Health Insurance Plans?

International students face unique challenges when it comes to healthcare, as they often navigate a new healthcare system with different regulations and costs. Understanding the specific needs of international students and the differences between domestic and international student health insurance plans is crucial for ensuring they have adequate coverage.

International Student Health Insurance Needs

International students require health insurance that meets the specific requirements of their visa status and the institution they are attending. These needs typically include:

- Comprehensive Coverage: International students need coverage for a wide range of medical expenses, including doctor’s visits, hospitalizations, emergency care, and prescription drugs.

- Emergency Medical Evacuation: This coverage is essential in case of a medical emergency requiring transportation back to their home country.

- Repatriation of Remains: In the unfortunate event of death, this coverage assists with the transportation of the deceased’s remains back to their home country.

- Compliance with Visa Requirements: Many countries require international students to have health insurance as a condition of their visa. It is crucial to ensure the chosen plan meets these requirements.

Differences Between Domestic and International Student Health Insurance Plans

Domestic and international student health insurance plans differ in several key aspects:

- Coverage Scope: International plans often provide broader coverage, including emergency medical evacuation and repatriation of remains, which are not always included in domestic plans.

- Cost: International plans tend to be more expensive due to the additional coverage they offer.

- Eligibility: Domestic plans are generally available only to students who are citizens or permanent residents of the country. International plans are designed specifically for students from other countries.

- Network Providers: International plans may have a smaller network of providers compared to domestic plans, making it important to check the network before choosing a plan.

Resources for International Students Seeking Health Insurance

International students can find information and resources on student health insurance from various sources:

- University International Student Office: The international student office at the university can provide information about specific health insurance requirements and recommended plans.

- Embassy or Consulate: The student’s embassy or consulate in the host country can offer guidance on health insurance requirements and recommend reputable providers.

- Insurance Brokers: Insurance brokers specializing in international student health insurance can assist in finding suitable plans and provide expert advice.

- Online Resources: Websites like the Council on International Educational Exchange (CIEE) and the Institute of International Education (IIE) offer information and resources on international student health insurance.

Ultimate Conclusion

Navigating the world of student health insurance can seem overwhelming, but remember, you’re not alone! With a little research and a clear understanding of your needs, you can find the perfect plan to keep you healthy and financially secure throughout your college journey.

So, take the time to explore your options, compare plans, and choose the one that fits your lifestyle and budget. You’ll be glad you did when you’re facing those unexpected medical hurdles.

Frequently Asked Questions

What happens if I already have health insurance through my parents?

If you have health insurance through your parents, you may not need to enroll in a separate student health insurance plan. However, it’s important to check with your parents’ insurance provider to see if their plan covers you while you’re attending college.

Some plans may have limitations or exclusions for students living away from home.

Can I choose a different student health insurance plan if my school’s plan doesn’t meet my needs?

Yes, you can usually choose a different student health insurance plan if your school’s plan doesn’t meet your needs. Many schools offer a variety of plans from different providers, so you can compare coverage and prices to find the best option for you.

How do I know if I need student health insurance?

It’s best to check with your school’s health services department to determine if student health insurance is required or recommended. They can provide information about the benefits of having health insurance and help you decide if it’s right for you.