What are the best health insurance plans for individuals? This is a question that many people ask themselves, especially as healthcare costs continue to rise. Choosing the right health insurance plan can be a daunting task, but it’s essential for protecting your financial well-being and ensuring access to quality healthcare.

Navigating the world of health insurance can feel like deciphering a foreign language. There are HMOs, PPOs, deductibles, and co-pays – all terms that can leave you scratching your head. But don’t worry! We’re here to break down the complexities and help you find a plan that fits your needs and budget.

Understanding Your Needs

Choosing the right health insurance plan is a crucial decision that requires careful consideration of your individual needs and circumstances. It’s not a one-size-fits-all situation, and what works for one person might not be the best option for another.

Factors Influencing Individual Health Insurance Needs

Your individual health insurance needs are influenced by a combination of factors. It’s important to understand these factors to make an informed decision.

- Age:As you age, your healthcare needs tend to increase. You might be more prone to chronic conditions, requiring more frequent doctor visits and potentially higher healthcare costs.

- Health Status:Your current health status plays a significant role in determining your insurance needs. If you have pre-existing conditions, you might need a plan with comprehensive coverage and robust benefits.

- Lifestyle:Your lifestyle choices can also influence your healthcare needs. For example, if you’re an active individual who enjoys outdoor activities, you might consider a plan with coverage for sports-related injuries.

- Budget:Your financial situation is a crucial factor to consider. Health insurance premiums can vary widely, and it’s important to choose a plan that fits your budget while providing adequate coverage.

- Coverage Preferences:Different health insurance plans offer varying levels of coverage and benefits. Consider your priorities and preferences when selecting a plan. For instance, some individuals prioritize coverage for prescription drugs, while others might focus on mental health services.

Assessing Your Healthcare Needs

Once you understand the factors influencing your health insurance needs, it’s time to assess your individual healthcare requirements. This involves taking a comprehensive look at your health history, current health status, and future healthcare needs.

- Review your medical history:Look back at your past medical records and consider any chronic conditions or recurring health issues you’ve experienced. This information will help you understand your potential future healthcare needs.

- Evaluate your current health:Assess your current health status and any ongoing health concerns. Consider whether you require regular doctor visits, medication, or specialized treatments.

- Anticipate future healthcare needs:Think about your potential future healthcare needs. For instance, if you’re planning to start a family, you might want a plan with strong maternity coverage. If you’re approaching retirement, you might consider a plan with coverage for senior care.

Prioritizing Coverage

Once you’ve assessed your healthcare needs, it’s time to prioritize coverage. This involves identifying the essential benefits you need and those you might be willing to compromise on.

- Preventive Care:Preventive care is crucial for maintaining good health and preventing serious illnesses. Look for plans that cover regular checkups, screenings, and vaccinations.

- Prescription Drugs:If you take regular medication, consider plans that offer comprehensive prescription drug coverage. This can help you manage the cost of your medications and ensure you have access to the drugs you need.

- Mental Health Services:Mental health is just as important as physical health. Look for plans that cover mental health services, including therapy, counseling, and medication.

- Other Essential Benefits:Consider other essential benefits, such as coverage for hospital stays, surgery, and emergency care. Ensure the plan you choose provides adequate coverage for these critical healthcare services.

Types of Individual Health Insurance Plans: What Are The Best Health Insurance Plans For Individuals?

Navigating the world of health insurance can feel like trying to decipher a foreign language. But fear not! Understanding the different types of plans available can help you make an informed decision that best suits your needs.

Health Maintenance Organization (HMO)

HMO plans emphasize preventative care and work with a network of doctors and hospitals. They typically have lower monthly premiums compared to other plans.

- Key Features:You choose a primary care physician (PCP) within the network who acts as your gatekeeper for accessing specialists.

- Benefits:Lower premiums, often include preventive care services at no additional cost.

- Drawbacks:Limited network, require referrals for specialist visits, typically have higher out-of-pocket costs if you go outside the network.

Preferred Provider Organization (PPO)

PPO plans offer more flexibility than HMOs, allowing you to see doctors and hospitals both in and out of their network.

- Key Features:You can choose any doctor or hospital you like, but you’ll pay less if you stay within the network.

- Benefits:More network options, no referral needed to see specialists, typically have lower out-of-pocket costs than HMOs.

- Drawbacks:Higher monthly premiums compared to HMOs, higher out-of-pocket costs for out-of-network services.

Exclusive Provider Organization (EPO)

EPO plans are similar to HMOs, but they offer slightly more flexibility. They are a hybrid between HMO and PPO plans.

- Key Features:Like HMOs, you must choose a PCP within the network and get referrals to see specialists. However, you can see out-of-network providers, but it will cost more.

- Benefits:Lower premiums compared to PPOs, typically have lower out-of-pocket costs than HMOs.

- Drawbacks:Limited network, require referrals for specialist visits, out-of-network coverage is limited and usually more expensive.

Point of Service (POS), What are the best health insurance plans for individuals?

POS plans offer a combination of HMO and PPO features.

- Key Features:You choose a PCP within the network, but you can see out-of-network providers if you are willing to pay a higher copayment or coinsurance.

- Benefits:More flexibility than HMOs, lower premiums compared to PPOs.

- Drawbacks:Higher out-of-pocket costs for out-of-network services, may require referrals for specialist visits.

Plan Type Comparison Table

| Plan Type | Network Size | Cost-Sharing | Flexibility |

|---|---|---|---|

| HMO | Limited | Lower premiums, higher out-of-pocket costs for out-of-network services | Low |

| PPO | Larger | Higher premiums, lower out-of-pocket costs for in-network services | High |

| EPO | Limited | Lower premiums, limited out-of-network coverage | Moderate |

| POS | Limited | Lower premiums, higher out-of-pocket costs for out-of-network services | Moderate |

Key Considerations for Choosing a Plan

Choosing the right health insurance plan is crucial for your financial well-being and peace of mind. It’s not just about finding the cheapest option; it’s about finding the plan that best suits your individual needs and circumstances.

Understanding Key Plan Features

When comparing health insurance plans, it’s essential to understand the key features that impact your costs and coverage. These features help you determine how much you’ll pay out-of-pocket for medical care.

- Premium Cost:This is the monthly amount you pay for your health insurance. It’s one of the most obvious factors to consider, but remember, the cheapest plan might not always be the best value.

- Deductible:This is the amount you pay out-of-pocket before your insurance starts covering your medical expenses. A higher deductible typically means a lower premium, but you’ll have to pay more upfront for medical care.

- Co-pay:This is a fixed amount you pay for specific medical services, such as doctor’s visits or prescriptions. Co-pays help to manage costs and encourage you to be more conscious of your healthcare utilization.

- Out-of-Pocket Maximum:This is the maximum amount you’ll pay out-of-pocket for covered medical expenses in a year. Once you reach this limit, your insurance will cover 100% of your eligible medical costs.

- Network Coverage:This refers to the healthcare providers (doctors, hospitals, etc.) included in your insurance plan’s network. Choosing a plan with a network that includes your preferred providers is essential. If you use providers outside your network, you’ll likely face higher out-of-pocket costs.

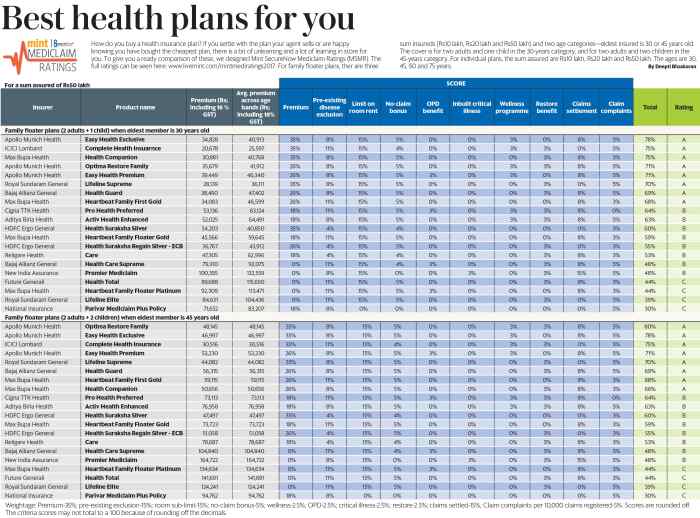

Comparing Plans from Different Insurers

Don’t settle for the first plan you see. It’s crucial to compare plans from multiple insurers to find the best value for your money. Online comparison tools can help you quickly compare plans side-by-side, considering your specific needs and budget.

Asking the Right Questions

Before making a decision, it’s essential to ask your insurer some key questions:

- What are the specific benefits and limitations of the plan?

- Are there any pre-existing conditions that might affect my coverage?

- What are the procedures for filing claims and getting reimbursements?

- Does the plan cover preventive care, such as annual checkups and screenings?

- What are the options for managing my prescription drug costs?

- What are the customer service and grievance procedures?

Finding the Right Plan for You

Now that you have a good understanding of the different types of individual health insurance plans and key considerations for choosing one, let’s dive into the practical steps of finding the right plan for your unique needs.

Utilizing Online Marketplaces and Comparison Tools

Navigating the world of health insurance can be overwhelming, but luckily, several resources can make the process easier. Online marketplaces like Healthcare.gov and state-based exchanges offer a centralized platform to compare plans from different insurers. These marketplaces allow you to filter plans based on your budget, coverage needs, and other preferences.

Additionally, numerous online comparison tools can help you side-by-side compare plans from various insurers, making it easier to identify the best fit for you.

Leveraging Insurance Brokers and Agents

While online resources provide valuable information, seeking guidance from a licensed insurance broker or agent can be incredibly beneficial. These professionals possess extensive knowledge of the health insurance market and can assist you in understanding your options, comparing plans, and navigating the enrollment process.

They can also help you determine if you qualify for any subsidies or tax credits, potentially saving you money on your premiums.

Understanding Enrollment Periods and Deadlines

The open enrollment period for individual health insurance plans typically runs from November 1st to January 15th of each year. During this time, you can apply for coverage or switch plans without a qualifying life event. However, if you miss the open enrollment period, you may only be able to enroll in a plan if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

It’s crucial to stay informed about enrollment deadlines and ensure you take action before the window closes.

Choosing the right health insurance plan can feel like navigating a jungle of confusing acronyms and fine print. But fear not! The key to finding the perfect plan is understanding your individual needs and comparing different options. To get you started, check out this guide on How to find the best health insurance policy?

Once you’ve armed yourself with knowledge, you can confidently explore plans that offer the right coverage for your health and budget. Remember, the best plan is the one that fits your unique situation!

Understanding Coverage and Benefits

Now that you’ve got a handle on the different types of health insurance plans, let’s dive into the nitty-gritty of what your coverage actually means. Understanding the terms and benefits will help you make the most informed decision for your individual needs.

Common Health Insurance Terms

Knowing these common health insurance terms will help you understand the costs associated with your plan and how they might impact your out-of-pocket expenses.

- Deductible:This is the amount you pay out-of-pocket before your insurance kicks in to cover medical expenses. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of medical expenses yourself before your insurance starts covering the rest.

- Co-pay:This is a fixed amount you pay for specific medical services, such as doctor’s visits or prescriptions. Co-pays are usually a lower amount than deductibles and help to keep your overall costs manageable.

- Coinsurance:This is a percentage of the cost of a medical service that you are responsible for paying after you’ve met your deductible. For example, if your coinsurance is 20%, you’ll pay 20% of the cost of a medical service after your deductible is met.

- Out-of-pocket Maximum:This is the maximum amount you’ll have to pay for medical expenses in a given year. Once you reach this limit, your insurance will cover 100% of your remaining medical costs.

Types of Medical Services Covered

Most individual health insurance plans cover a wide range of medical services, including:

- Preventive care:This includes routine checkups, screenings, and immunizations, which are often covered at no cost to you.

- Hospitalization:This includes inpatient care, surgery, and emergency room visits.

- Outpatient care:This includes doctor’s visits, specialist appointments, and physical therapy.

- Prescription drugs:Many plans offer coverage for prescription medications, although the specific drugs covered and the cost-sharing requirements may vary.

- Mental health and substance abuse treatment:Many plans now offer coverage for mental health and substance abuse services, recognizing the importance of overall well-being.

Common Medical Expenses Covered and Excluded

It’s essential to understand what medical expenses are typically covered by your health insurance plan and what might be excluded.

Covered Expenses

- Routine checkups and screenings:Annual physical exams, mammograms, and colonoscopies are often covered under preventive care benefits.

- Emergency room visits:If you require immediate medical attention, emergency room services are generally covered.

- Hospital stays:Costs associated with inpatient hospital care, including room and board, are typically covered.

- Surgery:Most plans cover a wide range of surgical procedures, including elective surgeries and emergency surgeries.

- Prescription medications:Many plans offer coverage for prescription drugs, but the specific drugs covered and cost-sharing requirements may vary.

Excluded Expenses

- Cosmetic procedures:These are generally not covered by health insurance plans.

- Weight loss programs:Most plans do not cover weight loss programs unless they are medically necessary.

- Over-the-counter medications:These are usually not covered by health insurance plans.

- Long-term care:Health insurance plans typically do not cover long-term care services, such as nursing home care or assisted living.

Managing Your Health Insurance

You’ve chosen a health insurance plan, but now what? Managing your health insurance effectively can save you money and ensure you get the most out of your coverage. Let’s dive into some strategies for making the most of your plan.

Maximizing Your Benefits

Knowing your health insurance plan inside and out is crucial for maximizing its benefits. Here are some key strategies to keep in mind:

- Understand Your Coverage:Familiarize yourself with your plan’s coverage details, including deductibles, copayments, coinsurance, and out-of-pocket maximums. This will help you make informed decisions about healthcare services.

- Utilize Preventive Care:Most health insurance plans cover preventive care services like screenings and vaccinations at no cost. Take advantage of these services to maintain your health and potentially prevent costly health problems down the line.

- Consider Generic Medications:Generic medications often cost significantly less than brand-name medications while providing the same therapeutic effects. Ask your doctor about generic options if they are available.

- Take Advantage of Telemedicine:Telemedicine services offer convenient and often more affordable access to healthcare professionals. Check if your plan covers telehealth services and explore its potential benefits.

- Use In-Network Providers:Generally, using in-network providers (doctors, hospitals, etc.) will result in lower out-of-pocket costs. However, always confirm the provider’s participation in your network before scheduling appointments.

- Review Your Plan Regularly:Health insurance plans can change, so it’s essential to review your plan annually to ensure you’re still getting the coverage you need and to identify any potential cost-saving opportunities.

Minimizing Healthcare Costs

While health insurance helps cover healthcare expenses, out-of-pocket costs can still add up. Here are some strategies to minimize your healthcare spending:

- Shop Around for Services:Don’t assume the first provider you find is the most affordable. Compare prices for services like lab tests, imaging scans, and prescription drugs. Websites like GoodRx can help you find the best prices for medications.

- Negotiate Medical Bills:Don’t hesitate to negotiate medical bills. Hospitals and healthcare providers are often willing to negotiate payment plans or discounts, especially if you have a good payment history.

- Use a Health Savings Account (HSA):HSAs allow you to save pre-tax dollars for healthcare expenses. If you have a high-deductible health plan, an HSA can be a valuable tool for managing out-of-pocket costs.

- Explore Financial Assistance Options:Many healthcare providers offer financial assistance programs to patients who cannot afford their medical bills. Ask about these programs if you are struggling to pay for your healthcare.

Keeping Track of Your Coverage

Staying organized and informed about your health insurance is essential for managing your healthcare finances. Here are some key tips:

- Keep Your Policy Documents:Store your health insurance policy documents in a safe and accessible location. Review them regularly to understand your coverage and benefits.

- Track Your Claims:Keep track of your claims and ensure they are processed promptly. If you have any questions or concerns, contact your insurance company.

- Review Your Explanation of Benefits (EOB):Carefully review your EOBs, which detail the costs of your healthcare services and how your insurance plan paid for them. This can help you identify any errors or billing discrepancies.

- Contact Your Insurance Company:Don’t hesitate to contact your insurance company if you have any questions or need assistance understanding your coverage. They are there to help you navigate your plan.

Ending Remarks

Ultimately, finding the best individual health insurance plan is a personal journey. It involves understanding your needs, comparing different options, and making informed decisions. By taking the time to research and understand your choices, you can secure a plan that provides the coverage and peace of mind you deserve.

Remember, your health is your most valuable asset, and having the right insurance can be a vital step in protecting it.

Helpful Answers

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician within their network and get referrals for specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see any doctor within their network without a referral, but usually come with higher premiums.

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. The higher the deductible, the lower your monthly premiums will usually be.

How do I know if I need to enroll in a health insurance plan during Open Enrollment?

Open Enrollment is a specific time of year when you can change your health insurance plan without a qualifying life event. If you’re satisfied with your current plan, you don’t need to enroll again. However, if you’ve had a significant life change, like getting married or having a baby, you may be eligible to enroll outside of Open Enrollment.