What are the best life insurance policies for smokers? It’s a question many smokers ask themselves, especially when they’re looking to protect their loved ones financially. The reality is that smoking can significantly impact your life expectancy and, consequently, your insurance premiums.

But don’t despair! There are still options available, and understanding your options is key to finding the right policy for your needs.

This guide will walk you through the ins and outs of life insurance for smokers, exploring the different types of policies, the factors influencing costs, and strategies for finding affordable coverage. We’ll also address common questions and concerns, providing you with the information you need to make informed decisions about your life insurance.

Understanding the Impact of Smoking on Life Insurance

Smoking is a significant factor that life insurance companies consider when determining your eligibility and premium rates. It’s a well-established fact that smoking significantly increases your risk of developing various health problems, including heart disease, stroke, lung cancer, and other respiratory illnesses.

These health risks directly impact your life expectancy, which is a crucial factor in calculating life insurance premiums.

Life Expectancy and Insurance Premiums

Smoking significantly reduces life expectancy. This is due to the numerous health risks associated with smoking, leading to a higher probability of premature death. Life insurance companies carefully analyze the impact of smoking on life expectancy and adjust premiums accordingly.

Smokers typically face higher premiums compared to non-smokers because they are statistically more likely to make a claim on their policy. The higher risk associated with smokers translates into higher costs for insurance companies, which they pass on to policyholders through increased premiums.

Finding the right life insurance policy as a smoker can feel like navigating a smoke-filled maze. But don’t worry, there are options! You might even consider policies that skip the medical exam, like the ones discussed in this helpful article: What are the best no exam life insurance policies?

. While these no-exam policies can be convenient, it’s important to weigh the pros and cons carefully to find the best fit for your needs and budget as a smoker.

Smoking Categories Used by Insurance Companies

Life insurance companies use different categories to classify smokers based on their smoking habits. These categories usually include:

- Current Smoker:An individual who currently smokes cigarettes or other tobacco products regularly.

- Former Smoker:An individual who has quit smoking but smoked within a specific timeframe, typically within the past few years. The exact timeframe varies depending on the insurance company.

- Non-Smoker:An individual who has never smoked or has not smoked for a significant period, typically several years.

These categories are essential for determining premium rates. Current smokers generally face the highest premiums, while former smokers may receive lower premiums than current smokers but still higher than non-smokers. The specific timeframe for former smokers varies depending on the insurance company and their underwriting guidelines.

Impact of Smoking History on Policy Eligibility

Smoking history can significantly impact your eligibility for life insurance policies. Some insurance companies may have stricter policies for smokers, particularly those with a long history of smoking.

- Denial of Coverage:In some cases, individuals with a significant smoking history may be denied coverage altogether. This is especially true for individuals with health conditions related to smoking, such as lung disease or heart problems.

- Higher Premiums:Even if you are eligible for coverage, your premiums will be significantly higher than those of non-smokers.

The premium increase reflects the higher risk associated with your smoking history.

- Limited Coverage:Some insurance companies may offer limited coverage to smokers, such as a lower death benefit or a shorter policy term. This limitation further reflects the increased risk associated with smoking.

For example, a smoker with a history of lung cancer may be denied coverage altogether or may only be offered a policy with a limited death benefit. In contrast, a former smoker who quit smoking several years ago and has a clean bill of health may be eligible for coverage with a slightly higher premium compared to a non-smoker.It’s crucial to be honest with your insurance company about your smoking history.

Providing inaccurate information can lead to the policy being voided or denied in the future, resulting in significant financial consequences.

Types of Life Insurance Policies for Smokers

Smokers face higher premiums than non-smokers due to their increased risk of health problems. However, smokers still have access to a variety of life insurance policies. Understanding the different types of policies and their features can help smokers find the best coverage for their needs and budget.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It’s known for its affordability, making it a popular choice for smokers.

- Key Features:Term life insurance offers a fixed death benefit if the insured dies within the policy’s term. It is generally less expensive than permanent life insurance, and premiums are typically fixed for the duration of the term.

- Benefits for Smokers:Term life insurance can provide affordable coverage for a set period, allowing smokers to secure financial protection for their loved ones during their working years.

- Pros:

- Lower premiums compared to permanent life insurance.

- Simple and straightforward coverage.

- Provides a death benefit during the policy term.

- Cons:

- No cash value component, meaning no savings or investment feature.

- Coverage expires at the end of the term, requiring renewal or purchase of a new policy.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifelong coverage and builds cash value. It’s a more expensive option than term life insurance, but it offers long-term financial benefits.

- Key Features:Whole life insurance offers a fixed death benefit and accumulates cash value that grows tax-deferred. Premiums are typically fixed for life, and the policy can be borrowed against.

- Benefits for Smokers:Whole life insurance provides lifelong coverage and a cash value component that can be used for various purposes, such as retirement planning or covering unexpected expenses.

- Pros:

- Lifelong coverage, ensuring a death benefit even if the insured lives to a very old age.

- Cash value component that grows over time.

- Potential for tax-deferred growth of cash value.

- Cons:

- Higher premiums than term life insurance.

- Limited flexibility in terms of premium payments.

- May not be the most cost-effective option for smokers who are primarily seeking affordable death benefit coverage.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that combines death benefit coverage with a flexible premium payment structure and a cash value component. It offers greater flexibility than whole life insurance.

- Key Features:Universal life insurance offers a flexible death benefit and premium payment structure. It allows for adjustments to the death benefit and premium payments based on changing needs. The cash value component earns interest at a variable rate, and the policy can be borrowed against.

- Benefits for Smokers:Universal life insurance provides flexibility in terms of premium payments and death benefit coverage, allowing smokers to tailor the policy to their specific circumstances.

- Pros:

- Flexible premium payments, allowing for adjustments based on financial situation.

- Adjustable death benefit to meet changing needs.

- Cash value component that earns interest.

- Cons:

- Premiums can fluctuate depending on market conditions.

- Complexity of the policy structure.

- Potential for higher fees compared to other types of life insurance.

Factors Influencing Policy Costs for Smokers

Life insurance premiums for smokers are generally higher than for non-smokers. This is because smoking significantly increases the risk of developing various health problems, which can lead to premature death. Several factors influence the cost of life insurance for smokers.

Factors Affecting Life Insurance Premiums for Smokers, What are the best life insurance policies for smokers?

The cost of life insurance for smokers is determined by a combination of factors, including:

| Factor | Impact on Premiums | Example |

|---|---|---|

| Age | Older smokers face higher premiums because their life expectancy is shorter. | A 40-year-old smoker may pay a higher premium than a 30-year-old smoker, even if they have similar health conditions. |

| Health Conditions | Smokers with pre-existing health conditions related to smoking, such as lung disease or heart disease, will pay higher premiums. | A smoker with a history of lung cancer will likely face higher premiums than a smoker without any pre-existing conditions. |

| Smoking Habits | The number of cigarettes smoked daily, the duration of smoking, and the type of tobacco used all affect premiums. | A smoker who smokes two packs of cigarettes a day will likely pay a higher premium than a smoker who smokes half a pack a day. |

| Type of Life Insurance | Different types of life insurance policies have varying premium structures. Term life insurance generally has lower premiums than permanent life insurance, but it provides coverage for a limited period. | A smoker may opt for a term life insurance policy with a lower premium, knowing that the coverage is temporary, or choose a permanent life insurance policy with a higher premium for lifelong coverage. |

| Lifestyle Factors | Other lifestyle factors, such as diet, exercise, and alcohol consumption, can also influence premiums. | A smoker who maintains a healthy lifestyle, including regular exercise and a balanced diet, may receive a lower premium than a smoker who has an unhealthy lifestyle. |

| Underwriting Process | Life insurance companies assess individual risks through an underwriting process, which involves reviewing medical history, lifestyle habits, and other relevant factors. | A smoker who provides inaccurate information about their smoking habits during the underwriting process may face higher premiums or even policy denial. |

Finding Affordable Life Insurance Options: What Are The Best Life Insurance Policies For Smokers?

It’s understandable that finding affordable life insurance as a smoker can feel like a daunting task. You might feel like you’re facing higher premiums and limited options. But don’t worry! With a little research and strategic planning, you can secure a policy that fits your budget and provides the coverage you need.

Strategies for Finding Affordable Life Insurance

Finding affordable life insurance as a smoker requires a thoughtful approach. Here’s a step-by-step guide to help you navigate the process:

- Understand Your Needs:Before diving into quotes, assess your family’s financial situation and determine how much life insurance you truly need. Consider factors like outstanding debts, mortgage payments, and your dependents’ future financial security. This will help you narrow down your search to policies that provide adequate coverage without unnecessary expenses.

- Explore Different Policy Types:Life insurance policies come in various forms, each with its own set of features and costs. Term life insurance, which offers coverage for a specific period, is generally more affordable than permanent life insurance, which provides lifelong coverage. Explore different types to find the one that best aligns with your budget and needs.

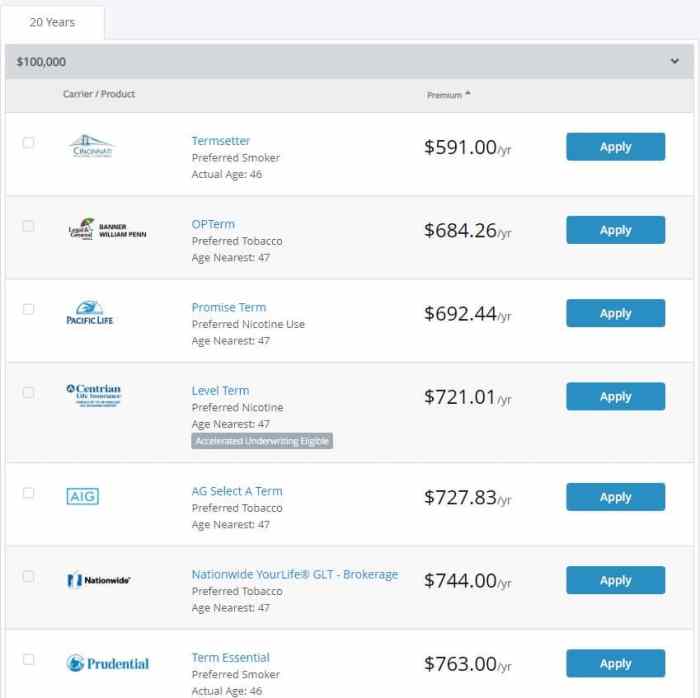

- Shop Around for Quotes:Don’t settle for the first quote you receive. Get quotes from multiple insurance companies to compare prices and coverage options. Online comparison websites can streamline this process, allowing you to easily compare policies side-by-side.

- Consider Healthier Habits:While you may not be able to change your smoking status overnight, making positive changes to your overall health can positively impact your premiums. Engage in regular exercise, maintain a healthy diet, and consider quitting smoking. These actions can demonstrate your commitment to improving your health and potentially lead to lower premiums in the future.

- Explore Discounts:Many insurers offer discounts for healthy habits, such as nonsmoking, good driving records, and participation in wellness programs. Inquire about available discounts to potentially reduce your premiums.

- Negotiate with Your Agent:Don’t hesitate to negotiate with your insurance agent. They might have some flexibility in adjusting premiums based on your specific circumstances.

Comparing Quotes and Finding the Best Value

Comparing quotes is crucial for finding the most affordable life insurance option. When reviewing quotes, consider these factors:

- Premium Amount:The monthly premium is the most obvious factor to consider. Look for policies with premiums that fit your budget.

- Coverage Amount:Ensure the policy provides sufficient coverage to meet your family’s financial needs.

- Policy Term:If you choose term life insurance, consider the length of the term and whether it aligns with your needs.

- Riders and Benefits:Some policies offer additional riders or benefits, such as accidental death coverage or living benefits. Evaluate these features and their potential value to you.

- Company Reputation:Research the insurer’s financial stability and customer satisfaction ratings. Look for companies with a strong track record of paying claims promptly and fairly.

Resources and Tools for Finding Affordable Life Insurance

Several resources and tools can assist you in your search for affordable life insurance:

- Online Comparison Websites:Websites like Policygenius, NerdWallet, and Insurance.com allow you to compare quotes from multiple insurers simultaneously. This can save you time and effort in your search.

- Independent Insurance Agents:Independent agents can provide personalized guidance and help you find policies that meet your specific needs. They often have access to a wide range of insurers and can help you navigate the complexities of the life insurance market.

- Consumer Reports:Consumer Reports provides ratings and reviews of life insurance companies, helping you choose a reputable insurer.

Strategies for Reducing Insurance Costs

As a smoker, you might be paying higher life insurance premiums. However, there are strategies you can employ to potentially reduce these costs.

Reducing Premiums

Taking steps to improve your health can lead to lower premiums. Here are some strategies:

- Quit smoking:This is the most impactful step you can take. Quitting smoking significantly reduces your risk of developing smoking-related illnesses, making you a less risky insured individual. This often leads to a substantial reduction in premiums.

- Maintain a healthy weight:Being overweight or obese increases your risk for various health issues, including heart disease and diabetes. Maintaining a healthy weight can improve your health profile and potentially lower your premiums.

- Exercise regularly:Regular physical activity improves cardiovascular health, lowers blood pressure, and reduces the risk of developing chronic diseases. This can positively impact your insurance rates.

- Manage existing health conditions:If you have pre-existing health conditions, effectively managing them through medication, lifestyle changes, and regular checkups can improve your health status and potentially lower your premiums.

- Consider a shorter policy term:Choosing a shorter policy term, like a 10-year term life insurance policy instead of a 20-year term, can often result in lower premiums. However, ensure it aligns with your needs and financial goals.

- Shop around for different policies:Different insurers have varying underwriting criteria and pricing structures. Comparing quotes from multiple insurers can help you find the most affordable option.

The Impact of Quitting Smoking

Quitting smoking has a significant impact on your life insurance premiums. Insurers recognize the health benefits of quitting and often offer reduced rates to non-smokers.

Cost Comparison

Here’s a table comparing the estimated annual premiums for a 35-year-old male with a $500,000 20-year term life insurance policy:

| Smoker | Non-Smoker |

|---|---|

| $1,200 | $700 |

As you can see, the smoker pays significantly more for the same coverage. This demonstrates the substantial financial benefit of quitting smoking.

Understanding Policy Exclusions and Limitations

While life insurance offers financial protection for your loved ones, it’s crucial to understand that policies often contain exclusions and limitations, especially for smokers. These clauses can restrict coverage or deny benefits in specific situations, impacting the overall value of your policy.

Exclusions and Limitations for Smokers

It’s essential to carefully review your life insurance policy to understand its exclusions and limitations. These clauses can significantly impact your coverage and benefits. Here are some common exclusions and limitations that might apply to smokers:

- Death due to smoking-related illnesses:Many policies exclude coverage for death caused by smoking-related illnesses such as lung cancer, heart disease, or emphysema. This means your beneficiaries might not receive the death benefit if your death is attributed to these conditions.

- Increased premiums or denial of coverage:Smokers often face higher premiums compared to non-smokers. Some insurers might even deny coverage altogether if you smoke, especially if you have a history of smoking-related health issues.

- Limited coverage for specific types of policies:Some life insurance policies, such as term life insurance, might have specific limitations for smokers. For example, they might offer shorter coverage terms or lower death benefits.

- Waiting periods for full coverage:Policies might include waiting periods before full coverage kicks in for smokers. This means that if you die within the waiting period, your beneficiaries might not receive the full death benefit.

- Increased scrutiny during underwriting:Insurers may conduct more rigorous underwriting processes for smokers, including requiring additional medical tests or information. This can delay the approval process and increase the chances of your application being declined.

Implications for Policyholders

These exclusions and limitations can significantly impact policyholders in various ways:

- Reduced financial protection:Exclusions can limit the financial protection your beneficiaries receive if you die due to smoking-related causes.

- Higher premiums:Increased premiums can strain your budget, making life insurance less affordable.

- Limited policy options:Exclusions can restrict your choice of policies, leaving you with fewer options that meet your needs.

- Potential denial of coverage:Denial of coverage can leave your loved ones without financial security in the event of your death.

- Delayed approval process:Increased scrutiny during underwriting can delay the approval process, potentially leaving you without coverage when you need it most.

Examples of Specific Situations

Here are some examples of how exclusions and limitations can impact smokers:

- John, a smoker, dies from lung cancer:John’s life insurance policy excludes coverage for death caused by smoking-related illnesses. As a result, his beneficiaries receive no death benefit.

- Mary, a smoker, applies for a life insurance policy:The insurer requires Mary to undergo additional medical tests and ultimately denies her application due to her smoking history.

- David, a smoker, purchases a term life insurance policy:The policy offers a shorter coverage term and a lower death benefit compared to non-smokers.

- Sarah, a smoker, dies within the waiting period of her life insurance policy:Her beneficiaries receive a reduced death benefit as full coverage had not yet kicked in.

Closure

Navigating the world of life insurance as a smoker can feel like a maze, but armed with the right information, you can find a policy that fits your budget and provides the peace of mind you need. Remember, it’s never too late to make changes to improve your health and potentially lower your premiums.

Don’t hesitate to reach out to a qualified insurance agent for personalized advice and guidance.

FAQ Overview

What if I’m a smoker but I’m planning to quit?

Great news! Many insurance companies offer discounts or lower premiums for smokers who are actively trying to quit. Be sure to check with your insurer about their policies and any programs they offer to support you in your journey.

Do I need to disclose my smoking history?

Absolutely. Honesty is crucial when applying for life insurance. Failing to disclose your smoking history can lead to policy cancellation or even denial of benefits if your insurer finds out later.

Can I get life insurance if I have a pre-existing health condition?

While it might be more challenging, it’s not impossible. Insurance companies consider various factors, including your health history, current health status, and lifestyle choices. It’s best to consult with an insurance agent to discuss your specific situation.