What are the benefits of permanent life insurance? This question often arises when considering financial security and legacy planning. Permanent life insurance, unlike its temporary counterpart, offers a lifetime of coverage, ensuring your loved ones are financially protected, even after you’re gone.

But the benefits go beyond just death benefits. Think of it as a financial fortress, providing a safety net for your family and a tool for building wealth.

Permanent life insurance isn’t just about protection; it’s about creating a legacy. It’s about ensuring your family can maintain their lifestyle, pay off debts, and achieve their dreams, even in your absence. It’s about leaving a lasting impact on those you love, a testament to your care and foresight.

Financial Security and Legacy Planning

Permanent life insurance offers a powerful tool for ensuring your loved ones’ financial security long after you’re gone. It’s not just about covering funeral expenses; it’s about creating a financial safety net that protects your family’s future.

Financial Security for Beneficiaries

Permanent life insurance provides a death benefit, a lump sum payment made to your beneficiaries upon your passing. This money can be used to cover various expenses, ensuring your family’s financial stability during a difficult time.

- Funeral Costs and Final Expenses:These costs can be significant, and permanent life insurance can help alleviate the financial burden on your loved ones.

- Debt Repayment:Mortgages, loans, and credit card debt can be paid off with the death benefit, preventing financial strain on your family.

- Ongoing Living Expenses:Permanent life insurance can provide a steady stream of income for your beneficiaries, helping them maintain their lifestyle and cover everyday expenses.

- Education Costs:The death benefit can be used to fund college tuition or other educational expenses for your children.

- Financial Independence:Permanent life insurance can provide your spouse or other dependents with the financial freedom to pursue their goals and aspirations without worrying about financial constraints.

Role in Estate Planning and Wealth Transfer

Permanent life insurance plays a crucial role in estate planning, enabling you to transfer wealth to your beneficiaries tax-efficiently.

- Estate Tax Minimization:The death benefit is generally exempt from estate taxes, allowing your beneficiaries to receive a larger inheritance.

- Asset Protection:Permanent life insurance can be used to protect your assets from creditors and lawsuits.

- Business Succession Planning:For business owners, permanent life insurance can provide funds to buy out a deceased partner’s shares, ensuring the business’s continuity.

- Charitable Giving:You can name a charity as a beneficiary of your permanent life insurance policy, leaving a lasting legacy and supporting causes you care about.

Cash Value Accumulation

Permanent life insurance is not just about providing a death benefit; it also offers a unique feature known as cash value accumulation. This component acts as a savings vehicle, allowing policyholders to build a nest egg over time.

Permanent life insurance is a great option for those seeking long-term coverage and potential investment growth. But with so many policies out there, it can be a real head-scratcher to figure out which one is right for you! That’s where comparing comes in – check out this helpful guide on How to compare life insurance policies?

to make sure you’re getting the best bang for your buck. Remember, the right permanent life insurance policy can offer peace of mind knowing your loved ones are protected, while potentially building wealth over time.

Understanding Cash Value

Cash value is a portion of your premium that is invested and grows over time. It is not a separate investment account but rather a part of your life insurance policy. As premiums are paid, a portion is allocated to the death benefit, while the remaining amount goes towards building cash value.

This accumulation occurs through a combination of interest earned on the invested funds and dividends (if applicable) paid by the insurance company.

Benefits of Accessing Cash Value, What are the benefits of permanent life insurance?

Cash value can be accessed through loans or withdrawals, providing flexibility and financial security.

Accessing Cash Value Through Loans

- Tax-Deferred Growth:Interest earned on cash value loans is tax-deferred, meaning you only pay taxes when you withdraw the funds.

- Flexibility:You can borrow against your cash value for any purpose, including home renovations, education expenses, or even unexpected medical bills.

- No Credit Check:Unlike traditional loans, cash value loans do not require a credit check, making it an accessible option for individuals with less-than-perfect credit.

Accessing Cash Value Through Withdrawals

- Partial Access:You can withdraw a portion of your cash value without jeopardizing your death benefit.

- Flexibility:Withdrawals can be used for various purposes, such as covering emergency expenses, funding retirement, or paying for unexpected events.

- Tax Considerations:Withdrawals are considered taxable income, but you may be able to deduct the cost basis of the premiums paid.

Comparing Cash Value Growth to Other Investments

Cash value growth is not guaranteed, and its rate of return can vary depending on market conditions and the specific insurance company. However, it generally provides a more stable and predictable growth compared to other investments like stocks or mutual funds.

Tax Advantages

Permanent life insurance offers several tax advantages that can make it an attractive financial planning tool. These advantages can help you maximize your savings and minimize your tax burden, potentially leading to greater financial security for you and your loved ones.

Tax-Free Death Benefit

The death benefit paid out to your beneficiaries upon your passing is generally tax-free. This means your loved ones will receive the full amount of the benefit without having to pay any income taxes on it. This can be a significant benefit, especially for large death benefits, as it can help your family avoid a substantial tax liability at a time when they may be grieving.

For example, if you have a $500,000 permanent life insurance policy and die, your beneficiaries will receive the full $500,000 without having to pay any income taxes on it.

Tax-Deferred Growth of Cash Value

The cash value component of permanent life insurance grows tax-deferred, meaning you won’t have to pay taxes on the earnings until you withdraw them. This allows your money to grow more quickly, as you’re not paying taxes on the interest earned each year.

For example, if you invest $10,000 in a permanent life insurance policy and the cash value grows to $20,000 over 10 years, you won’t have to pay taxes on the $10,000 in earnings until you withdraw them.

Tax-Efficient Savings Vehicle

Permanent life insurance can be used as a tax-efficient savings vehicle, allowing you to accumulate wealth while minimizing your tax liability. By contributing to the policy’s cash value, you can potentially reduce your taxable income and defer taxes on your earnings.

This can be especially beneficial for high-income earners who are looking for ways to minimize their tax burden.

For example, if you are in a high tax bracket, contributing to a permanent life insurance policy’s cash value can help you reduce your taxable income and potentially save on taxes.

Tax Implications Compared to Other Financial Products

Compared to other financial products, permanent life insurance offers a unique combination of tax advantages. For example, traditional savings accounts and investments are typically subject to taxes on the earnings each year. In contrast, permanent life insurance allows you to defer taxes on your earnings until you withdraw them.

This can be a significant advantage, especially for long-term savings goals.

For example, if you invest $10,000 in a traditional savings account that earns 5% interest per year, you will have to pay taxes on the $500 in interest each year. However, if you invest $10,000 in a permanent life insurance policy, you will not have to pay taxes on the interest until you withdraw it.

Flexibility and Customization

Permanent life insurance isn’t a one-size-fits-all solution. Instead, it offers a customizable approach that allows you to tailor your policy to meet your unique needs and financial goals. This flexibility is a key advantage, ensuring your coverage evolves with your life’s changes.

Riders and Optional Features

Riders and optional features add an extra layer of protection and benefits to your permanent life insurance policy. These additions can be tailored to address specific concerns and enhance your coverage.

- Disability Rider:This rider provides coverage if you become disabled and unable to work. It can help pay your premiums and provide financial support during a challenging time. For example, if you experience a serious illness or accident that prevents you from working, the disability rider can help maintain your policy and provide financial stability.

- Long-Term Care Rider:This rider offers financial assistance for long-term care expenses, such as nursing home care or in-home assistance. As healthcare costs rise, this rider can provide peace of mind knowing your policy can help cover these expenses.

- Accidental Death Benefit Rider:This rider increases your death benefit if your death is caused by an accident. This can provide additional financial support to your beneficiaries in the event of an unexpected tragedy.

Adjusting Coverage and Premiums

Permanent life insurance policies offer flexibility in adjusting your coverage and premiums over time. This allows you to adapt your policy as your needs and financial situation change.

- Increasing Coverage:If your family grows or your financial obligations increase, you can adjust your policy to provide more coverage. This can ensure your loved ones are financially protected even as your responsibilities evolve.

- Decreasing Coverage:If your financial obligations decrease or your family’s needs change, you can reduce your coverage and lower your premiums. This can help manage your budget and ensure your policy remains affordable.

- Premium Adjustments:Depending on your policy, you may have the option to adjust your premiums. This can be helpful if your income changes or you need to adjust your financial commitments.

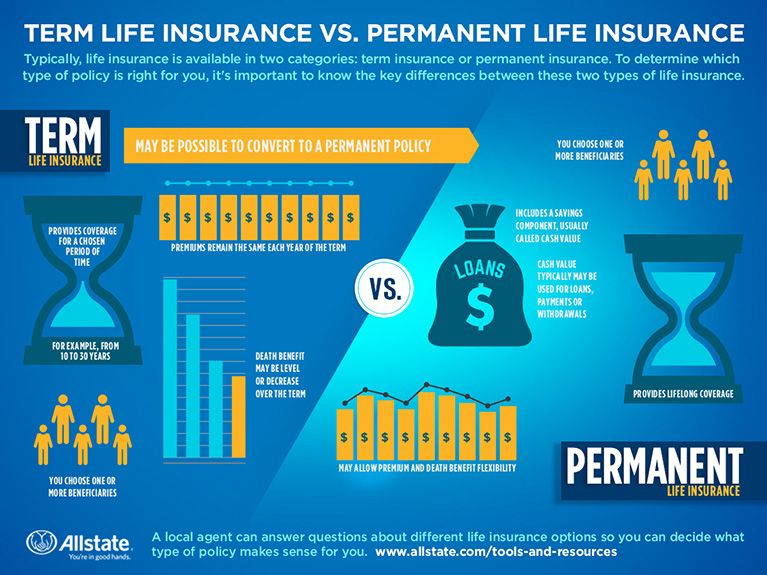

Long-Term Coverage

Permanent life insurance offers a unique advantage: lifelong coverage. Unlike term life insurance, which provides coverage for a specific period, permanent life insurance stays in effect as long as you pay your premiums. This provides continuous financial protection for your loved ones, regardless of how long you live.

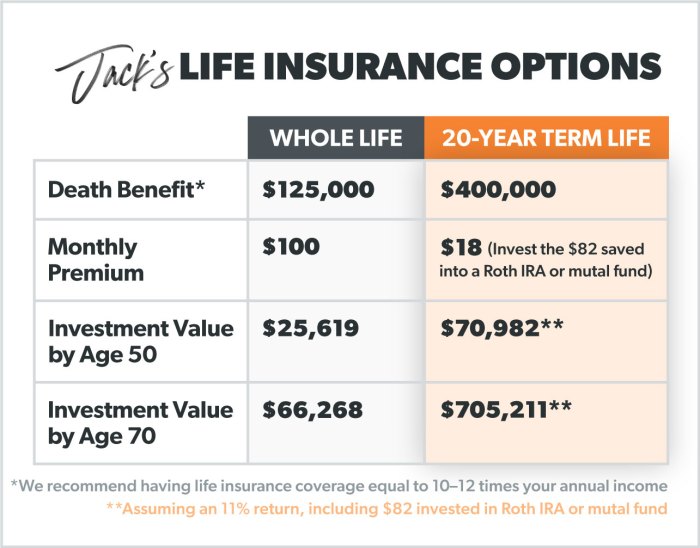

Comparing Permanent and Term Life Insurance

Understanding the differences between permanent and term life insurance is crucial to making an informed decision. Here’s a breakdown of their key distinctions:

- Term Life Insurance:Provides coverage for a specific period, typically 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you no longer receive coverage.

- Permanent Life Insurance:Offers lifetime coverage, meaning it remains in effect as long as you pay your premiums. This provides ongoing financial protection for your beneficiaries, even if you live a long life.

“Permanent life insurance is designed to provide lifelong coverage, ensuring that your beneficiaries receive a death benefit regardless of when you pass away.”

Peace of Mind for Long-Term Financial Protection

Permanent life insurance offers peace of mind knowing your loved ones will be financially protected for the long term. This is particularly important for:

- Families with young children:Permanent life insurance can ensure your children are financially secure even if you are no longer around to provide for them.

- Individuals with long-term financial obligations:If you have outstanding debts, such as a mortgage or student loans, permanent life insurance can provide the funds to cover these obligations after your passing.

- Those with a desire for legacy planning:Permanent life insurance can help you leave a lasting legacy for your family and loved ones, ensuring they are financially secure and able to pursue their dreams.

Outcome Summary

So, when considering permanent life insurance, remember it’s not just a policy; it’s a powerful tool for financial security, wealth building, and legacy planning. It offers a combination of protection, savings, and tax advantages, making it a valuable asset for those seeking long-term financial stability and peace of mind.

As you navigate the world of financial planning, explore the benefits of permanent life insurance and discover how it can help you secure your future and protect your legacy.

FAQ Section: What Are The Benefits Of Permanent Life Insurance?

What is the difference between permanent life insurance and term life insurance?

Permanent life insurance provides lifetime coverage, while term life insurance offers coverage for a specific period, typically 10, 20, or 30 years. If you die within the term, your beneficiaries receive a death benefit. If you outlive the term, the coverage ends, and you don’t receive any benefits.

How much permanent life insurance do I need?

The amount of permanent life insurance you need depends on your individual circumstances, including your financial goals, family size, and outstanding debts. It’s best to consult with a financial advisor to determine the appropriate coverage amount.

Can I access the cash value in my permanent life insurance policy?

Yes, you can access the cash value through loans or withdrawals, but keep in mind that this can impact the death benefit and reduce the policy’s overall value.

Are there any fees associated with permanent life insurance?

Yes, there are fees associated with permanent life insurance, including premiums, administrative fees, and potential surrender charges if you cancel the policy early.