Homeowners insurance is your safety net, protecting your biggest investment – your home. It’s a crucial financial safeguard that covers you against unexpected events like fires, theft, and natural disasters. But with so many different types of coverage and policy options, it can be overwhelming to choose the right one.

Think of it like this: Imagine waking up one morning to find your home flooded after a heavy storm. Without homeowners insurance, you’d be facing the daunting task of rebuilding your entire life from scratch. That’s where this insurance comes in, providing financial peace of mind and helping you bounce back from the unexpected.

Understanding Homeowners Insurance

Homeowners insurance is a type of property insurance that protects your home and belongings from various risks. It provides financial compensation for covered losses, helping you recover from unexpected events like fires, storms, theft, and other disasters.

Types of Coverage

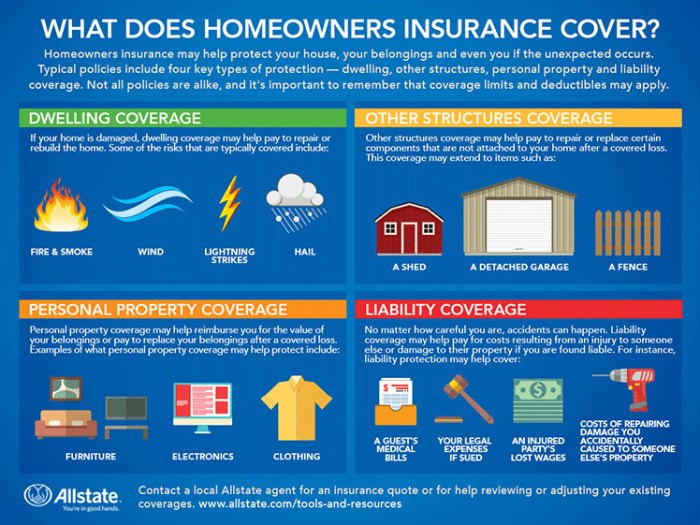

Homeowners insurance typically includes several types of coverage designed to protect different aspects of your property and your liability.

- Dwelling Coverage: This protects the physical structure of your home, including the walls, roof, plumbing, electrical systems, and other attached structures like a garage or deck. It covers damage caused by covered perils like fire, windstorms, hail, and vandalism.

- Personal Property Coverage: This covers your belongings inside your home, such as furniture, appliances, clothing, electronics, and personal items. It also extends coverage to certain belongings outside your home, like a shed or patio furniture.

- Liability Coverage: This protects you from financial responsibility if someone is injured on your property or if you accidentally damage someone else’s property. It covers legal defense costs and any settlements or judgments awarded against you.

- Additional Living Expenses (ALE): This coverage helps pay for temporary housing and other living expenses if you’re unable to live in your home due to a covered event. It can cover costs like hotel stays, meals, and other necessities.

Common Perils Covered and Excluded

Homeowners insurance policies typically cover a wide range of perils, but some events are excluded.

- Covered Perils: Examples of common perils covered by most homeowners insurance policies include fire, lightning, windstorms, hail, vandalism, theft, and some natural disasters. However, specific coverage can vary depending on your policy and location.

- Excluded Perils: Common perils not typically covered by homeowners insurance include earthquakes, floods, and acts of war. These events often require separate insurance policies to provide coverage. Some policies may also exclude certain types of damage, such as wear and tear or damage caused by negligence.

For example, if you leave a window open during a rainstorm and your belongings are damaged, this might not be covered.

Key Factors Affecting Homeowners Insurance Premiums

Your homeowners insurance premium is not set in stone. Several factors influence how much you pay each month. Understanding these factors can help you make informed decisions to potentially lower your premium.

Location

Your location plays a significant role in determining your homeowners insurance premium. Insurance companies assess the risk of damage to your property based on factors like:

- Natural disasters:Areas prone to hurricanes, earthquakes, wildfires, or floods have higher premiums due to the increased risk of damage.

- Crime rates:Higher crime rates in a neighborhood can lead to higher premiums, as there is a greater risk of theft or vandalism.

- Proximity to fire stations and other emergency services:Homes closer to emergency services may have lower premiums as they are more likely to receive prompt assistance in case of an incident.

Property Value and Construction Materials

The value of your home and the materials used in its construction are key factors in determining your premium.

- Property value:Homes with higher market values generally have higher premiums because the cost of rebuilding or repairing them is greater.

- Construction materials:Homes built with fire-resistant materials, such as brick or concrete, may have lower premiums than those built with wood, which is more susceptible to fire damage.

Personal Factors

Your personal factors, such as your credit score and claims history, can also influence your premium.

- Credit score:Insurance companies often use credit scores as an indicator of your financial responsibility. A good credit score can result in lower premiums, while a poor credit score may lead to higher premiums.

- Claims history:If you have filed numerous claims in the past, your premium may be higher. Insurance companies view frequent claims as a sign of increased risk. Conversely, a clean claims history can earn you discounts.

Choosing the Right Homeowners Insurance Policy

Finding the perfect homeowners insurance policy is like finding the perfect pair of shoes: it’s all about finding the right fit. You want a policy that provides adequate coverage at a price you can afford. Navigating the world of insurance policies can feel overwhelming, but with the right information and a little research, you can find a policy that meets your specific needs.

Comparing Policy Options

Different insurance providers offer a variety of homeowners insurance policies, each with its own set of coverage options and pricing. To make the best choice for you, it’s essential to compare and contrast different policy options. Here’s a breakdown of some key aspects to consider when comparing policies:

- Coverage Limits:Coverage limits determine the maximum amount your insurance company will pay for a covered loss. Consider the value of your home, belongings, and potential liabilities when choosing coverage limits. Higher limits offer greater protection, but also come with higher premiums.

- Deductibles:Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means a lower premium, while a lower deductible means a higher premium. Choose a deductible you can comfortably afford in case of a covered loss.

- Coverage Types:Different policies offer different types of coverage, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Make sure the policy you choose includes the coverage you need to protect your home and belongings.

- Discounts:Many insurance companies offer discounts for things like home security systems, fire alarms, and bundling your homeowners insurance with other policies like auto insurance. Ask your insurance provider about available discounts to lower your premium.

Key Features to Look For

While comparing policies, keep an eye out for these important features:

- Financial Stability:Choose a reputable insurance company with a strong financial rating. This ensures that your insurer will be able to pay out claims when you need them. You can find financial ratings from organizations like A.M. Best, Moody’s, and Standard & Poor’s.

- Customer Service:Look for an insurance company with a history of excellent customer service. This is especially important if you need to file a claim. Read online reviews and talk to friends and family about their experiences with different insurers.

- Claims Process:Understand the claims process before you buy a policy. Ask about the steps involved, the required documentation, and the average processing time for claims. A streamlined claims process can make a big difference during a stressful time.

- Policy Transparency:Choose a policy that is easy to understand. Ask your insurance agent to explain the policy’s terms and conditions in detail. Ensure you understand what is covered and what is not covered.

Importance of Coverage Limits and Deductibles, Homeowners insurance

Choosing the right coverage limits and deductibles is crucial in ensuring you have adequate protection and can afford your premiums.

Coverage limitsrepresent the maximum amount your insurer will pay for a covered loss. For example, if you have a dwelling coverage limit of $250,000 and your home is completely destroyed in a fire, your insurance company will pay up to $250,000 to rebuild it.

If the cost of rebuilding exceeds $250,000, you will be responsible for the difference.

Deductiblesare the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and your home suffers $5,000 in damage from a hailstorm, you will pay the first $1,000 and your insurance company will cover the remaining $4,000.

It’s important to balance coverage limits and deductibles to find the right level of protection and affordability. A higher deductible can significantly lower your premiums, but you’ll need to be prepared to pay more out-of-pocket in the event of a claim.

Conversely, a lower deductible means higher premiums, but you’ll have less out-of-pocket expenses.

Understanding Common Exclusions and Limitations

Homeowners insurance policies are designed to protect your home and belongings against various perils. However, it’s important to understand that they don’t cover everything. Many common exclusions and limitations exist, which can affect your coverage in specific situations.

Common Exclusions

Homeowners insurance policies typically exclude coverage for certain events or situations. Some of the most common exclusions include:

- Floods: Flood damage is generally not covered by standard homeowners insurance policies. You need to purchase a separate flood insurance policy to protect your home from flood risks.

- Earthquakes: Similar to floods, earthquake damage is often excluded from standard homeowners insurance policies. You’ll need to purchase earthquake insurance if you live in an area prone to earthquakes.

- Acts of War: Damage caused by acts of war, such as bombings or military attacks, is generally not covered by homeowners insurance.

- Intentional Acts: If you intentionally damage your property or cause damage to someone else’s property, your homeowners insurance won’t cover the losses.

- Neglect: If you fail to maintain your property and it suffers damage due to neglect, your insurance policy might not cover the losses.

Limitations on Coverage for Specific Items

Homeowners insurance policies often have limitations on the amount of coverage available for certain types of personal property. These limitations may apply to:

- Jewelry: The coverage for jewelry is often limited to a specific dollar amount, and you might need to purchase additional coverage for valuable pieces.

- Art: Similar to jewelry, the coverage for art pieces may be limited. If you have valuable artwork, you may need to purchase an endorsement or rider to increase your coverage.

- Collectibles: Collections of stamps, coins, or other valuable items might have specific coverage limitations. You may need to schedule these items separately to ensure adequate coverage.

Examples of Situations Where Coverage Might Be Denied or Limited

Here are some examples of situations where your homeowners insurance coverage might be denied or limited:

- Damage caused by a tree falling on your home during a hurricane: While hurricane damage is generally covered, if the tree was diseased or poorly maintained, your insurance company might deny coverage.

- Theft of valuables from your home while you were on vacation: Your insurance company might limit coverage for stolen items if you didn’t take reasonable precautions to secure your home while you were away.

- Damage caused by a fire that started because of a faulty electrical appliance: If you failed to have your electrical appliances regularly inspected and maintained, your insurance company might deny coverage for the fire damage.

Filing a Claim and Navigating the Claims Process

You’ve paid your homeowners insurance premiums, and now you need to file a claim. It’s a process that can feel overwhelming, but understanding the steps involved can help you navigate it smoothly.

Steps Involved in Filing a Homeowners Insurance Claim

Filing a claim is the process of notifying your insurance company about a covered loss. It’s the first step to receiving compensation for damages to your home or property. Here’s what you need to do:

- Contact your insurance company: The first step is to contact your insurance company as soon as possible after the incident. This can be done by phone, email, or online through your insurance portal.

- Report the claim: Provide detailed information about the incident, including the date, time, and location of the event, as well as the nature of the damage.

- File a claim form: You will need to complete a claim form, which may be provided by your insurance company or downloaded online. This form will require you to provide more detailed information about the incident and the damages.

- Cooperate with the insurance adjuster: Once you have filed your claim, your insurance company will assign an insurance adjuster to your case. The adjuster will be responsible for investigating the claim and determining the extent of the damage.

- Provide documentation: The insurance adjuster will likely request documentation to support your claim, such as police reports, repair estimates, and photographs of the damage.

- Negotiate the settlement: After the adjuster has completed their investigation, they will make a settlement offer. You have the right to negotiate this offer, and you may want to consult with an attorney if you are not satisfied with the offer.

Documentation Required for a Homeowners Insurance Claim

To support your claim and expedite the process, you will need to provide certain documentation. Here’s a list of common documents:

- Police report: If the damage was caused by a crime, such as theft or vandalism, you will need to file a police report and provide a copy to your insurance company.

- Repair estimates: Obtain repair estimates from qualified contractors for the damage to your home. This will help the insurance adjuster assess the cost of repairs.

- Photographs and videos: Take clear photographs and videos of the damage to your home. This documentation can be crucial in supporting your claim.

- Inventory of damaged belongings: Create a detailed list of all damaged or stolen belongings, including descriptions, purchase dates, and receipts.

- Proof of ownership: Provide proof of ownership for any damaged or stolen items, such as receipts, warranties, or appraisal documents.

The Role of the Insurance Adjuster

The insurance adjuster plays a critical role in the claims process. They are responsible for:

- Investigating the claim: The adjuster will visit your property to assess the damage and gather information about the incident.

- Determining coverage: The adjuster will review your policy and determine if the damage is covered under your policy.

- Estimating the cost of repairs: The adjuster will use their expertise to estimate the cost of repairing or replacing the damaged property.

- Negotiating the settlement: The adjuster will work with you to negotiate a settlement for your claim.

Common Challenges and Pitfalls During the Claims Process

While the claims process is designed to be straightforward, there are common challenges and pitfalls you should be aware of:

- Delayed claim processing: Claim processing can take time, especially if there are complex issues or a large amount of damage.

- Disputes over coverage: There may be disputes over whether the damage is covered under your policy. This can lead to delays and negotiations.

- Low settlement offers: The insurance company may offer a settlement that is less than the actual cost of repairs or replacement.

- Miscommunication: Miscommunication between you and the insurance company or the adjuster can lead to misunderstandings and delays.

- Fraudulent claims: Be aware of fraudulent claims and avoid any actions that could jeopardize your claim.

Maintaining Coverage and Protecting Your Home

You’ve chosen your homeowners insurance policy, but your journey doesn’t end there. Maintaining adequate coverage and protecting your home from potential risks are crucial for peace of mind. This section will guide you on how to minimize the likelihood of claims, ensuring your home and belongings are safeguarded.

Regular Home Maintenance and Safety Precautions

Regular maintenance and safety precautions are essential to prevent costly damages and ensure your insurance coverage remains effective.

Just like you want to protect your home with homeowners insurance, it’s equally important to safeguard your wheels with reliable auto insurance. And guess what? You can easily compare different auto insurance quotes to find the best deal for your needs by checking out this helpful resource.

Once you’ve got your auto insurance sorted, you can rest assured that you’re covered on the road, just like your homeowners insurance protects your haven.

- Roof Inspections:A well-maintained roof is your first line of defense against weather damage. Schedule regular inspections, at least every three to five years, to identify and address any potential issues, such as leaks, cracked shingles, or missing flashing. Addressing these problems promptly can prevent major repairs and potential insurance claims.

- Plumbing Checks:Leaks and burst pipes can cause significant water damage, leading to expensive repairs and potential insurance claims. Regularly inspect your plumbing system, including faucets, pipes, and appliances, for leaks or signs of corrosion. If you notice any issues, address them immediately to prevent further damage.

- Electrical System:Faulty electrical wiring can cause fires, leading to significant damage and potential insurance claims. Have your electrical system inspected regularly by a qualified electrician, especially if you notice flickering lights, buzzing sounds, or warm outlets. Ensure your electrical system is up to code and can safely handle the demands of your appliances and electronics.

- Smoke Detectors:Working smoke detectors are crucial for early fire detection, potentially saving lives and limiting property damage. Install smoke detectors on every level of your home, including the basement and attic, and test them monthly to ensure they are operational. Replace batteries at least once a year or as recommended by the manufacturer.

- Carbon Monoxide Detectors:Carbon monoxide is a colorless and odorless gas that can be deadly. Install carbon monoxide detectors on every level of your home, especially near bedrooms and areas where fuel-burning appliances are located. Test these detectors regularly to ensure they are functioning correctly.

Preparing for Potential Disasters and Emergencies

While you can’t predict every disaster, being prepared can minimize damage and make the recovery process smoother.

- Emergency Kit:Assemble a comprehensive emergency kit that includes essential supplies, such as water, non-perishable food, first-aid supplies, a flashlight, a battery-powered radio, and extra batteries. Store the kit in an accessible location and ensure it is regularly updated.

- Disaster Plan:Develop a family disaster plan that Artikels evacuation routes, meeting points, and communication procedures. Practice the plan regularly to ensure everyone knows what to do in an emergency.

- Flood Protection:If your home is located in a flood-prone area, take steps to mitigate flood damage. Consider installing flood barriers, elevating electrical outlets, and storing valuables in waterproof containers.

- Windstorm Protection:If your home is in a region prone to high winds, secure loose objects on your property, such as patio furniture, grills, and lawn ornaments. Trim trees and shrubs to prevent branches from falling on your roof or house.

- Earthquake Preparedness:If you live in an earthquake-prone area, secure heavy objects to walls, identify safe spots in your home, and keep a supply of essential items in a designated earthquake kit.

Final Review

Navigating the world of homeowners insurance can feel like a maze, but understanding the basics, comparing policies, and choosing the right coverage for your needs is essential. Remember, your home is more than just bricks and mortar; it’s where you build memories, nurture relationships, and create a life.

By taking the time to understand homeowners insurance, you’re taking a proactive step towards protecting your haven and ensuring your future is secure.

User Queries: Homeowners Insurance

What does homeowners insurance typically cover?

Homeowners insurance usually covers damage to your dwelling, personal property inside your home, liability if someone is injured on your property, and additional living expenses if you’re unable to live in your home due to a covered event.

How much homeowners insurance do I need?

The amount of coverage you need depends on the value of your home, personal belongings, and your individual risk tolerance. It’s best to consult with an insurance agent to determine the right amount for your specific situation.

What are some common exclusions in homeowners insurance?

Most policies exclude coverage for certain events like floods, earthquakes, and acts of war. Some policies also have limitations on coverage for specific items like jewelry and art. It’s important to carefully review your policy to understand what is and isn’t covered.

How do I file a homeowners insurance claim?

Contact your insurance company as soon as possible after an event occurs. They will guide you through the claims process and provide instructions on what documentation you need to submit.