Funeral Insurance Policy – the phrase itself might seem somber, but it’s actually a powerful tool for peace of mind. Imagine a world where your loved ones aren’t burdened with the financial stress of arranging a dignified farewell. That’s the promise of funeral insurance.

It’s a safety net, a financial plan that allows you to say goodbye with grace and dignity, without leaving your family with a mountain of debt.

This comprehensive guide will explore the ins and outs of funeral insurance, from understanding the different types of policies to navigating the application process. We’ll discuss the key features, benefits, and potential drawbacks, leaving you equipped to make informed decisions about your end-of-life planning.

Introduction to Funeral Insurance

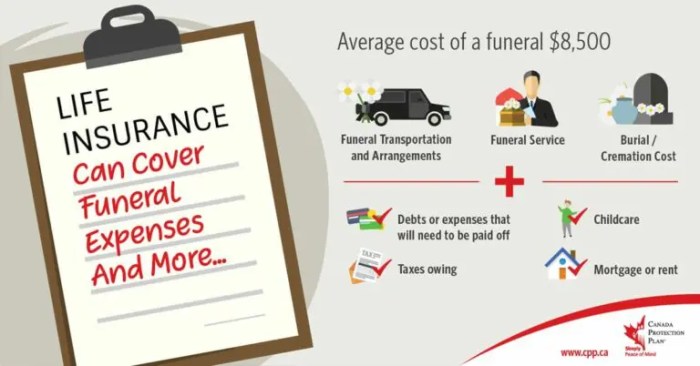

Funeral insurance is a type of life insurance that is specifically designed to cover the costs associated with a funeral. It is a valuable tool for individuals who want to ensure that their loved ones are not burdened with the financial responsibility of their funeral arrangements.Funeral insurance policies provide a lump sum payment to the beneficiary upon the death of the insured individual.

This payment can be used to cover various expenses, including:

- The cost of the funeral itself, such as embalming, cremation, burial, and the casket.

- The cost of a memorial service or wake.

- The cost of a headstone or burial plot.

- Any other expenses related to the funeral.

Types of Funeral Insurance Policies

Funeral insurance policies come in various forms, each offering different benefits and features. The most common types include:

- Traditional Funeral Insurance:This type of policy provides a fixed death benefit that can be used to cover funeral expenses. It typically has a set premium that remains the same throughout the policy term.

- Whole Life Funeral Insurance:This policy combines a death benefit with a cash value component. The cash value grows over time and can be borrowed against or withdrawn. It typically has higher premiums than traditional funeral insurance.

- Term Funeral Insurance:This policy provides coverage for a specific period, such as 10, 20, or 30 years. It is typically more affordable than traditional or whole life funeral insurance, but the coverage expires at the end of the term.

Benefits of Funeral Insurance

There are several benefits to having funeral insurance:

- Financial Peace of Mind:Knowing that your funeral expenses will be covered can provide peace of mind for you and your loved ones.

- Financial Protection for Loved Ones:Funeral insurance helps to protect your family from the financial burden of your funeral costs.

- Flexibility in Funeral Arrangements:The death benefit can be used to cover a wide range of funeral expenses, giving your loved ones the flexibility to choose the arrangements that best reflect your wishes.

- Affordable Coverage:Funeral insurance policies are generally affordable, especially if purchased at a younger age.

Drawbacks of Funeral Insurance

While funeral insurance offers several benefits, there are also some potential drawbacks:

- Limited Coverage:Some policies may have limitations on the types of expenses they cover.

- Higher Premiums:Some policies, such as whole life funeral insurance, may have higher premiums than other types of life insurance.

- Limited Investment Potential:Funeral insurance policies typically do not offer significant investment potential.

Key Features of Funeral Insurance Policies

Funeral insurance policies offer financial protection to cover the costs of funeral arrangements and related expenses. They are designed to ease the financial burden on loved ones during a difficult time.

Coverage Amount

The coverage amount is the sum of money the policy will pay out upon the insured’s death. This amount should be sufficient to cover the anticipated funeral expenses. It’s important to consider factors like the cost of burial or cremation, funeral services, memorial services, and other related expenses.

Premiums

Premiums are the regular payments you make to maintain the policy. These payments are typically calculated based on factors such as your age, health, and the coverage amount you choose. The premium amount will affect the total cost of the policy over its lifetime.

Policy Term

The policy term refers to the duration for which the policy is in effect. Some policies have a fixed term, while others may be renewable for a lifetime. The term of the policy will influence the total cost of the policy and the amount of time you have to accumulate funds.

Optional Features

While the core elements of a standard funeral insurance policy include coverage amount, premiums, and policy term, several optional features can enhance the policy’s benefits.

Cash Value Accumulation

Some funeral insurance policies include a cash value accumulation component. This feature allows the policyholder to build up a cash value that can be accessed for various purposes, such as paying premiums, withdrawing funds, or borrowing against the policy.

Accidental Death Benefits

These benefits provide an additional payout if the insured’s death is due to an accident. This feature can provide extra financial support to cover unexpected expenses associated with an accidental death.

Rider Options

Funeral insurance policies may offer riders, which are optional add-ons that provide additional coverage or benefits. These riders can include features like:

- Waiver of Premium: This rider waives future premium payments if the insured becomes disabled.

- Guaranteed Insurability: This rider allows the policyholder to increase the coverage amount at specific intervals without undergoing a medical examination.

- Return of Premium: This rider refunds a portion or the full premium amount if the policy is canceled before the insured’s death.

Waiting Periods

Most funeral insurance policies have a waiting period before the death benefit becomes payable. This waiting period is typically a few weeks or months, and it ensures that the policy is not used for fraudulent purposes.

Exclusions

Funeral insurance policies may have exclusions, which are specific circumstances or events that are not covered by the policy. These exclusions can include:

- Death by suicide within a specific period after policy issuance.

- Death due to pre-existing conditions that were not disclosed during the application process.

- Death due to war or other acts of hostilities.

Eligibility and Application Process

Understanding the eligibility requirements and navigating the application process is crucial for securing funeral insurance. This section will Artikel the key factors that determine your eligibility and guide you through the steps involved in applying for a funeral insurance policy.

Eligibility Criteria

Eligibility for funeral insurance varies depending on the insurer and the specific policy you choose. However, some general criteria commonly apply. These include:

- Age:Most insurers have age limits for eligibility. The minimum age is usually 18, while the maximum age can vary from 65 to 85 years old, depending on the insurer.

- Health:Some insurers may require a medical examination or health questionnaire to assess your health status. This helps them determine your risk profile and set appropriate premiums. However, there are also policies designed for individuals with pre-existing health conditions, offering coverage without stringent medical requirements.

- Residency:You typically need to be a resident of the country or region where the insurer operates to be eligible for their policies.

- Employment:While not always a requirement, some policies may consider your employment status, especially if you are self-employed or retired.

Application Process

The application process for funeral insurance generally involves the following steps:

- Contact the Insurer:You can reach out to the insurer through their website, phone, or by visiting their office.

- Request an Application Form:The insurer will provide you with an application form that you need to complete.

- Provide Personal Information:This includes your name, address, date of birth, contact details, and other relevant information.

- Health Information:You may need to provide details about your health history, including any pre-existing conditions or recent medical treatments.

- Beneficiary Information:Specify the name and relationship of the person(s) who will receive the death benefit.

- Documentation:You may need to provide supporting documentation, such as proof of identity, address, and income.

- Medical Examination:Depending on the policy and your age, a medical examination may be required. This usually involves a physical assessment and blood tests.

- Underwriting:The insurer will review your application and medical information to assess your risk profile. This process, known as underwriting, determines whether you qualify for the policy and the premium you will pay.

- Policy Approval:If your application is approved, the insurer will issue you a policy document outlining the terms and conditions of your coverage.

Underwriting and Policy Approval

Underwriting is a crucial part of the application process. The insurer uses underwriting to evaluate your risk and determine whether to approve your application. The process typically involves:

- Reviewing Your Application:The insurer carefully reviews your application form, including your personal information, health history, and beneficiary details.

- Medical Records:If a medical examination is required, the insurer will review the results of your physical assessment and blood tests.

- Risk Assessment:The insurer assesses your overall risk profile based on factors like age, health, lifestyle, and family history.

- Policy Approval:If the insurer approves your application, they will issue you a policy document that Artikels the coverage, premiums, and other terms and conditions.

- Policy Denial:If your application is denied, the insurer will provide you with a reason for the denial. This may be due to health concerns, incomplete information, or other factors.

Cost and Premiums

The cost of funeral insurance is determined by various factors, and understanding these factors is crucial for making informed decisions. Premiums are the regular payments you make to maintain your funeral insurance policy.

Factors Influencing Premiums

Several factors influence the cost of funeral insurance premiums. These factors are categorized based on individual characteristics, coverage details, and market conditions.

- Age:Younger individuals generally pay lower premiums than older individuals. This is because younger people have a statistically lower risk of death in the near future. As you age, the risk of death increases, leading to higher premiums.

- Health:Your health status also plays a significant role in determining premiums. Individuals with pre-existing health conditions or a history of health issues may face higher premiums. This is because insurers consider the likelihood of claiming the policy benefits.

- Coverage Amount:The amount of coverage you choose directly affects the premium. Higher coverage amounts translate to higher premiums, as insurers need to cover a larger financial obligation.

- Policy Type:Different types of funeral insurance policies come with varying coverage options and features. These variations influence the cost of premiums. For instance, a policy with a higher payout or additional benefits, such as pre-need arrangements, will typically have higher premiums.

- Lifestyle:Certain lifestyle choices, such as smoking or engaging in high-risk activities, can increase premiums. Insurers consider these factors as they contribute to a higher risk of death.

Premium Calculation Examples

To illustrate the impact of different factors on premiums, let’s consider a hypothetical example. Imagine two individuals, John and Mary, both applying for funeral insurance. John is 35 years old, in good health, and seeks $10,000 in coverage. Mary is 50 years old, has a pre-existing health condition, and desires $20,000 in coverage.John’s premium might be around $25 per month, while Mary’s premium could be around $50 per month.

This difference in premiums reflects the influence of age, health, and coverage amount.

Impact of Inflation and Interest Rates

Inflation and interest rates can affect premium adjustments over time. When inflation rises, the cost of funeral services also increases. Insurers may adjust premiums to account for this inflation, ensuring that the policy continues to provide adequate coverage.Similarly, changes in interest rates can impact the cost of premiums.

If interest rates decline, insurers may need to adjust premiums to maintain profitability. Conversely, rising interest rates could lead to lower premiums.

It’s essential to note that premiums can vary significantly across different insurance providers. Comparing quotes from multiple insurers is crucial to finding the most affordable and suitable policy.

Benefits and Coverage

Funeral insurance policies are designed to provide financial assistance to your loved ones during a difficult time. The policy’s primary goal is to cover the costs associated with your funeral, easing the financial burden on your family.

Funeral insurance policies are a thoughtful way to ease the financial burden on loved ones during a difficult time. But have you considered the potential gap between your car’s actual value and what you owe on it? That’s where Gap insurance comes in, covering the difference if your car is totaled and you still have a loan.

While funeral insurance focuses on final arrangements, gap insurance helps protect your wallet after a car accident.

Funeral Expenses, Funeral insurance policy

The main purpose of funeral insurance is to cover the expenses associated with your funeral arrangements. These expenses can include:

- Casket and burial vault:These are essential items for traditional burials. The cost of a casket can vary depending on the material, size, and features.

- Embalming and cremation:These services are often required for both burial and cremation. The cost of embalming can be influenced by the complexity of the process.

- Funeral home services:This category includes services such as the preparation of the body, transportation, and the funeral ceremony. The cost can vary depending on the location and the type of services selected.

- Cemetery plot and interment:The cost of a cemetery plot can vary depending on the location and the type of burial. Interment fees are charged for the burial itself.

- Memorial services:This can include the cost of a memorial service, flowers, and other related expenses.

- Other expenses:Funeral insurance can also cover other expenses such as death certificates, legal fees, and transportation costs.

Distribution of Proceeds

When a funeral insurance policyholder passes away, the policy proceeds are paid out to the designated beneficiaries. This money can be used to cover funeral expenses and other final expenses. The beneficiary can be a spouse, child, parent, sibling, or any other individual or entity named in the policy.

The beneficiary can use the policy proceeds to pay for funeral expenses directly or use the money for other purposes, as they see fit.

Limitations and Exclusions

While funeral insurance provides financial support, it’s important to be aware of its limitations and exclusions:

- Policy limits:Funeral insurance policies typically have a maximum payout amount. This means that if the funeral expenses exceed the policy’s limit, the beneficiary will have to cover the remaining cost.

- Waiting period:Some policies have a waiting period before they become active. This means that if the policyholder passes away within the waiting period, the policy may not pay out.

- Exclusions:Some policies may exclude certain expenses, such as costs related to a suicide or a death caused by a pre-existing condition. It’s crucial to carefully review the policy documents to understand any exclusions.

Alternatives to Funeral Insurance

Planning for your final expenses can be a daunting task, but it’s essential to ensure your loved ones aren’t burdened with the financial stress of your funeral arrangements. Funeral insurance is one option, but it’s not the only one. Exploring other financial planning tools can help you find the best solution for your needs and budget.This section compares and contrasts funeral insurance with other options, including life insurance, prepaid funeral arrangements, and savings accounts, highlighting their pros and cons in relation to funeral expenses.

Life Insurance

Life insurance is a widely recognized financial planning tool that can provide a lump sum payment to your beneficiaries upon your death. This payment can cover a variety of expenses, including funeral costs.Life insurance offers several advantages for funeral planning:

- Flexibility:You can choose the death benefit amount to meet your specific needs, ensuring enough funds to cover funeral costs and other expenses.

- Coverage for other expenses:The death benefit can be used for other financial obligations, like outstanding debts, medical bills, or even provide financial support for your family.

- Tax advantages:Life insurance proceeds are typically tax-free for beneficiaries.

However, life insurance also has some drawbacks:

- Cost:Premiums can be substantial, especially for larger death benefits and younger policyholders.

- Waiting period:Some policies have a waiting period before the death benefit is payable, meaning you might not have immediate coverage.

- Complexity:Choosing the right type of life insurance policy and determining the appropriate coverage amount can be complex.

Prepaid Funeral Arrangements

Prepaid funeral arrangements allow you to plan and pre-pay for your funeral services and goods in advance. This can offer peace of mind knowing your funeral wishes will be carried out and your loved ones won’t have to make difficult decisions during a stressful time.Prepaid funeral arrangements have several benefits:

- Price lock:You secure the cost of services and goods at today’s prices, protecting against inflation.

- Peace of mind:Knowing your funeral is planned and paid for can alleviate stress for your family.

- Personalized arrangements:You can specify your funeral preferences, ensuring they are honored.

However, prepaid funeral arrangements also have some drawbacks:

- Limited flexibility:Once you pre-pay, you may have limited flexibility to make changes to your arrangements.

- Potential for fraud:Choose a reputable funeral home and ensure the arrangement is properly documented and protected.

- Limited financial benefits:Prepaid arrangements primarily cover funeral costs and may not provide funds for other expenses.

Savings Accounts

Saving money in a dedicated account for funeral expenses is a simple and straightforward option. This allows you to accumulate funds gradually and have control over your finances.Saving for funeral expenses offers several advantages:

- Control and flexibility:You have full control over your funds and can adjust your savings strategy as needed.

- No premiums:You only contribute the amount you can afford, making it a budget-friendly option.

- Potential for growth:Savings can earn interest, increasing your funds over time.

However, savings accounts also have some drawbacks:

- No guaranteed returns:Savings accounts don’t offer guaranteed returns, so your funds may not keep pace with inflation.

- Potential for depletion:Funds may be used for other purposes before your death, leaving your family with insufficient funds for funeral expenses.

- Limited financial benefits:Savings accounts solely provide funds for funeral costs and may not cover other expenses.

Choosing the Right Policy

Finding the perfect funeral insurance policy is like finding the right pair of shoes – it needs to fit your needs, budget, and style. Don’t just grab the first policy you see; take your time to understand your options and choose the one that truly suits you.

Factors to Consider

Before diving into the details, consider these key factors:

- Your Financial Situation:How much can you comfortably afford to pay in premiums? A higher premium might mean greater coverage, but it could also strain your budget. Consider your current expenses and income when choosing a premium amount.

- Your Needs and Preferences:Do you have specific wishes for your funeral? Are there any particular services or expenses you want to cover? Knowing your preferences will help you choose a policy that aligns with your needs.

- Your Age and Health:Your age and health can influence the premium you’ll pay. Younger and healthier individuals typically pay lower premiums compared to older or individuals with pre-existing health conditions.

Coverage Amount

Deciding on the right coverage amount is crucial. Consider these aspects:

- Funeral Expenses:Research average funeral costs in your area. Factor in expenses like embalming, cremation, burial, casket, memorial services, and transportation. Remember, these costs can vary significantly depending on your location and choices.

- Additional Expenses:Think about any other expenses you want to cover, such as outstanding debts, medical bills, or final expenses for your family.

- Inflation:Keep in mind that funeral costs can increase over time. Choosing a policy with a higher coverage amount can help ensure your loved ones are adequately covered in the future.

Premium Affordability

The premium you pay should be manageable and fit within your budget. Consider these points:

- Premium Payment Options:Explore different payment options, such as monthly, quarterly, or annual payments. Choose a payment frequency that aligns with your cash flow.

- Budgeting:Factor your funeral insurance premium into your overall budget. Ensure it doesn’t significantly impact your other financial obligations.

- Financial Stability:If you anticipate financial instability in the future, consider a policy with a lower premium or a shorter term.

Policy Features

Don’t overlook the features of the policy. These details can impact your coverage and benefits:

- Waiting Period:Some policies have a waiting period before the death benefit becomes payable. Understand this period to avoid any surprises.

- Grace Period:This period allows you to pay your premium after the due date without jeopardizing your coverage. A longer grace period offers more flexibility.

- Cash Value Option:Some policies offer a cash value option, allowing you to withdraw a portion of your premium for personal use. This can be beneficial in case of financial emergencies.

Comparing Quotes

Don’t settle for the first quote you receive. Take the time to compare quotes from different insurance providers:

- Get Multiple Quotes:Contact several insurance providers and request quotes for policies that meet your needs. This will allow you to compare premiums, coverage, and features.

- Read the Fine Print:Carefully review the policy documents to understand the terms and conditions, including any exclusions or limitations.

- Ask Questions:Don’t hesitate to ask questions about anything you don’t understand. Ensure you are comfortable with the policy and its terms before making a decision.

Choosing the Best Provider

Consider these factors when choosing an insurance provider:

- Financial Stability:Choose a provider with a strong financial track record, ensuring they can fulfill their obligations in the future.

- Customer Service:Look for a provider known for excellent customer service. You want to be confident that you’ll receive timely and helpful support when needed.

- Reputation:Research the provider’s reputation by reading reviews and testimonials from other customers.

Common Misconceptions and Concerns

Funeral insurance is a valuable tool for planning ahead and alleviating financial burdens during a difficult time. However, certain misconceptions and concerns often arise regarding this type of insurance. This section addresses common misunderstandings and provides clarity on potential issues.

Funeral Insurance Is Only for Older Adults

Funeral insurance is often associated with older individuals, but this is a misconception. While it is true that many people purchase funeral insurance as they age, it can be a beneficial option for individuals of all ages. Younger adults, particularly those with families or dependents, can also benefit from the peace of mind and financial security that funeral insurance provides.

Funeral Insurance Is Too Expensive

The cost of funeral insurance can vary depending on factors such as age, health, and coverage amount. However, it is not necessarily too expensive. Many policies are available with affordable premiums, and the cost can be offset by the financial benefits it provides.

It’s important to compare policies and premiums from different providers to find the most suitable option for your individual needs and budget.

Concerns About Policy Cancellation

Policy cancellation can be a concern for some individuals. It’s important to understand the terms and conditions of your policy regarding cancellation. Most funeral insurance policies allow for cancellation within a specific period, typically a free-look period, without any penalties.

However, after this period, cancellation may result in a loss of premiums or other financial implications. It’s crucial to carefully review the policy details and seek clarification from the insurance provider if you have any questions.

Concerns About Premium Increases

Premium increases are a common concern in the insurance industry. Funeral insurance policies may also have provisions for premium increases, but these are typically tied to factors such as inflation or changes in the insurer’s risk assessment. Many policies have clauses that limit the extent of premium increases, and some may even have fixed premiums for a specific period.

It’s essential to review the policy details and understand the potential for premium increases before making a decision.

Concerns About Claims Processing

Concerns about claims processing are understandable. However, reputable funeral insurance providers have established procedures for handling claims. The claims process typically involves submitting necessary documentation, such as the death certificate and funeral expenses, to the insurer. It’s advisable to familiarize yourself with the claims process Artikeld in your policy and contact the insurer if you have any questions or require assistance.

Consumer Protection Measures and Resources

Consumer protection measures and resources are available to help individuals navigate the world of funeral insurance. These include:

- The National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that provides information and resources for consumers regarding insurance, including funeral insurance. It offers tools and guides to help consumers understand their rights and make informed decisions.

- State Insurance Departments: Each state has an insurance department that regulates insurance companies and protects consumers’ rights. Contact your state’s insurance department for information about funeral insurance policies, consumer complaints, and other resources.

The Role of Funeral Directors

Funeral directors play a crucial role in the funeral insurance process, acting as guides and facilitators for families navigating this sensitive period. They provide valuable assistance in understanding policy options, processing claims, and arranging funeral services, ensuring a smooth and respectful experience for all involved.

Assistance with Policy Selection

Funeral directors can provide valuable insights into the various funeral insurance policies available, helping you choose one that aligns with your specific needs and budget. They understand the intricacies of different policy features and can explain their implications in clear and understandable terms.

They can also help you assess the adequacy of coverage based on your preferred funeral arrangements.

Conclusion

Planning for funeral expenses is an essential part of responsible financial planning. While it’s a sensitive topic, taking proactive steps can provide peace of mind for you and your loved ones. Funeral insurance can play a significant role in alleviating the financial burden associated with end-of-life arrangements.

Key Takeaways and Insights

- Funeral insurance can help cover the costs of funeral services, such as embalming, cremation, burial, memorial services, and interment.

- It can provide financial support to your loved ones, allowing them to focus on grieving rather than worrying about financial obligations.

- The cost and features of funeral insurance policies vary widely, so it’s crucial to compare options and choose a policy that aligns with your needs and budget.

- It’s important to understand the benefits and limitations of funeral insurance and consider alternative options, such as pre-need arrangements or a life insurance policy with a death benefit.

Importance of Planning Ahead

Planning ahead for funeral expenses allows you to make informed decisions about your end-of-life arrangements, ensuring your wishes are respected and your loved ones are not left with an unexpected financial burden. By considering funeral insurance or other financial strategies, you can provide a valuable legacy for your family.

Seeking Professional Guidance

Consult with a financial advisor or insurance professional to receive personalized advice and determine the most appropriate funeral planning strategy for your specific circumstances. They can help you assess your needs, compare different options, and make informed decisions based on your financial goals and objectives.

Closing Notes: Funeral Insurance Policy

Funeral insurance isn’t just about the final goodbye; it’s about taking control and ensuring your legacy is honored with the respect it deserves. By understanding the options available, comparing policies, and seeking professional guidance, you can secure a future where your loved ones are free to focus on healing and remembering, not on financial worries.

So, let’s explore the world of funeral insurance together, and create a plan that provides peace of mind for both you and your family.

Commonly Asked Questions

What are the typical coverage amounts for funeral insurance?

Coverage amounts vary widely depending on the policy and provider. They can range from a few thousand dollars to tens of thousands, allowing you to choose a level of coverage that aligns with your needs and budget.

Is funeral insurance only for older adults?

Not at all! While funeral insurance is often associated with seniors, it can be beneficial for people of all ages. It’s a smart way to prepare for the unexpected and protect your loved ones from financial strain, regardless of your age.

How do I choose the right funeral insurance provider?

Consider factors like coverage amount, premium affordability, policy features, and the provider’s reputation. Comparing quotes and reading reviews from other policyholders can help you find the best fit for your needs.

Can I cancel my funeral insurance policy?

Yes, most funeral insurance policies allow for cancellation, but there might be specific conditions and potential penalties involved. It’s important to review the policy terms carefully.