Dental insurance plans are essential for protecting your oral health and wallet. They offer a safety net against the potentially high costs of dental care, ensuring you can access regular cleanings, fillings, and even more complex procedures without breaking the bank.

But with various plan types and coverage options available, choosing the right dental insurance can feel like navigating a maze. This guide will equip you with the knowledge to make informed decisions and find the perfect plan for your needs.

From understanding the different types of dental insurance, such as PPO, HMO, and Indemnity, to exploring coverage limitations and premiums, we’ll cover all the essentials. We’ll also delve into the impact of healthcare reform on dental insurance and its role in preventative care.

By the end of this journey, you’ll be a dental insurance expert, ready to confidently choose a plan that keeps your smile healthy and your budget happy.

Understanding Dental Insurance Plans

Dental insurance can be a valuable asset, helping you manage the costs associated with maintaining a healthy smile. But with so many different types of plans available, choosing the right one can feel overwhelming. This guide will explore the various types of dental insurance plans and their key features to help you make an informed decision.

Dental insurance plans can help you keep your smile bright and healthy, but they don’t cover everything. For example, they might not cover major procedures or accidents. That’s where Term life insurance comes in, providing financial protection for your loved ones in case the unexpected happens.

While dental insurance helps you chew, Term life insurance can help your family keep their heads above water if you’re not around to do it.

Types of Dental Insurance Plans

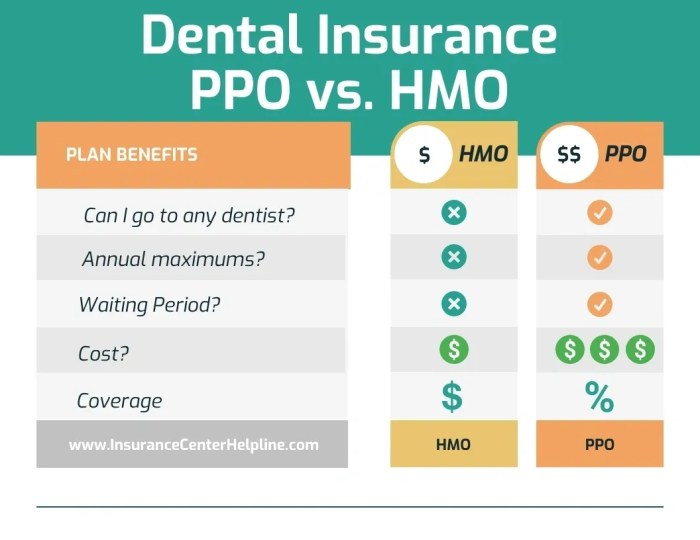

Dental insurance plans are categorized into three primary types: Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Indemnity plans. Each type offers distinct advantages and disadvantages, impacting your coverage, costs, and access to dental care.

Preferred Provider Organizations (PPOs)

PPO plans provide you with a network of dentists who have agreed to provide services at discounted rates. You are free to choose a dentist within or outside the network, but opting for an out-of-network dentist will usually lead to higher out-of-pocket expenses.

- Flexibility:You can choose any dentist you prefer, but network dentists offer discounted rates.

- Wider Network:PPOs typically have a broader network of dentists compared to HMOs.

- Higher Premiums:PPOs generally have higher premiums than HMOs due to their greater flexibility.

- Lower Out-of-Pocket Costs:In-network dentists offer discounted rates, leading to lower out-of-pocket expenses.

Health Maintenance Organizations (HMOs)

HMO plans require you to select a primary care dentist within their network. You need a referral from your primary care dentist to see a specialist. HMOs usually have lower premiums but offer less flexibility in choosing your dentist.

- Lower Premiums:HMOs typically have lower premiums compared to PPOs due to their restricted network.

- Limited Network:You are limited to choosing dentists within the HMO network.

- Lower Out-of-Pocket Costs:HMOs often have lower copayments and deductibles.

- Referral Required:You need a referral from your primary care dentist to see a specialist.

Indemnity Plans, Dental insurance plans

Indemnity plans, also known as “fee-for-service” plans, provide you with the freedom to choose any dentist you want. However, they typically have higher out-of-pocket expenses as you pay for services upfront and then submit claims for reimbursement.

- Maximum Flexibility:You can choose any dentist without network restrictions.

- Higher Out-of-Pocket Costs:You pay for services upfront and then submit claims for reimbursement, leading to higher out-of-pocket expenses.

- No Network:Indemnity plans do not have a network of preferred dentists.

- Higher Premiums:Premiums for indemnity plans are generally higher due to the lack of network discounts.

Comparing Dental Insurance Plan Types

| Feature | PPO | HMO | Indemnity |

|---|---|---|---|

| Network | Yes | Yes | No |

| Flexibility | High | Low | High |

| Premiums | High | Low | High |

| Out-of-Pocket Costs | Moderate | Low | High |

| Referral Requirements | No | Yes | No |

Coverage and Benefits

Dental insurance plans offer financial protection against the costs associated with various dental procedures. Understanding the coverage and benefits of a plan is crucial to making informed decisions about your dental care.

Commonly Covered Procedures

Dental insurance plans typically cover a range of preventive, diagnostic, and restorative procedures. These procedures are designed to maintain oral health, detect potential issues early, and restore damaged teeth.

- Preventive Care:This category includes routine procedures aimed at preventing dental problems.

- Cleanings:Regular cleanings help remove plaque and tartar buildup, reducing the risk of cavities and gum disease.

- Dental Exams:Exams allow dentists to assess your oral health, identify any potential issues, and recommend appropriate treatments.

- Fluoride Treatments:Fluoride strengthens tooth enamel, making it more resistant to decay.

- X-rays:X-rays help detect cavities, bone loss, and other dental problems that may not be visible during a visual examination.

- Restorative Procedures:These procedures address existing dental problems, restoring damaged teeth to their original function.

- Fillings:Fillings repair cavities by replacing decayed tooth structure with a material such as composite resin or amalgam.

- Crowns:Crowns cover damaged or weakened teeth, restoring their shape, size, and strength.

- Root Canals:Root canals treat infected or damaged tooth pulp, saving the tooth from extraction.

- Dentures:Dentures replace missing teeth, restoring chewing function and improving aesthetics.

- Bridges:Bridges replace missing teeth by anchoring artificial teeth to existing teeth or implants.

Coverage Limitations and Exclusions

While dental insurance plans cover a wide range of procedures, they typically have limitations and exclusions. It’s important to understand these limitations before choosing a plan.

- Cosmetic Procedures:Most dental insurance plans do not cover cosmetic procedures, such as teeth whitening, veneers, or dental implants for purely aesthetic purposes. These procedures are typically considered elective and not medically necessary.

- Pre-Existing Conditions:Some plans may exclude coverage for pre-existing conditions, such as gum disease or tooth decay, that were present before the policy’s effective date. However, most plans will cover treatment for these conditions after the waiting period.

- Annual Maximums:Dental insurance plans often have annual maximums, which limit the total amount of benefits you can receive in a year. Once you reach the maximum, you will be responsible for paying any remaining costs out-of-pocket.

- Waiting Periods:Most plans have waiting periods before certain procedures are covered. This means you may have to wait a certain number of months before you can receive benefits for specific treatments, such as crowns or dentures.

Coverage Percentages

Dental insurance plans typically cover a percentage of the cost of covered procedures. The coverage percentage can vary depending on the plan, the type of procedure, and the provider.

| Procedure | Coverage Percentage |

|---|---|

| Cleanings | 100% |

| Dental Exams | 100% |

| Fillings | 80% |

| Crowns | 50% |

| Root Canals | 70% |

Cost and Premiums

Dental insurance premiums are the monthly or annual payments you make to your insurance provider in exchange for coverage. These premiums can vary significantly based on several factors.

Factors Influencing Premiums

The cost of your dental insurance plan is determined by several factors. Understanding these factors can help you choose a plan that fits your budget and needs.

- Age:Younger individuals generally have lower premiums than older individuals. This is because younger people tend to have healthier teeth and are less likely to need expensive dental procedures.

- Location:Premiums can vary depending on where you live. This is because the cost of living and the cost of dental care can vary by region.

- Coverage Level:The amount of coverage you choose will also affect your premium. Plans with higher coverage limits, such as those that cover more procedures or have lower deductibles, will typically have higher premiums.

- Dental History:If you have a history of dental problems, your premiums may be higher. This is because you are more likely to need dental care, and insurers may see you as a higher risk.

- Family Size:Premiums for family plans are typically higher than individual plans. This is because the plan covers more people.

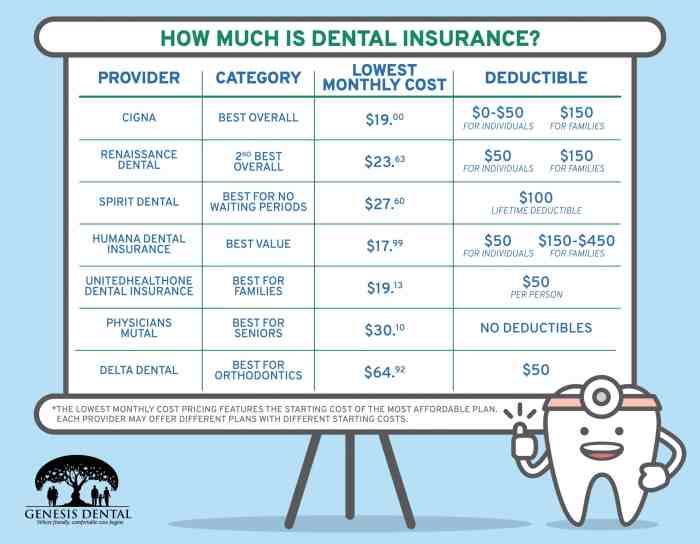

Average Costs of Dental Insurance Plans

The average cost of dental insurance plans varies depending on the factors mentioned above. However, here are some general estimates based on data from the National Association of Dental Plans (NADP):

- Individual Plans:Average premiums for individual dental insurance plans range from $25 to $75 per month.

- Family Plans:Average premiums for family dental insurance plans range from $75 to $200 per month.

It’s important to note that these are just averages, and actual premiums can vary significantly.

Tips for Finding Affordable Dental Insurance

Here are some tips for finding affordable dental insurance options:

- Shop around:Compare quotes from multiple insurers to find the best price.

- Consider a higher deductible:Choosing a higher deductible can lower your monthly premiums.

- Ask about discounts:Some insurers offer discounts for things like good dental health, non-smoking status, or group membership.

- Look for plans with limited coverage:If you are generally healthy and don’t anticipate needing a lot of dental care, a plan with limited coverage may be a good option.

- Check for employer-sponsored plans:Many employers offer dental insurance as part of their benefits package. If your employer offers a plan, you may be able to get coverage at a lower cost than if you were to purchase a plan on your own.

Choosing the Right Plan

Choosing the right dental insurance plan can be a bit like choosing the right pair of shoes – it’s all about finding the perfect fit for your individual needs and budget. Just like you wouldn’t wear hiking boots to a fancy dinner, you wouldn’t want a dental plan that doesn’t cover the treatments you need.

Understanding Your Needs

Before you start browsing dental insurance plans, it’s important to understand your own dental needs. Consider your dental history, any current dental issues, and your future dental goals. Are you prone to cavities? Do you need regular cleanings? Are you planning on getting braces or implants in the future?

Answering these questions will help you narrow down your search and find a plan that aligns with your specific requirements.

Budget Considerations

Dental insurance, like any other insurance, comes with a price tag. You’ll need to consider your budget and determine how much you’re willing to spend on premiums and out-of-pocket costs. A good starting point is to compare the annual premiums of different plans and see how they fit into your overall financial picture.

Remember, lower premiums may come with higher deductibles or co-pays, so it’s essential to weigh these factors carefully.

Step-by-Step Guide to Choosing a Dental Insurance Plan

Here’s a step-by-step guide to help you navigate the process of choosing the right dental insurance plan:

- Assess your needs:Take a close look at your dental history, current dental issues, and future dental goals. This will help you identify the essential coverage you need.

- Determine your budget:Set a realistic budget for your premiums and out-of-pocket expenses. Consider your financial situation and how much you’re comfortable spending on dental care.

- Research insurance providers:Explore different insurance providers and compare their plans, coverage, and pricing. Look for providers with a strong reputation and positive customer reviews.

- Review plan details:Carefully read the plan documents, including the coverage details, deductibles, co-pays, and exclusions. Pay close attention to the specific procedures covered and the limits on coverage.

- Compare plan options:Once you’ve narrowed down your choices, compare the remaining plans side-by-side to see which one best aligns with your needs and budget.

- Ask questions:Don’t hesitate to contact the insurance providers with any questions you have about their plans. This will ensure you fully understand the terms and conditions before making a decision.

Questions to Ask Potential Insurance Providers

To make sure you’re getting the best possible dental insurance, it’s important to ask the right questions. Here’s a checklist of questions to ask potential insurance providers:

- What is the annual premium for the plan?

- What is the deductible? How much do I need to pay out-of-pocket before coverage kicks in?

- What are the co-pays for different procedures? How much do I pay for each visit, cleaning, filling, etc.?

- What is the coverage limit for each procedure? Is there a maximum amount the plan will pay for a specific treatment?

- Are there any exclusions or limitations on coverage? Are certain procedures not covered or have specific restrictions?

- What is the network of dentists? Is my preferred dentist in the network?

- What is the process for filing claims? How do I submit a claim and how long does it take to process?

- Are there any waiting periods for certain procedures?

- What are the plan’s cancellation policies? What happens if I need to cancel my coverage?

Dental Insurance and Healthcare Reform

Healthcare reform has had a significant impact on dental insurance coverage in the United States. The Affordable Care Act (ACA), passed in 2010, has brought about changes that affect how dental insurance is provided and accessed.

Dental Insurance and Preventative Care

Dental insurance plays a crucial role in promoting preventative care and overall health. Regular dental checkups and cleanings are essential for maintaining oral health, which is directly linked to overall well-being. By covering these services, dental insurance encourages individuals to prioritize their oral health and potentially avoid more expensive treatments in the future.

The Role of Dental Insurance in Healthcare Reform

Dental insurance is not mandated by the ACA, but it is an important part of the broader healthcare system. The ACA has introduced some changes that indirectly impact dental insurance:

- Expansion of Medicaid:The ACA expanded Medicaid eligibility, providing health insurance coverage to millions of low-income Americans. While Medicaid does not typically cover dental services for adults, it does offer coverage for children, promoting early oral health care.

- Marketplaces:The ACA created health insurance marketplaces where individuals can purchase health plans. While these marketplaces do not typically include dental coverage, they provide a platform for consumers to compare and choose dental insurance plans alongside their medical insurance.

- Emphasis on Prevention:The ACA has emphasized the importance of preventative care, aligning with the role of dental insurance in promoting regular checkups and cleanings.

The Future of Dental Insurance in the Context of Healthcare Reform

The future of dental insurance in the context of healthcare reform remains uncertain. Some experts believe that dental insurance may become more integrated into the broader healthcare system, potentially becoming a mandated benefit under the ACA or similar legislation. Others argue that dental insurance will continue to be a separate market, with increased focus on preventative care and cost-effective treatment options.

“The future of dental insurance is likely to be shaped by a combination of factors, including technological advancements, consumer preferences, and government policies.”

Ending Remarks: Dental Insurance Plans

Navigating the world of dental insurance doesn’t have to be a daunting task. With a clear understanding of the different plan types, coverage details, and cost factors, you can confidently choose the plan that best suits your individual needs and budget.

Remember, investing in dental insurance is an investment in your overall health and well-being. It’s a smart move that ensures you can access the care you need to maintain a healthy, dazzling smile for years to come.

Question Bank

What is the difference between PPO and HMO dental plans?

A PPO (Preferred Provider Organization) offers more flexibility, allowing you to see any dentist you choose, but you’ll generally pay higher premiums and copays. HMO (Health Maintenance Organization) plans are typically more affordable but require you to choose a dentist within their network.

How often can I get my teeth cleaned with dental insurance?

Most dental insurance plans cover two preventive cleanings per year. However, this can vary depending on your specific plan.

What are some common exclusions in dental insurance plans?

Common exclusions include cosmetic procedures like teeth whitening, implants, and orthodontics unless you have a separate rider for these services.