Car insurance comparison is a crucial step in finding the best coverage for your vehicle and your budget. It’s not just about finding the cheapest option, but about finding a policy that aligns with your needs and provides adequate protection in case of an accident or other unforeseen events.

This guide will equip you with the knowledge and tools to navigate the car insurance landscape and make informed decisions.

Understanding the basics of car insurance is essential. You’ll need to familiarize yourself with different coverage types, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each type of coverage provides a specific level of protection and comes with its own set of premiums and deductibles.

Understanding Car Insurance

Car insurance is an essential safety net that protects you financially in the event of an accident or other unforeseen incidents involving your vehicle. It’s a contract between you and an insurance company where you pay premiums in exchange for coverage against various risks associated with car ownership.

Types of Car Insurance Coverage

Car insurance policies typically offer various coverage options, each designed to protect you from specific types of risks. Understanding these coverage types is crucial to ensuring you have adequate protection.

- Liability Coverage:This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It covers the costs of repairs, medical expenses, and legal fees incurred by the other party.

- Collision Coverage:This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage:This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects.

- Uninsured/Underinsured Motorist Coverage:This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage, up to the limits of your policy.

- Personal Injury Protection (PIP):This coverage, also known as “no-fault” insurance, pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident.

- Medical Payments Coverage:This coverage pays for your medical expenses, regardless of who is at fault, if you are injured in an accident while driving or occupying your vehicle.

Car Insurance Premium Calculation

The cost of your car insurance premium is determined by several factors, each contributing to the overall risk assessment. These factors include:

- Driving History:Your driving record plays a significant role in determining your premium. Drivers with a history of accidents, traffic violations, or DUI convictions are considered higher risk and typically pay higher premiums.

- Vehicle Type:The make, model, and year of your vehicle influence your premium. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to repair and insure.

- Location:Your location, including your state and zip code, affects your premium. Areas with higher rates of accidents or theft tend to have higher insurance costs.

- Coverage Options:The type and amount of coverage you choose directly impact your premium. Higher coverage limits and additional coverage options, such as roadside assistance or rental car reimbursement, will increase your premium.

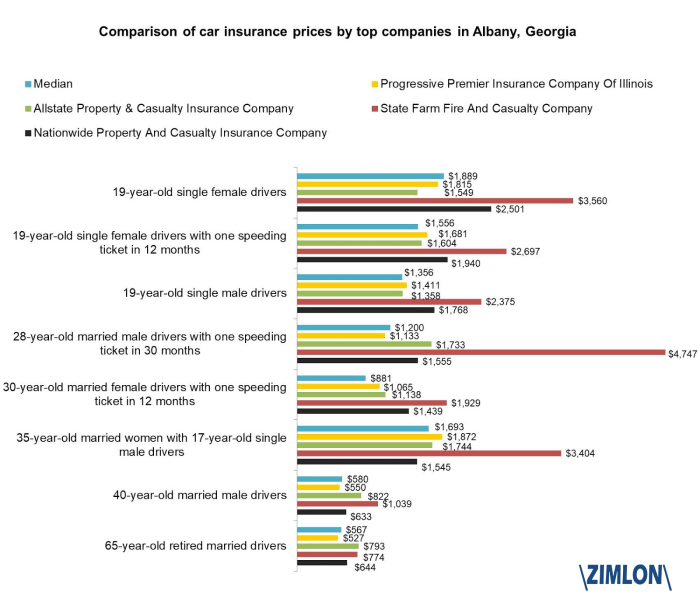

- Age and Gender:Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Gender also plays a role, with men generally paying higher premiums than women.

- Credit Score:In some states, insurance companies may use your credit score as a factor in determining your premium. This is based on the idea that individuals with good credit history are more financially responsible and less likely to file claims.

Common Car Insurance Terms

Navigating the world of car insurance can be confusing due to the numerous terms and acronyms used. Understanding these terms is essential for making informed decisions about your coverage.

- Deductible:This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium.

- Premium:This is the amount you pay to your insurance company for coverage.

- Claim:This is a request for payment from your insurance company after an accident or other covered event.

- Policy:This is the written contract between you and your insurance company that Artikels the terms and conditions of your coverage.

- Coverage Limits:These are the maximum amounts your insurance company will pay for specific types of claims, such as bodily injury or property damage.

- Exclusions:These are specific events or situations that are not covered by your insurance policy.

- Endorsements:These are additional coverage options that can be added to your policy, such as roadside assistance or rental car reimbursement.

Why Compare Car Insurance

Imagine this: you’re paying for car insurance, but are you getting the best deal? You could be missing out on significant savings and better coverage options. Comparing car insurance quotes is like shopping around for any other major purchase – it allows you to find the best value for your money.

Benefits of Comparing Car Insurance Quotes

Comparing car insurance quotes offers numerous advantages, ultimately helping you secure the most suitable policy for your needs and budget.

- Significant Cost Savings:Insurance companies have varying pricing structures. Comparing quotes from multiple insurers can reveal significant price differences, allowing you to potentially save hundreds or even thousands of dollars annually.

- Finding the Right Coverage:Insurance policies vary in terms of coverage and features. Comparing quotes enables you to identify policies that align with your specific needs, such as comprehensive coverage for a new car or liability coverage for a high-risk driver.

- Improved Coverage Options:By comparing quotes, you can discover policies with better coverage than your current plan, such as increased liability limits, roadside assistance, or rental car coverage.

How Comparing Quotes Can Help

Comparing car insurance quotes empowers you to make informed decisions about your insurance needs.

- Personalized Coverage:Different insurance companies offer different coverage options and discounts. Comparing quotes allows you to find a policy that caters to your unique circumstances, such as your driving history, vehicle type, and location.

- Budget-Friendly Options:By comparing quotes, you can identify policies that fit within your budget. You can explore options with lower premiums or adjust your coverage to reduce costs without compromising essential protection.

- Negotiating Power:Armed with multiple quotes, you can leverage the competition among insurers to negotiate a better price or request additional coverage features.

Real-World Examples

Here are some real-world examples of how comparing car insurance quotes has yielded positive results:

- John, a young driver with a clean driving record,found that comparing quotes from multiple insurers saved him $300 per year on his car insurance.

- Sarah, a new car owner,compared quotes and discovered a policy with comprehensive coverage for a lower price than her previous insurer offered.

- David, a seasoned driver with a history of minor accidents,compared quotes and found a policy with higher liability limits and roadside assistance, offering him peace of mind on the road.

Methods for Comparing Car Insurance

Finding the right car insurance can be a bit like navigating a maze. But with the right tools and a little bit of effort, you can find the perfect policy that fits your needs and budget. One of the most effective ways to compare car insurance quotes is by using online comparison websites.

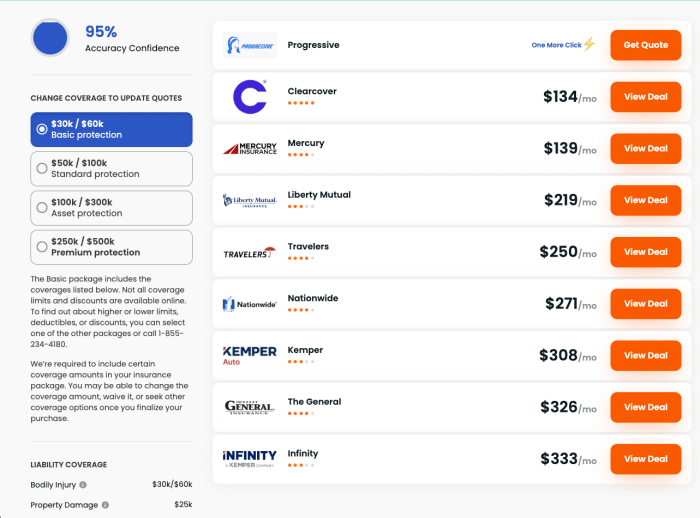

These websites act as a one-stop shop for gathering quotes from multiple insurers, allowing you to easily compare prices and features side-by-side.

Using Online Comparison Websites

Online comparison websites are a great way to get a quick overview of the car insurance market. They allow you to enter your details once and receive quotes from multiple insurers. This saves you time and effort compared to contacting each insurer individually.

Here’s a step-by-step guide on how to effectively use online comparison websites:

- Choose a reputable comparison website:Look for websites that have a good reputation and are trusted by consumers. You can check online reviews or ask for recommendations from friends and family.

- Enter your details accurately:Make sure to provide all the necessary information, including your vehicle details, driving history, and desired coverage levels. The more accurate your information, the more accurate the quotes you receive.

- Compare quotes carefully:Pay attention to the coverage levels, deductibles, and other terms and conditions. Don’t just focus on the price; make sure the coverage meets your needs.

- Read the fine print:Before making a decision, take the time to carefully read the policy documents provided by each insurer. This will ensure you understand the terms and conditions of the coverage.

- Contact insurers directly:If you have any questions or need clarification, don’t hesitate to contact the insurers directly. This will help you make an informed decision.

Reputable Car Insurance Comparison Websites

There are many reputable car insurance comparison websites available. Here are a few popular options with their key features:

| Website | Key Features |

|---|---|

| Compare.com | Offers quotes from multiple insurers, including major brands and regional providers. Provides detailed policy comparisons and allows you to customize your search criteria. |

| Insurify | Provides quotes from a wide range of insurers, including niche providers. Offers a user-friendly interface and allows you to compare quotes based on different factors, such as price, coverage, and customer satisfaction. |

| The Zebra | Offers quotes from over 100 insurers, including major brands and regional providers. Provides detailed policy comparisons and allows you to filter quotes based on your specific needs. |

Beyond Price: Other Factors to Consider

While price is an important factor when choosing car insurance, it’s not the only thing you should consider. Other important factors include:

- Customer service:Look for insurers with a reputation for excellent customer service. This is especially important if you’re likely to need to file a claim or have questions about your policy.

- Claims handling processes:Check how insurers handle claims. Do they have a reputation for being fair and efficient?

- Financial stability:Choose insurers with a strong financial rating. This indicates that they are financially sound and likely to be able to pay claims if needed.

Factors Influencing Car Insurance Costs

Your car insurance premium is not set in stone. Several factors influence the cost, and understanding them can help you make informed decisions to potentially save money. This section delves into the key factors that determine your car insurance rates, empowering you to navigate the world of car insurance with greater control.

Driving History

Your driving history is a significant factor in determining your car insurance premium. Insurance companies use your driving record to assess your risk of being involved in an accident.

- A clean driving record with no accidents or violations usually results in lower premiums.

- On the other hand, having a history of accidents, speeding tickets, or other traffic violations can significantly increase your insurance costs.

To minimize your premiums, it is crucial to maintain a safe driving record.

“A clean driving record is your best friend when it comes to car insurance.”

Vehicle Type

The type of vehicle you drive plays a significant role in your insurance premium. Insurance companies consider factors like the vehicle’s make, model, year, safety features, and repair costs.

- Expensive cars, luxury vehicles, and high-performance models often have higher insurance premiums due to their higher repair costs and potential for greater damage in an accident.

- Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts.

By choosing a vehicle with a good safety rating and reasonable repair costs, you can potentially reduce your insurance premiums.

Location

Your location can significantly impact your car insurance rates. Insurance companies consider factors like the density of population, traffic volume, crime rates, and the frequency of accidents in your area.

- Urban areas with high traffic congestion and higher crime rates generally have higher insurance premiums.

- Rural areas with lower population density and fewer accidents typically have lower premiums.

While you may not be able to change your location, understanding the impact of your area on insurance rates can help you make informed decisions.

Age

Age is a significant factor in determining car insurance premiums. Younger drivers, particularly those under 25, often have higher premiums due to their lack of experience and higher risk of accidents.

- As drivers gain experience and age, their premiums generally decrease.

- Older drivers may also see their premiums increase due to potential health concerns or decreased reaction times.

It is important to note that insurance companies may offer discounts for young drivers who complete defensive driving courses or have good grades in school.

Coverage Options

The coverage options you choose for your car insurance policy significantly influence your premium.

Just like you compare car insurance quotes to find the best deal, it’s smart to compare international health insurance plans when you’re venturing abroad. International Health Insurance Plans: Your Global Safety Net can provide peace of mind, knowing you’re covered in case of unexpected medical emergencies.

Think of it as a safety net for your health, just as car insurance protects your vehicle. So, before you pack your bags, take a look at these plans and see how they can safeguard your well-being on your next adventure!

- Comprehensive and collision coverage, which protect you from damage to your vehicle caused by non-accident events like theft or vandalism, typically increase premiums.

- Liability coverage, which protects you from financial responsibility in case of an accident you cause, is usually required by law and has a significant impact on your premium.

By carefully considering your coverage needs and choosing the appropriate options, you can find the right balance between protection and affordability.

Driving Violations and Accidents

Driving violations and accidents have a significant impact on your car insurance premiums.

- Traffic violations, such as speeding tickets, reckless driving, and DUI offenses, can significantly increase your premiums.

- Accidents, even if you were not at fault, can also increase your premiums.

Insurance companies view these events as indicators of higher risk, leading to increased premiums. It is essential to maintain a clean driving record to keep your insurance costs manageable.

Tips for Getting the Best Car Insurance Deal

Finding the most affordable car insurance can be a daunting task, but with the right strategies, you can significantly reduce your premiums. This section will provide you with valuable tips to secure the best car insurance deal, empowering you to make informed decisions and save money.

Take Advantage of Discounts

Insurance companies offer various discounts to reduce premiums. These discounts are designed to incentivize safe driving practices, responsible vehicle ownership, and loyalty. Here’s a list of common discounts you can explore:

- Good Driver Discount:This discount is typically awarded to drivers with a clean driving record, free of accidents or traffic violations.

- Safe Driver Discount:This discount is often offered to drivers who complete defensive driving courses or demonstrate safe driving habits.

- Multi-Car Discount:Insuring multiple vehicles with the same company can lead to significant savings.

- Multi-Policy Discount:Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can result in lower premiums.

- Loyalty Discount:Long-term customers often qualify for discounts for their continued business.

- Anti-theft Device Discount:Installing anti-theft devices, such as alarms or GPS tracking systems, can reduce your insurance premiums.

- Good Student Discount:This discount is available to students with high GPAs or excellent academic performance.

Negotiate Your Premium

Don’t hesitate to negotiate with your insurance company. It’s a common practice, and it could save you a significant amount of money. Here are some negotiation strategies:

- Shop Around for Quotes:Obtaining quotes from multiple insurance companies allows you to compare prices and coverage options. Armed with this information, you can leverage the best offer when negotiating with your current insurer.

- Highlight Your Good Driving Record:Emphasize your clean driving history and lack of accidents or violations. This demonstrates your responsible driving habits and can sway the insurer in your favor.

- Bundle Policies:Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. This can be a strong negotiating point, as it increases the value of your business to the insurer.

- Be Prepared to Switch:If your current insurer is unwilling to negotiate, be prepared to switch to a competitor offering better rates and coverage. This can create a sense of urgency and motivate them to make a counteroffer.

Avoid Common Pitfalls

While comparing car insurance quotes, it’s crucial to avoid common pitfalls that can lead to suboptimal choices.

- Don’t Just Focus on the Lowest Price:While price is an important factor, don’t solely focus on the cheapest quote. Carefully consider the coverage options and ensure they meet your needs. A lower price might come with limited coverage, leaving you vulnerable in case of an accident.

- Don’t Ignore Deductibles:Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles generally result in higher premiums, while higher deductibles lead to lower premiums. Choose a deductible that aligns with your financial situation and risk tolerance.

- Don’t Neglect Coverage Limits:Coverage limits determine the maximum amount your insurance company will pay for specific claims. Ensure the limits are sufficient to cover potential costs, considering the value of your vehicle and the potential for significant repairs or medical expenses.

- Don’t Be Afraid to Ask Questions:Don’t hesitate to clarify any uncertainties or seek further information from insurance representatives. Ensure you understand the terms and conditions of the policy before committing to it.

Understanding Car Insurance Policies

Your car insurance policy is a contract that Artikels the terms of coverage between you and your insurance company. It’s crucial to understand the different types of coverage, their benefits, and limitations to ensure you have adequate protection in case of an accident or other covered events.

Types of Car Insurance Coverage

The most common types of car insurance coverage are:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. It covers the costs of medical bills, lost wages, property repairs, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than collisions, such as theft, vandalism, fire, hail, or floods.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Interpreting Car Insurance Policy Documents

Understanding your car insurance policy can seem daunting, but it’s essential to know what you’re covered for. Here’s a guide to interpreting key sections and clauses:

- Declarations Page: This page summarizes your policy details, including your name, address, vehicle information, coverage limits, and premium amount.

- Coverage Sections: Each section of your policy describes the specific types of coverage you have, including the limits and conditions.

- Exclusions and Limitations: This section lists the situations and circumstances that are not covered by your policy.

- Definitions: This section defines key terms used in the policy, ensuring clarity and understanding.

Understanding Policy Limitations and Exclusions

It’s crucial to understand the limitations and exclusions in your policy to avoid unexpected coverage gaps. For example:

- Deductibles: This is the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in.

- Coverage Limits: Your policy will have limits on the maximum amount it will pay for certain types of claims, such as medical expenses or property damage.

- Exclusions: Certain events or circumstances are explicitly excluded from coverage, such as driving under the influence of alcohol or drugs.

Filing a Car Insurance Claim

Filing a car insurance claim can be a stressful experience, but understanding the process and taking the right steps can help ensure a smoother and more successful outcome. This section will guide you through the steps involved, highlight important considerations, and provide valuable tips for maximizing your claim payout.

The Process of Filing a Car Insurance Claim

The process of filing a car insurance claim typically involves several steps:

- Contact Your Insurance Company:Immediately after an accident, contact your insurance company to report the incident. This should be done as soon as possible, preferably within 24 hours. Your insurance company will guide you through the next steps.

- Provide Necessary Information:Be prepared to provide detailed information about the accident, including the date, time, location, and parties involved. This may include contact information for the other driver(s), witnesses, and any police reports filed.

- File a Claim:Your insurance company will provide you with a claim form, which you will need to complete and submit. This form will request information about the accident, your vehicle, and any injuries sustained.

- Documentation:Gather all relevant documentation, such as photos of the damage, police reports, witness statements, and medical bills. Ensure that all documentation is clear and legible.

- Inspection and Appraisal:Your insurance company may arrange for an inspection of your vehicle to assess the damage. An appraiser will determine the cost of repairs or replacement.

- Negotiation:Once the damage has been assessed, you may need to negotiate with your insurance company regarding the claim payout. This may involve discussing the repair costs, replacement value, and any deductible you are responsible for.

- Payment:After the negotiation is complete, your insurance company will issue a payment for the claim. This payment may be made directly to you or to the repair shop.

Required Documentation

Accurate and comprehensive documentation is crucial for a successful claim. Here are some key documents to gather:

- Police Report:If the accident involved injuries, property damage exceeding a certain threshold, or a hit-and-run, obtain a police report from the responding officers.

- Photos and Videos:Take clear photos and videos of the damage to your vehicle, the accident scene, and any injuries sustained. These can serve as visual evidence to support your claim.

- Witness Statements:If there were witnesses to the accident, gather their contact information and obtain written statements from them.

- Medical Records:If you sustained injuries, obtain copies of your medical records, including doctor’s notes, treatment summaries, and billing statements.

- Repair Estimates:Obtain repair estimates from reputable auto body shops to support your claim for repair costs.

- Vehicle Registration and Insurance Information:Keep your vehicle registration and insurance information readily available for easy access.

Communication with the Insurer, Car insurance comparison

Clear and effective communication with your insurance company is essential throughout the claims process.

- Be Prompt:Respond to all requests for information and documentation promptly. Delays can hinder the progress of your claim.

- Be Clear and Concise:Provide detailed information in a clear and concise manner, avoiding ambiguity or jargon.

- Keep Records:Maintain a record of all communication with your insurance company, including dates, times, and summaries of conversations.

- Be Professional:Maintain a professional and respectful tone in all communications, even if you are frustrated.

- Understand Your Policy:Review your insurance policy carefully to understand your coverage, deductibles, and any limitations.

Tips for Maximizing Claim Payouts

Here are some tips to help you maximize your claim payout:

- Document Everything:Take detailed notes, photos, and videos of the accident scene, your vehicle’s damage, and any injuries sustained.

- Seek Medical Attention:Even if your injuries seem minor, seek medical attention promptly. This will provide documentation of your injuries and potential treatment costs.

- Get Repair Estimates:Obtain multiple repair estimates from reputable auto body shops to ensure you are receiving a fair price for repairs.

- Negotiate:Be prepared to negotiate with your insurance company to ensure you receive a fair settlement for your claim.

- Consider Legal Counsel:If you are having difficulty negotiating with your insurance company or believe your claim is being unfairly denied, consider seeking legal advice from an experienced attorney.

Resolving Disputes with Insurance Companies

Disputes with insurance companies can arise, especially if you believe your claim is being unfairly denied or undervalued.

- Understand Your Rights:Familiarize yourself with your rights as a policyholder and the procedures for appealing a claim denial.

- Gather Evidence:Compile all relevant documentation, including photos, videos, witness statements, and medical records, to support your case.

- Contact Your Insurance Commissioner:If you are unable to resolve the dispute with your insurance company, contact your state’s insurance commissioner for assistance.

- Consider Mediation:Mediation can be a helpful alternative to litigation for resolving insurance disputes.

- Legal Action:If all other options fail, you may need to file a lawsuit to pursue your claim.

Car Insurance and Technology

The car insurance industry has undergone a significant transformation thanks to advancements in technology. From telematics devices to mobile apps and online platforms, technology has revolutionized the way we manage our policies and claims.

Telematics Devices and Usage-Based Insurance

Telematics devices, also known as black boxes, are small gadgets that plug into a car’s diagnostic port. They collect data about driving behavior, such as speed, acceleration, braking, and mileage. This information is then transmitted to the insurance company, which uses it to assess risk and offer personalized premiums.

- Benefits:Usage-based insurance (UBI) programs based on telematics data can offer significant savings to safe drivers who demonstrate responsible driving habits. They can also provide valuable insights into driving behavior, allowing policyholders to improve their driving skills and potentially reduce their insurance costs.

- Drawbacks:Privacy concerns are a major issue associated with telematics devices. Some drivers may be uncomfortable with the idea of their driving habits being constantly monitored. Additionally, there are concerns about the potential for data breaches and misuse of personal information.

Mobile Apps for Policy Management and Claims

Mobile apps have become increasingly popular for managing car insurance policies and filing claims. They offer a convenient and efficient way to access policy information, make payments, report accidents, and track the status of claims.

- Benefits:Mobile apps provide 24/7 access to insurance information and services, eliminating the need for phone calls or visits to insurance offices. They also allow for faster claim processing and provide real-time updates on the status of claims.

- Drawbacks:Some mobile apps may have limited functionality or be prone to glitches. Additionally, there are concerns about the security of personal information stored on mobile devices.

Online Platforms for Policy Comparison and Purchase

Online platforms have made it easier than ever to compare car insurance quotes from different providers. They allow users to enter their personal information and vehicle details to receive personalized quotes within minutes.

- Benefits:Online platforms offer a convenient and efficient way to compare quotes from multiple insurance providers. They also provide access to a wider range of insurance products and services.

- Drawbacks:Some online platforms may not offer all available insurance options or may not be able to provide personalized advice. Additionally, there are concerns about the security of personal information shared online.

Final Conclusion

By taking the time to compare quotes and understand your policy, you can ensure that you’re getting the best possible car insurance deal. Remember, the right policy will provide you with peace of mind knowing that you’re financially protected in case of an accident or other unexpected event.

Don’t settle for the first quote you see – take the time to compare and find the coverage that’s right for you.

Questions Often Asked: Car Insurance Comparison

How often should I compare car insurance quotes?

It’s generally recommended to compare quotes at least once a year, or even more frequently if you experience significant life changes like getting married, having a child, or moving to a new location.

What are some common discounts offered by car insurance companies?

Many companies offer discounts for safe driving records, good grades for young drivers, bundling multiple insurance policies, installing safety features in your car, and being a loyal customer.

What if I’m unsure about which coverage options are right for me?

Don’t hesitate to contact an insurance agent or broker. They can help you understand your coverage needs and recommend the most appropriate policy for your situation.