What are the most affordable life insurance policies? This is a question on many people’s minds, especially as they navigate the complex world of financial planning. Finding the right life insurance policy can feel like a daunting task, but it doesn’t have to be.

Understanding the different types of policies, the factors that affect cost, and the resources available to help you compare options can make the process much smoother.

The key to finding an affordable life insurance policy lies in a careful analysis of your individual needs and circumstances. This includes considering your age, health, desired coverage amount, and the length of time you need the policy to be in effect.

Armed with this information, you can confidently explore various options and secure a policy that provides peace of mind without breaking the bank.

Understanding Life Insurance Basics: What Are The Most Affordable Life Insurance Policies?

Before diving into the world of affordable life insurance policies, it’s crucial to grasp the fundamental concepts of life insurance. This will equip you with the knowledge to make informed decisions and find the policy that best suits your needs and budget.

Types of Life Insurance Policies

Life insurance policies are categorized based on their structure, coverage duration, and premium payment options. Here’s a breakdown of the most common types:

- Term Life Insurance:This is the most basic and typically the most affordable type of life insurance. It provides coverage for a specific period, usually 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit.

If you outlive the term, the policy expires, and you receive nothing.

- Whole Life Insurance:Whole life insurance offers lifelong coverage, meaning it remains in effect as long as you pay the premiums. It combines a death benefit with a cash value component that grows over time. Premiums are typically higher than term life insurance due to the permanent coverage and the cash value component.

- Universal Life Insurance:Universal life insurance is a flexible type of permanent life insurance that allows you to adjust your death benefit and premium payments. It offers a cash value component that earns interest, but the interest rate can fluctuate.

- Variable Life Insurance:This type of life insurance allows you to invest your premiums in a variety of sub-accounts, similar to mutual funds. The death benefit and cash value can fluctuate depending on the performance of the investments.

- Indexed Universal Life Insurance:Indexed universal life insurance ties the cash value growth to the performance of a specific market index, such as the S&P 500. It offers potential for higher returns but also carries some risk.

Defining “Affordable” in Life Insurance, What are the most affordable life insurance policies?

The concept of “affordable” is subjective and depends on your individual financial situation. In the context of life insurance, an affordable policy is one that you can comfortably afford to pay for over the long term without straining your budget.

It should also provide adequate coverage for your needs and financial obligations.

Factors Influencing Life Insurance Premium Costs

Several factors contribute to the cost of life insurance premiums. Understanding these factors can help you make informed decisions about your coverage needs and find the most affordable policy.

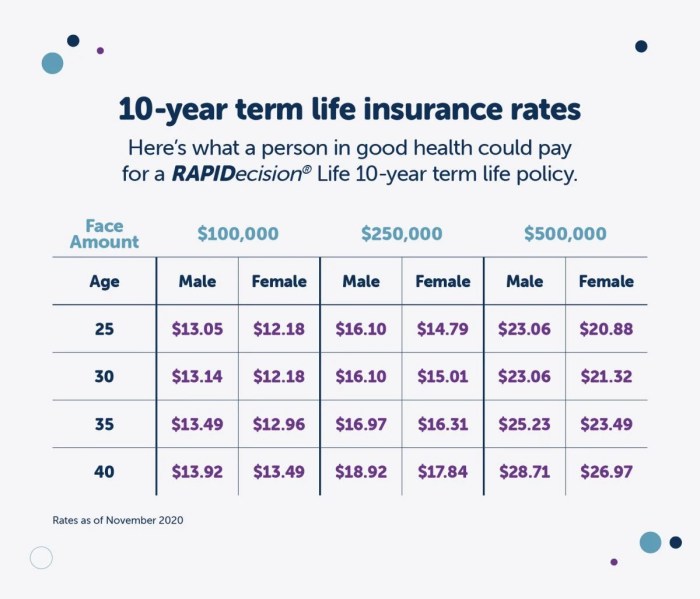

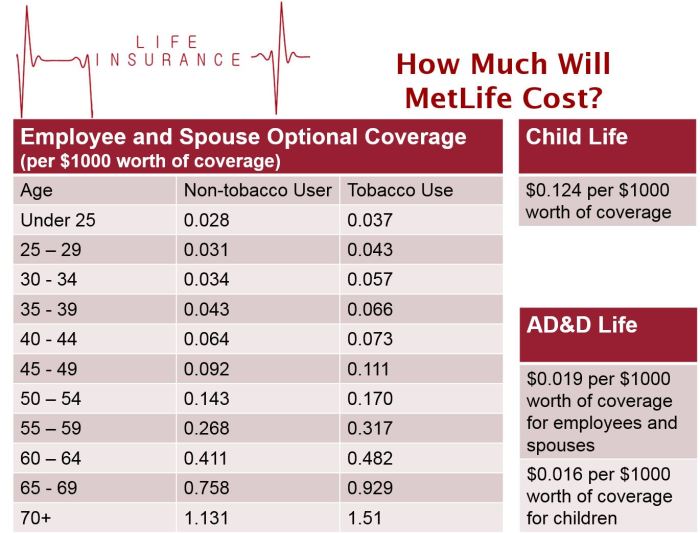

- Age:Younger individuals generally pay lower premiums than older individuals because they have a longer life expectancy.

- Health:Your health status significantly influences your premium costs. Individuals with pre-existing medical conditions or unhealthy habits may face higher premiums.

- Lifestyle:Your lifestyle choices, such as smoking, drinking, and participation in risky activities, can impact your premium rates.

- Death Benefit:The higher the death benefit you choose, the higher your premium will be.

- Policy Term:Longer policy terms generally result in higher premiums.

- Gender:Traditionally, women have paid lower premiums than men due to their longer life expectancy. However, this difference is gradually narrowing.

- Insurance Company:Different insurance companies have varying premium structures and underwriting practices. Comparing quotes from multiple companies is essential.

Factors Affecting Affordability

Life insurance premiums are calculated based on several factors, and understanding these factors can help you find the most affordable policy for your needs. The factors influencing affordability can be broadly categorized into personal characteristics, policy details, and insurance provider practices.

Age, Health, and Lifestyle

Your age, health, and lifestyle significantly impact the cost of your life insurance premiums. Younger and healthier individuals generally pay lower premiums compared to older and less healthy individuals. This is because life insurance companies assess the risk of you passing away during the policy term.

- Age:As you age, the probability of death increases, making you a higher risk for insurance companies. Therefore, older individuals generally pay higher premiums.

- Health:Individuals with pre-existing health conditions or unhealthy habits are considered higher risks and often face higher premiums. For instance, someone with a history of heart disease or cancer may pay more than someone with a clean bill of health.

- Lifestyle:Engaging in risky activities like smoking, excessive alcohol consumption, or dangerous hobbies can also increase your premium. Life insurance companies consider these factors as they increase your risk of early death.

Coverage Amount and Policy Term

The amount of coverage you choose and the duration of your policy term also play a significant role in determining the affordability of your life insurance.

- Coverage Amount:A higher coverage amount means a larger death benefit payable to your beneficiaries in case of your death. Naturally, higher coverage amounts require higher premiums.

- Policy Term:The length of your policy term also influences the cost. Longer policy terms generally lead to higher premiums because the insurance company is obligated to cover you for a more extended period.

Insurance Provider Comparison

Life insurance premiums can vary considerably between different insurance providers. Comparing quotes from multiple companies is crucial to finding the most affordable option.

- Competitive Pricing:Different insurance companies have different pricing strategies and risk assessments, resulting in varying premium costs.

- Discounts and Promotions:Some insurance providers offer discounts for certain groups, such as non-smokers, individuals with good credit scores, or those who bundle their life insurance with other policies.

- Financial Stability:It is essential to choose a financially stable insurance company. A financially sound company is more likely to be able to pay out claims in the future, providing you with greater peace of mind.

Finding Affordable Life Insurance Options

Now that you understand the basics of life insurance and the factors that influence its cost, let’s explore how to find affordable options that fit your needs. There are numerous resources and strategies you can utilize to navigate the world of life insurance and secure a policy that aligns with your budget.

Online Resources and Tools for Comparing Quotes

The internet is a treasure trove of information when it comes to life insurance. Several websites and tools allow you to compare quotes from various insurance companies, making it convenient to find the best deals. Here are some reputable online resources to consider:

- Insurance Comparison Websites:Websites like Policygenius, NerdWallet, and Compare.com aggregate quotes from multiple insurance companies, allowing you to easily compare options side-by-side. These platforms often provide detailed information about each policy, including coverage details, premiums, and customer reviews.

- Insurance Company Websites:Directly visiting the websites of major insurance companies can provide you with insights into their offerings, coverage options, and pricing structures.

- Independent Insurance Agents:Independent agents work with multiple insurance companies and can help you find policies that match your specific needs and budget. They can also provide valuable advice and guidance throughout the process.

Comparing Affordable Life Insurance Policies

Here’s a table comparing the key features and costs of some popular affordable life insurance policies:

| Policy Type | Coverage | Premium | Pros | Cons |

|---|---|---|---|---|

| Term Life Insurance | Temporary coverage for a specific period | Generally lower than permanent life insurance | Affordable, simple to understand | Coverage expires after the term ends, no cash value |

| Whole Life Insurance | Permanent coverage with cash value component | Higher than term life insurance | Provides lifetime coverage, builds cash value | More expensive, complex |

| Universal Life Insurance | Flexible coverage with cash value component | Variable premiums, can be adjusted based on needs | Flexible premiums, cash value growth potential | Can be complex, premiums can fluctuate |

Tips for Negotiating Lower Premiums

While online resources and tools can help you find affordable options, negotiating with insurance companies can further reduce your premiums. Here are some tips:

- Shop around and compare quotes:Don’t settle for the first quote you receive. Get quotes from multiple insurance companies and compare them side-by-side.

- Consider a longer policy term:A longer policy term typically translates to lower premiums. This is because the insurance company spreads the risk over a longer period.

- Increase your deductible:A higher deductible can lead to lower premiums. This is because you’ll be responsible for paying more out-of-pocket in case of a claim.

- Improve your health:A healthy lifestyle and good health habits can improve your insurability, leading to lower premiums.

- Bundle your insurance policies:Some insurance companies offer discounts for bundling multiple policies, such as life insurance, home insurance, and auto insurance.

- Ask about discounts:Many insurance companies offer discounts for various factors, such as being a non-smoker, having a good driving record, or being a member of certain organizations.

- Negotiate with the insurer:Don’t be afraid to negotiate with the insurance company. Explain your budget and see if they can offer you a lower premium.

Evaluating Coverage and Needs

Determining the right life insurance coverage amount is crucial for ensuring your loved ones are financially protected in your absence. The ideal amount depends on various factors, including your individual circumstances, financial obligations, and lifestyle.

Determining the Appropriate Coverage Amount

Calculating the appropriate coverage amount involves considering your financial obligations and the needs of your dependents. A common method is to estimate the total amount of income your family would need to replace, factoring in expenses such as mortgage payments, living costs, education, and outstanding debts.

For instance, if your annual household income is $100,000 and you have a mortgage of $300,000, a $50,000 student loan, and you want to ensure your family can maintain their current lifestyle for 10 years, you might need a coverage amount of $1 million.

Common Life Insurance Needs

Life insurance can address various financial needs, and understanding these needs can help you choose the right policy:

- Mortgage Protection: Life insurance can help cover the remaining mortgage balance if you pass away, preventing your family from losing their home. A policy with a death benefit equal to the mortgage amount can provide peace of mind.

- Final Expenses: This covers funeral costs, medical bills, and other expenses associated with your passing, easing the financial burden on your family.

- Income Replacement: This type of life insurance provides a lump sum payment to your family to replace your income, ensuring they can maintain their financial stability.

Assessing Policy Affordability and Needs

Once you’ve determined the coverage amount, it’s essential to assess whether the policy is truly affordable and meets your needs. Here’s a step-by-step guide:

- Compare Quotes: Obtain quotes from multiple insurance companies to compare premiums and coverage options. Consider factors like your age, health, and lifestyle.

- Review Policy Terms: Carefully examine the policy’s terms and conditions, including the death benefit, premiums, exclusions, and waiting periods.

- Consider Future Needs: Evaluate how your needs might change over time, such as a growing family or increased financial obligations. Choose a policy that can adapt to your evolving circumstances.

- Seek Professional Advice: Consult with a financial advisor to ensure you’re making the right decisions based on your individual circumstances.

Additional Considerations

While securing an affordable life insurance policy is a significant step, it’s crucial to explore additional factors that can further enhance your coverage and ensure you’re making the most informed decision. These considerations can significantly impact your policy’s overall value and effectiveness.

Policy Riders and Add-ons

Policy riders and add-ons are optional features that can be added to your life insurance policy to enhance its coverage and cater to your specific needs. These features can provide additional benefits or protection, but they often come with an extra premium.

Consider these examples:

- Accidental Death Benefit Rider:This rider pays a lump-sum benefit if the insured dies due to an accident. It can provide additional financial support to your beneficiaries in the event of an unexpected and tragic loss.

- Waiver of Premium Rider:This rider waives future premium payments if the insured becomes disabled. This ensures that your policy remains active even if you can’t afford to pay the premiums due to an unexpected disability.

- Living Benefits Rider:This rider allows you to access a portion of your death benefit while you are still living, if you are diagnosed with a terminal illness. This can provide financial assistance for medical expenses and other needs during a challenging time.

The Role of Financial Advisors

A financial advisor can play a crucial role in helping you select an affordable life insurance policy that meets your individual needs and financial goals. They can provide personalized guidance and expertise in assessing your situation, understanding your needs, and exploring various policy options.

- Expert Advice:Financial advisors have extensive knowledge of the life insurance market and can guide you through the complex world of policies, riders, and add-ons. They can help you understand the intricacies of different coverage options and ensure you choose the policy that best aligns with your circumstances.

- Objective Assessment:Financial advisors offer an unbiased perspective and can help you avoid making emotional decisions. They can help you objectively evaluate your needs and choose a policy that provides the right level of coverage without unnecessary extras.

- Long-Term Planning:Financial advisors can incorporate life insurance into your overall financial plan, considering factors such as your income, assets, liabilities, and future goals. This holistic approach ensures that your life insurance policy aligns with your broader financial objectives.

Resources for Further Information and Support

There are various resources available to provide you with additional information and support as you navigate the world of life insurance.

Finding the most affordable life insurance policies can feel like a treasure hunt! You’ll want to consider your age, health, and the amount of coverage you need. But remember, affordability isn’t just about the monthly premium – it’s also about finding a policy that fits your needs.

For seniors, it’s especially important to make sure you’re getting the right coverage. That’s why understanding how to find the best life insurance policy for seniors is crucial. By carefully comparing policies and understanding your options, you can find the most affordable life insurance that provides the peace of mind you deserve.

- Consumer Reports:This organization provides independent reviews and ratings of life insurance companies, helping you make informed decisions.

- National Association of Insurance Commissioners (NAIC):This organization offers a wealth of information on life insurance regulations, consumer protection, and resources.

- State Insurance Departments:Each state has its own insurance department that regulates insurance companies and provides consumer protection. You can contact your state’s insurance department for information on specific policies, complaints, or guidance.

Ultimate Conclusion

In conclusion, finding affordable life insurance is a journey of self-discovery. By understanding your individual needs, exploring various policy options, and utilizing available resources, you can find a policy that provides financial security for your loved ones without compromising your budget.

Remember, life insurance is a crucial investment in your future and the well-being of those who depend on you. Take the time to do your research, compare quotes, and choose a policy that fits your specific circumstances. It’s an investment worth making.

FAQ Overview

How much life insurance do I really need?

The amount of life insurance you need depends on your individual circumstances, including your income, dependents, debts, and financial goals. It’s generally recommended to have enough coverage to replace your income for a certain period, cover outstanding debts, and provide for your family’s basic needs.

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable than whole life insurance, which provides lifelong coverage and has a cash value component that can accumulate over time.

Can I get life insurance if I have a pre-existing health condition?

Yes, you can still get life insurance if you have a pre-existing health condition, but it may be more expensive or require you to answer additional health questions. Some insurance companies specialize in providing coverage for individuals with health issues.

How can I find the best life insurance rates?

The best way to find the best life insurance rates is to compare quotes from multiple insurance companies. You can use online comparison tools or work with a licensed insurance agent to get quotes from different providers.