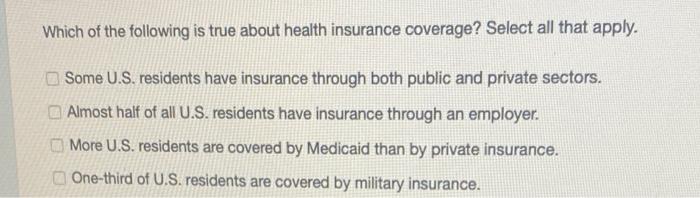

What are the best no exam life insurance policies? – What are the best no-exam life insurance policies? This question is on the minds of many looking for affordable and convenient coverage. No-exam life insurance, as the name suggests, skips the traditional medical exam, offering a faster and simpler application process.

But how does it work, and is it right for you? Let’s explore the ins and outs of this increasingly popular option.

Imagine this: You need life insurance but dread the idea of a medical exam. No-exam policies offer a way to get coverage without the hassle. They often come with simplified underwriting, focusing on health questionnaires and medical records. While this can be a huge plus, it’s crucial to understand the trade-offs, including potential limitations on coverage and higher premiums.

This guide will help you navigate the world of no-exam policies, empowering you to make the best choice for your needs.

Understanding No-Exam Life Insurance

Life insurance is a crucial financial tool, offering peace of mind to loved ones in the event of your passing. Traditional policies often require a medical exam, which can be time-consuming and inconvenient. No-exam life insurance, however, offers a streamlined approach, allowing you to secure coverage without undergoing a physical examination.

Finding the best no exam life insurance policy is like searching for a hidden treasure! You’ll want to consider factors like your age, health, and desired coverage amount. And to get a good sense of the price tag for this treasure, it’s wise to check out what are the rates for whole life insurance?

. This can give you a starting point to compare policies and find the one that fits your budget and needs. Remember, the right policy can be a valuable investment in your family’s future!

No-Exam Life Insurance Explained, What are the best no exam life insurance policies?

No-exam life insurance, also known as simplified issue life insurance, simplifies the application process by eliminating the requirement for a medical exam. Instead of undergoing a physical examination, insurers rely on a simplified application process, typically involving a health questionnaire and sometimes a review of your medical history.

This makes it a convenient option for individuals who may find traditional medical exams inconvenient or challenging.

Advantages and Disadvantages of No-Exam Life Insurance

Advantages

- Convenience:No-exam life insurance eliminates the need for a medical exam, saving you time and effort. You can apply for coverage from the comfort of your home, making it a convenient option for busy individuals.

- Speedier Approval:Since there’s no waiting for medical exam results, the approval process for no-exam policies is typically faster than traditional policies.

- Accessibility:No-exam life insurance is often more accessible to individuals with pre-existing medical conditions or those who may find it difficult to undergo a medical exam due to age, mobility issues, or other factors.

Disadvantages

- Higher Premiums:Due to the simplified underwriting process, no-exam policies often come with higher premiums compared to traditional policies. This is because insurers assume a higher level of risk without the benefit of a medical exam.

- Limited Coverage Amounts:No-exam policies typically have lower maximum coverage amounts compared to traditional policies. This is because insurers are unable to assess your health as thoroughly without a medical exam.

- Potential for Higher Risk:While no-exam policies offer convenience, it’s important to note that insurers may not have a complete picture of your health without a medical exam. This could potentially lead to higher risk for the insurer, which could impact your coverage in the long run.

Eligibility Criteria for No-Exam Life Insurance

No-exam life insurance policies are designed to be more accessible and convenient than traditional life insurance policies, but they still have eligibility criteria that you need to meet. These criteria are designed to ensure that the insurance company is not taking on too much risk by insuring you.

Underwriting for No-Exam Policies

Underwriting is the process that insurance companies use to assess your risk and determine your eligibility for a policy. While no-exam policies are designed to be more streamlined, they still involve underwriting, although it may be simplified.

- Age: No-exam life insurance policies typically have age limits, which may vary depending on the insurer. Generally, you can apply for a no-exam policy if you are between the ages of 18 and 80. However, some insurers may have stricter age limits, particularly for higher coverage amounts.

- Health History: While no-exam policies don’t require a medical exam, insurers will still ask about your health history. This information is used to assess your risk profile. You will typically be asked about your medical conditions, medications, surgeries, and any other health-related factors.

- Lifestyle Factors: Your lifestyle habits, such as smoking, alcohol consumption, and dangerous hobbies, can also affect your eligibility for a no-exam policy. Some insurers may require you to disclose these factors, and they may use this information to determine your premiums.

Health Conditions that May Prevent Qualification

While no-exam policies are more accessible, certain health conditions may still prevent you from qualifying. Some common conditions that may hinder eligibility include:

- Severe medical conditions: If you have a serious medical condition, such as cancer, heart disease, or diabetes, you may not be eligible for a no-exam policy. Insurers may require you to undergo a medical exam to assess your risk.

- Recent health issues: If you have recently been diagnosed with a health condition or have undergone a major surgery, you may not qualify for a no-exam policy. Insurers may require you to wait a certain period before applying.

- High-risk lifestyle: If you engage in high-risk activities, such as skydiving or motorcycling, you may not qualify for a no-exam policy. These activities increase your risk of death, which can make you a less desirable candidate for insurance.

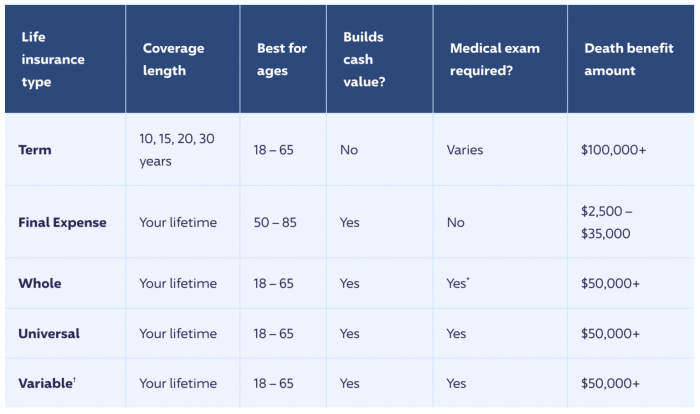

Types of No-Exam Life Insurance

No-exam life insurance policies come in various types, each with unique features, benefits, and costs. Understanding these differences is crucial to choosing the policy that best suits your individual needs and financial situation.

Types of No-Exam Life Insurance Policies

Here’s a breakdown of the common types of no-exam life insurance policies:

| Type | Features | Benefits | Costs |

|---|---|---|---|

| Term Life | Provides coverage for a specific period, typically 10 to 30 years. | Lower premiums than permanent life insurance. Affordable option for temporary coverage needs. | Premiums are generally lower than permanent life insurance, but coverage ends after the term expires. |

| Whole Life | Provides lifelong coverage and accumulates cash value. | Guaranteed premiums and death benefit. Cash value can be borrowed against or withdrawn. | Higher premiums than term life insurance. |

| Universal Life | Flexible premiums and death benefit. Accumulates cash value that earns interest. | Allows for adjustments to premiums and death benefit. Offers potential for investment growth. | Premiums can fluctuate based on market conditions. May have higher fees than term life insurance. |

Term Life Insurance

Term life insurance is a temporary coverage option that provides a death benefit if the insured person dies within the specified term.

Term life insurance is like renting a house: you pay a monthly premium for a set period, and if you die within that time, your beneficiaries receive the death benefit. But if you live beyond the term, you get nothing back.

Whole Life Insurance

Whole life insurance provides lifelong coverage and accumulates cash value. It is a permanent life insurance policy with a guaranteed death benefit and premiums.

Whole life insurance is like owning a house: you pay a fixed monthly premium, and the policy builds cash value over time, which you can borrow against or withdraw. The death benefit is guaranteed for life.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that allows for adjustments to premiums and death benefit. It accumulates cash value that earns interest, similar to a savings account.

Universal life insurance is like owning a house with a flexible mortgage: you can adjust your payments and the amount you owe, and the house value can fluctuate based on market conditions.

Key Factors to Consider When Choosing a No-Exam Policy

Choosing the right no-exam life insurance policy is crucial to ensure you have adequate financial protection for your loved ones. It’s not just about getting the lowest premium; it’s about finding a policy that aligns with your needs and budget.

Here are some key factors to consider:

Coverage Amount

The coverage amount, also known as the death benefit, is the sum your beneficiaries will receive upon your passing. It’s essential to determine the appropriate coverage amount based on your financial obligations, such as outstanding debts, mortgage payments, and future expenses for your family.

- Consider your family’s financial needs:How much income would your family need to replace your income if you were to pass away? This includes things like mortgage payments, bills, education costs, and other expenses.

- Calculate your outstanding debts:Factor in any outstanding loans, mortgages, or credit card debt.

- Estimate future expenses:Think about potential future expenses like college tuition for your children, or long-term care costs.

Policy Term

The policy term refers to the duration of your life insurance coverage. A shorter term might be more affordable initially, but you won’t have coverage after the term expires. Longer-term policies provide coverage for a more extended period, but they typically have higher premiums.

- Consider your age and health:Younger, healthier individuals might prefer longer-term policies, as they have more time to build wealth and cover potential future expenses.

- Evaluate your financial needs:If you have significant long-term financial obligations, a longer-term policy might be more suitable.

- Assess your risk tolerance:A shorter-term policy might be appropriate if you are comfortable with the risk of having no coverage after the term expires.

Premium Affordability

The premium is the monthly or annual payment you make for your life insurance policy. Finding a policy with affordable premiums is crucial to ensure you can maintain coverage long-term.

- Compare quotes from multiple providers:Different insurers offer varying premiums, so it’s essential to compare quotes before making a decision.

- Consider your budget:Choose a policy with premiums you can comfortably afford, without straining your finances.

- Explore options for premium payments:Some insurers offer flexible payment options, such as annual, semi-annual, or monthly payments, to suit your budget.

Table Comparing No-Exam Policy Options

Here’s a simplified table comparing different no-exam policy options based on coverage amount, policy term, and premium affordability:| Policy Option | Coverage Amount | Policy Term | Premium Affordability ||—|—|—|—|| Term Life| $100,000

$5,000,000 | 10-30 years | Typically lower |

| Guaranteed Universal Life| $25,000

$5,000,000 | Lifetime | Higher premiums, but potential for cash value growth |

| Simplified Issue Whole Life| $10,000

$100,000 | Lifetime | Higher premiums, but provides permanent coverage |

Checklist of Questions to Ask Potential Insurance Providers

Before finalizing your decision, consider asking these questions to potential insurance providers:

- What are the specific requirements for eligibility?

- What is the coverage amount and policy term available?

- What are the premiums and payment options?

- What are the exclusions and limitations of the policy?

- Are there any waiting periods before coverage takes effect?

- What are the options for changing or canceling the policy?

- What are the customer service options and support available?

Finding the Right No-Exam Policy

Now that you understand the basics of no-exam life insurance, it’s time to find the policy that best suits your needs. This is where the fun begins (well, as fun as life insurance can be)!

Comparing Quotes from Multiple Providers

You wouldn’t buy the first car you saw, right? The same goes for life insurance. Getting quotes from multiple insurance providers is essential to finding the best deal. This lets you compare coverage, premiums, and features side-by-side.

- Online Comparison Tools:Websites like Policygenius, NerdWallet, and Insurance.com allow you to compare quotes from various companies in one place.

- Directly Contact Insurance Companies:Don’t be afraid to call or visit the websites of individual insurance providers to get personalized quotes.

Researching and Selecting a Reputable Insurance Company

Once you have a few quotes, it’s time to do your homework on the insurance companies. A reputable company will have a strong financial rating, a history of fair claims handling, and positive customer reviews.

- Financial Ratings:Look for companies with high ratings from organizations like A.M. Best, Standard & Poor’s, and Moody’s. These ratings reflect the company’s financial stability and ability to pay claims.

- Customer Reviews:Read online reviews on sites like Trustpilot, Consumer Reports, and the Better Business Bureau to get an idea of the company’s customer service and claims handling practices.

- Industry Recognition:Look for awards and recognitions that demonstrate the company’s commitment to customer satisfaction and ethical practices.

The Role of an Independent Insurance Agent or Broker

Navigating the world of life insurance can feel overwhelming. That’s where an independent insurance agent or broker can be a valuable resource. They work with multiple insurance companies and can help you find a policy that meets your specific needs.

- Expert Guidance:Agents and brokers have extensive knowledge of the insurance industry and can provide personalized advice based on your situation.

- Access to Multiple Companies:They can access policies from a wide range of insurers, saving you the time and effort of contacting each one individually.

- Negotiation Power:Agents and brokers often have relationships with insurance companies, which can help you get better rates and terms.

Final Summary

No-exam life insurance can be a game-changer for those seeking a quick and straightforward application process. However, remember that it’s essential to weigh the pros and cons carefully. Consider your health, budget, and coverage needs before making a decision.

By understanding the different types of policies, comparing quotes, and asking the right questions, you can find the no-exam life insurance solution that fits your unique circumstances. So, get ready to explore the world of no-exam life insurance and discover the policy that provides peace of mind for you and your loved ones.

FAQ Explained: What Are The Best No Exam Life Insurance Policies?

What is the difference between no-exam and traditional life insurance?

Traditional life insurance requires a medical exam to assess your health, while no-exam policies rely on health questionnaires and medical records. This makes the no-exam process quicker and more convenient, but it can also lead to higher premiums or limitations on coverage.

Can I get no-exam life insurance if I have a pre-existing health condition?

It depends on the severity of the condition and the insurer’s underwriting guidelines. Some insurers may offer coverage with adjustments to premiums or coverage terms. It’s best to contact insurers directly to discuss your specific situation.

How much coverage can I get with a no-exam policy?

Coverage amounts vary depending on the insurer, your health, and other factors. No-exam policies may have lower coverage limits compared to traditional policies.