What are the best life insurance policies with living benefits? This question is on the minds of many seeking financial protection for themselves and their loved ones. Living benefits, also known as accelerated death benefits, provide a lifeline during times of critical illness or long-term care needs, allowing policyholders to access a portion of their death benefit while they’re still alive.

This can be a game-changer for families facing unexpected medical expenses or those needing financial assistance for long-term care.

This guide will delve into the various types of life insurance policies offering living benefits, outlining the key features, advantages, and disadvantages of each. We’ll also explore crucial factors to consider when choosing a policy, ensuring you make an informed decision that aligns with your individual needs and financial situation.

Understanding Living Benefits in Life Insurance

Life insurance policies with living benefits offer a unique twist on traditional coverage, allowing policyholders to access a portion of their death benefit while they are still alive. This feature provides financial security and peace of mind, particularly in situations where unexpected medical expenses or long-term care needs arise.

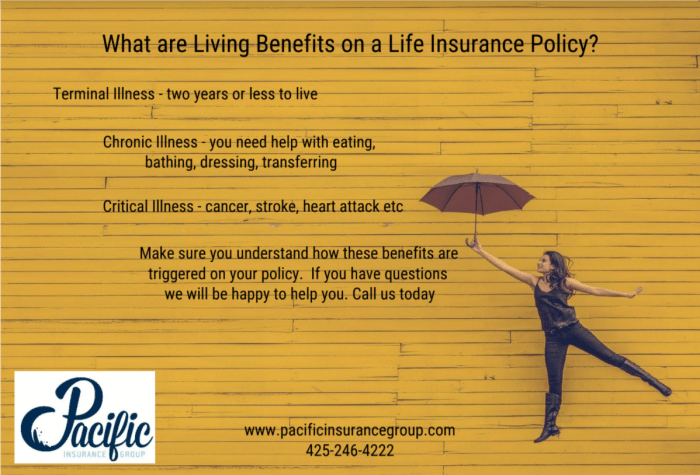

Types of Living Benefits

Living benefits are typically offered as riders, which are optional additions to your base life insurance policy. Here are some common examples:

- Accelerated Death Benefits:These benefits allow you to access a portion of your death benefit if you are diagnosed with a terminal illness. This can help cover medical expenses, end-of-life care, or other financial burdens.

- Chronic Illness Riders:Similar to accelerated death benefits, these riders provide access to a portion of your death benefit if you are diagnosed with a chronic illness, such as Alzheimer’s disease or multiple sclerosis. This can help cover the costs associated with long-term care, home modifications, or other needs.

- Long-Term Care Riders:These riders provide financial assistance for long-term care services, such as nursing home care, assisted living, or in-home care. This benefit can help cover the costs of care, which can be significant and unpredictable.

Advantages of Living Benefits

Policies with living benefits offer several advantages, including:

- Financial Security:These benefits provide financial assistance during times of need, such as a serious illness or long-term care. This can help alleviate financial stress and allow you to focus on your health and well-being.

- Peace of Mind:Knowing you have access to a portion of your death benefit if needed can provide peace of mind and reduce anxiety about unexpected expenses.

- Flexibility:Living benefits can be tailored to your individual needs and circumstances. You can choose the type of benefit, the amount of coverage, and the conditions under which it can be accessed.

Potential Drawbacks of Living Benefits

While living benefits offer significant advantages, there are also some potential drawbacks to consider:

- Increased Premiums:Policies with living benefits typically have higher premiums than traditional life insurance policies. This is because the insurer is assuming additional risk by offering these benefits.

- Limited Coverage:The amount of coverage available through living benefits is typically limited to a percentage of your death benefit. This may not be sufficient to cover all of your expenses, especially if your needs are significant.

- Restrictions and Eligibility:There may be restrictions on how and when you can access your living benefits. For example, you may need to meet specific medical criteria or have a terminal illness diagnosis.

Types of Life Insurance Policies with Living Benefits

Life insurance policies with living benefits offer a unique way to access a portion of your death benefit while you are still alive. These benefits can be used to cover a wide range of expenses, including medical bills, long-term care costs, or even to supplement your retirement income.

There are several different types of life insurance policies that offer living benefits, each with its own set of features and benefits. Let’s explore these options in detail.

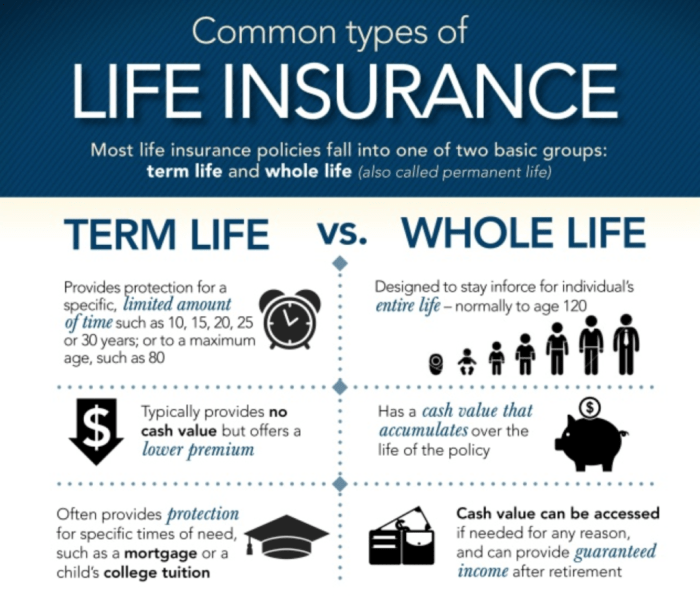

Term Life Insurance with Living Benefits

Term life insurance with living benefits provides temporary coverage for a specific period, typically 10, 20, or 30 years. It is generally the most affordable type of life insurance, making it a popular choice for families with young children or those on a tight budget.

While it doesn’t build cash value, it offers the option to access a portion of your death benefit for specific needs, such as critical illness or long-term care. These benefits typically come with limitations, such as a maximum payout amount and specific qualifying conditions.

However, they can provide valuable financial assistance during challenging times.

Whole Life Insurance with Living Benefits

Whole life insurance with living benefits offers permanent coverage for your entire lifetime. It builds cash value over time, which can be borrowed against or withdrawn. This makes it a more flexible option than term life insurance. Whole life insurance with living benefits also provides access to a portion of your death benefit for various needs, including long-term care or critical illness.The premiums for whole life insurance are typically higher than those for term life insurance, as you are paying for both the death benefit and the cash value accumulation.

However, the potential for long-term growth and access to living benefits can make it a worthwhile investment for some individuals.

Universal Life Insurance with Living Benefits

Universal life insurance with living benefits offers permanent coverage and allows for flexible premium payments. It also allows you to adjust your death benefit and cash value accumulation over time. This type of policy typically includes living benefits, such as accelerated death benefits or long-term care riders.Universal life insurance offers a higher level of flexibility compared to whole life insurance.

However, it also carries a higher degree of risk, as the policy’s performance depends on the investment options chosen.

Comparing Different Types of Policies

Here’s a table summarizing the key features and benefits of each type of life insurance policy with living benefits:

| Policy Type | Premiums | Coverage | Flexibility | Living Benefits |

|---|---|---|---|---|

| Term Life Insurance with Living Benefits | Lower | Temporary | Limited | Limited access to death benefit for specific needs |

| Whole Life Insurance with Living Benefits | Higher | Permanent | Moderate | Access to death benefit for various needs, including long-term care and critical illness |

| Universal Life Insurance with Living Benefits | Variable | Permanent | High | Access to death benefit for various needs, including long-term care and critical illness |

Factors to Consider When Choosing a Policy: What Are The Best Life Insurance Policies With Living Benefits?

Choosing a life insurance policy with living benefits requires careful consideration of your individual circumstances. It’s not a one-size-fits-all decision. Factors like your age, health, financial situation, and specific needs for long-term care or chronic illness support play a crucial role in determining the best policy for you.

Age and Health

Your age and health are key factors influencing the cost and availability of life insurance policies with living benefits. Younger and healthier individuals generally qualify for lower premiums, as they are statistically less likely to experience health issues requiring the benefits.

As you age and your health deteriorates, premiums tend to increase, and you may encounter limitations in the types of policies available to you.

Financial Situation

Your financial situation is critical in determining the affordability and suitability of a policy. Consider your current income, expenses, and savings. You need to ensure the premiums fit comfortably within your budget without straining your finances. Additionally, evaluate the amount of coverage you need, balancing your financial obligations and the potential costs of long-term care or chronic illness.

Specific Needs

Consider your specific needs for long-term care or chronic illness support. If you have a family history of health conditions or are concerned about potential future health challenges, a policy with living benefits can provide valuable financial protection. Assess the types of benefits offered, such as accelerated death benefits, chronic illness riders, or long-term care riders, and determine which best aligns with your individual needs.

Policy Features

Compare the features of different policies, including the premiums, coverage amount, waiting periods, and exclusions. Consider the flexibility and adaptability of the policy to your changing needs. For example, some policies allow you to adjust the coverage amount or add riders as your circumstances evolve.

Provider Reputation and Financial Stability

Choose a reputable and financially stable insurance provider. Research the company’s track record, financial ratings, and customer satisfaction. A financially sound provider ensures the availability of benefits when you need them.

Professional Advice

Consulting with a financial advisor or insurance agent can provide valuable insights and guidance. They can help you understand the complexities of life insurance policies with living benefits, assess your individual needs, and recommend policies that align with your goals and financial situation.

Key Considerations for Living Benefit Riders

Living benefit riders are valuable additions to life insurance policies, offering financial support during your lifetime. However, it’s essential to understand the different types of riders, their benefits, limitations, and costs to make an informed decision.

Accelerated Death Benefit Riders

Accelerated death benefit riders, also known as terminal illness riders, allow you to access a portion of your death benefit while you are still alive if you are diagnosed with a terminal illness. This benefit can help cover medical expenses, end-of-life care costs, and other financial needs.

- Eligibility Criteria:Typically, you must be diagnosed with a terminal illness with a life expectancy of less than 12 months to qualify for an accelerated death benefit. The specific criteria may vary depending on the insurance company.

- Payout Amounts:The payout amount is usually a percentage of the death benefit, ranging from 25% to 100%. The amount may be paid in a lump sum or installments.

- Limitations on Use:The funds can only be used for specific purposes, such as medical expenses, long-term care, or other expenses related to your terminal illness. You may also be required to provide documentation of your diagnosis and expenses.

- Cost:Accelerated death benefit riders come with an additional premium, which can vary depending on the amount of coverage and the insurance company.

Chronic Illness Riders

Chronic illness riders provide financial support if you are diagnosed with a chronic illness, such as Alzheimer’s disease, Parkinson’s disease, or multiple sclerosis. This benefit can help cover medical expenses, home care, and other costs associated with your illness.

Want a policy that’s like a superhero for your golden years? Life insurance with living benefits can be a lifesaver, offering financial support for long-term care or other unexpected expenses. But navigating the world of senior life insurance can be tricky.

That’s where a little research comes in handy, so you can find the perfect policy for your needs. Check out this article for tips on how to find the best life insurance policy for seniors and then dive into the world of living benefits to find the best fit for your future!

- Eligibility Criteria:You must meet the insurer’s definition of a chronic illness and be diagnosed by a qualified physician. The specific criteria may vary depending on the insurance company.

- Payout Amounts:The payout amount is typically a lump sum, but it may be paid in installments. The amount may vary depending on the policy and the severity of your illness.

- Limitations on Use:The funds can only be used for specific purposes, such as medical expenses, long-term care, or other expenses related to your chronic illness.

- Cost:Chronic illness riders come with an additional premium, which can vary depending on the amount of coverage and the insurance company.

Long-Term Care Riders

Long-term care riders provide financial support if you need long-term care, such as assistance with activities of daily living, such as bathing, dressing, and eating. This benefit can help cover the costs of nursing homes, assisted living facilities, or home health care.

- Eligibility Criteria:You must meet the insurer’s definition of needing long-term care. This typically means you are unable to perform two or more activities of daily living without assistance.

- Payout Amounts:The payout amount is typically a daily or monthly benefit, which can be used to pay for long-term care expenses. The amount may vary depending on the policy and the level of care you need.

- Limitations on Use:The funds can only be used for long-term care expenses. You may also be required to provide documentation of your need for care.

- Cost:Long-term care riders come with an additional premium, which can vary depending on the amount of coverage and the insurance company.

Tips for Finding the Best Policy

Finding the right life insurance policy with living benefits can feel overwhelming, but it doesn’t have to be. With a little research and planning, you can find a policy that meets your needs and provides financial security for you and your loved ones.

Researching Insurers and Comparing Quotes, What are the best life insurance policies with living benefits?

Before you start comparing quotes, it’s essential to research different insurers to understand their reputation, financial stability, and customer service. Consider the following steps:

- Check the insurer’s financial strength rating: Look for ratings from reputable agencies like A.M. Best, Moody’s, and Standard & Poor’s. These ratings assess the insurer’s ability to pay claims.

- Read customer reviews and complaints: Websites like the Better Business Bureau, Consumer Reports, and Trustpilot can provide insights into customer experiences with different insurers.

- Compare quotes from multiple insurers: Use online comparison tools or contact insurers directly to get quotes. Be sure to compare policies with similar coverage and benefits.

- Consider the insurer’s reputation for claims processing: Look for insurers with a track record of fair and efficient claims handling.

Consulting with a Financial Advisor or Insurance Broker

A financial advisor or insurance broker can provide personalized guidance and help you navigate the complexities of life insurance. They can:

- Assess your needs and goals: They can help you determine the amount of coverage you need and the type of living benefits that are right for you.

- Compare different policies and insurers: They can provide unbiased recommendations based on your specific circumstances.

- Explain the intricacies of policies: They can clarify the terms and conditions of different policies and help you understand the benefits and limitations.

- Negotiate premiums and coverage: They can leverage their expertise to secure the best possible rates and coverage for you.

Last Recap

Navigating the world of life insurance can be complex, especially when considering policies with living benefits. By understanding the different types of policies, their features, and the factors influencing your choice, you can make a confident decision that provides financial security for you and your loved ones.

Remember, consulting with a financial advisor or insurance broker can offer personalized guidance and help you find the best policy for your unique circumstances.

FAQ Summary

What are the tax implications of using living benefits?

The tax implications of using living benefits can vary depending on the specific policy and the rider you choose. It’s essential to consult with a tax professional to understand the tax treatment of your specific situation.

Can I use living benefits to pay for any medical expenses?

Living benefits are typically designed to cover specific medical expenses, such as those related to critical illnesses or long-term care. They may not be available for all medical expenses. Review your policy carefully to understand the specific conditions for using your living benefits.

How do I know if I qualify for living benefits?

Eligibility for living benefits is determined by your insurance provider based on your health status, policy terms, and the specific rider you’ve chosen. Contact your insurance company for details on eligibility criteria.