What are the best life insurance policies with cash value? This question is on the minds of many seeking a financial safety net that goes beyond simple death benefits. Cash value life insurance offers a unique blend of protection and investment, allowing you to build wealth while securing your loved ones’ future.

But with various types and features, navigating the world of cash value insurance can be overwhelming. This guide will equip you with the knowledge to make informed decisions, ensuring you find the policy that best aligns with your financial goals and aspirations.

Imagine a life insurance policy that acts as both a shield for your loved ones and a powerful tool for your financial future. That’s the promise of cash value life insurance. These policies go beyond the traditional death benefit, offering a savings component that accumulates over time, allowing you to access funds for various financial needs.

But choosing the right cash value policy is crucial, as each type has its own set of advantages and disadvantages.

Understanding Cash Value Life Insurance

Cash value life insurance is a type of permanent life insurance that offers both a death benefit and a savings component. Unlike term life insurance, which provides coverage for a specific period, cash value life insurance provides lifelong coverage and allows you to accumulate cash value over time.

Cash Value Accumulation

Cash value life insurance policies work by accumulating cash value through premiums paid. A portion of each premium payment goes towards the death benefit, while the remaining portion is invested in the policy’s cash value account. This account earns interest, which can grow tax-deferred over time.

Accessing Cash Value, What are the best life insurance policies with cash value?

Policyholders can access their cash value in several ways:

- Loans:Policyholders can borrow against their cash value at a fixed interest rate. This is a common way to access funds without surrendering the policy.

- Withdrawals:Policyholders can withdraw some or all of their cash value, but withdrawals are typically subject to taxes and may reduce the death benefit.

- Surrender:Policyholders can surrender their policy and receive the accumulated cash value, but they will lose the death benefit.

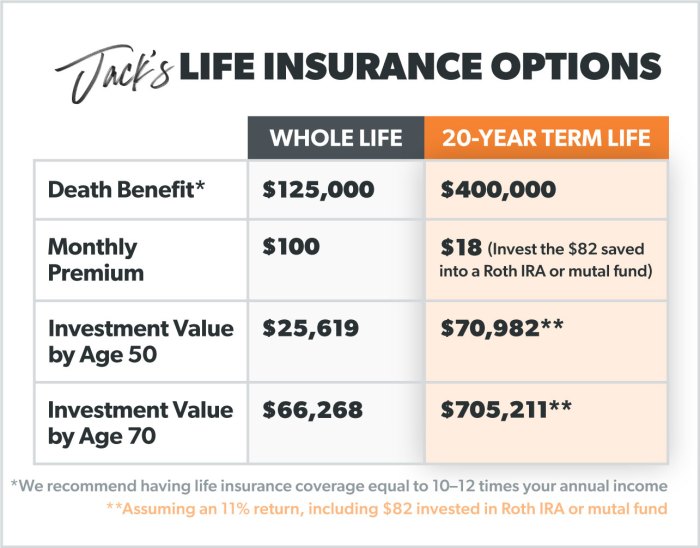

Cash Value Life Insurance vs. Term Life Insurance

Cash value life insurance and term life insurance differ significantly in their coverage and cost:

| Feature | Cash Value Life Insurance | Term Life Insurance |

|---|---|---|

| Coverage | Lifelong | Specific period |

| Savings Component | Yes | No |

| Premiums | Higher | Lower |

| Flexibility | More flexible | Less flexible |

“Cash value life insurance is a good option for individuals who want lifelong coverage and a savings component, while term life insurance is more suitable for those who need temporary coverage at a lower cost.”

Types of Cash Value Life Insurance

Cash value life insurance policies offer a unique blend of death benefit protection and savings. They accumulate cash value over time, which you can access for various financial needs. Let’s explore the different types of cash value life insurance to understand their features and suitability.

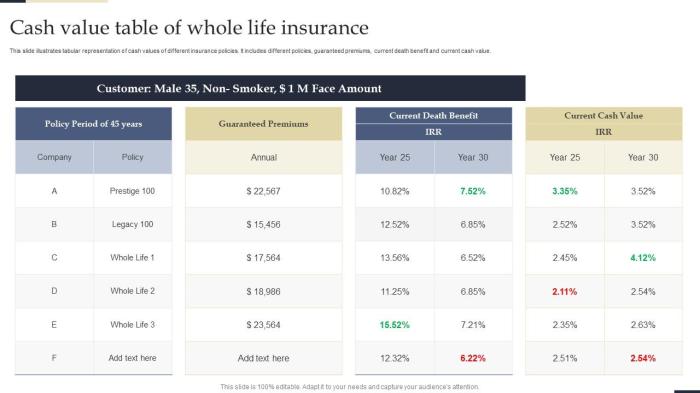

Whole Life Insurance

Whole life insurance is a permanent life insurance policy that provides lifelong coverage and builds cash value.

- Guaranteed Premiums:Whole life insurance premiums remain fixed throughout your life, offering predictable budgeting.

- Guaranteed Death Benefit:The death benefit is guaranteed, ensuring your beneficiaries receive a specific amount upon your passing.

- Cash Value Growth:Cash value accumulates at a guaranteed rate, providing a stable investment with predictable returns.

Whole life insurance offers financial security and long-term savings potential, but its premiums tend to be higher than other types of life insurance.

Universal Life Insurance

Universal life insurance provides flexibility in premium payments and death benefit options.

- Flexible Premiums:You can adjust your premium payments based on your financial situation, allowing for greater flexibility.

- Variable Death Benefit:You can choose the death benefit amount and adjust it over time, providing greater control over your coverage.

- Investment Options:Universal life policies often offer investment options, allowing you to potentially earn higher returns on your cash value.

However, universal life insurance premiums can fluctuate based on market performance, and investment returns are not guaranteed.

Variable Life Insurance

Variable life insurance offers investment options that can potentially generate higher returns, but it also carries higher risk.

- Investment Choices:You have the ability to invest your cash value in a variety of sub-accounts, including mutual funds, stocks, and bonds.

- Potential for Higher Returns:Your cash value growth is tied to the performance of your chosen investments, offering the potential for greater returns.

- Death Benefit Flexibility:You can adjust your death benefit based on your investment performance, providing greater control over your coverage.

However, variable life insurance carries investment risk, and your cash value growth and death benefit can fluctuate based on market conditions.

Comparison Table

| Feature | Whole Life | Universal Life | Variable Life |

|---|---|---|---|

| Premiums | Fixed | Flexible | Flexible |

| Death Benefit | Guaranteed | Variable | Variable |

| Cash Value Growth | Guaranteed | Variable | Variable |

| Investment Options | Limited | Limited | Wide Range |

| Risk | Low | Moderate | High |

Factors to Consider When Choosing a Policy

Choosing the right cash value life insurance policy involves careful consideration of your unique circumstances and financial goals. It’s not a one-size-fits-all decision, and what works for one person may not be the best choice for another.

Financial Goals and Risk Tolerance

Your financial goals play a significant role in determining the type of cash value life insurance policy that suits you. For example, if your primary goal is to accumulate wealth for retirement, you might prefer a policy with a higher cash value growth potential, even if it means paying higher premiums.

Conversely, if you prioritize affordable coverage with a lower premium, you might opt for a policy with a lower cash value component. Your risk tolerance also factors into the decision. Are you comfortable with the potential for lower returns, or do you prefer a policy with guaranteed returns, even if they are lower?

Understanding your risk appetite helps you choose a policy that aligns with your financial goals and comfort level.

Age, Health, and Income

Your age, health, and income all influence the cost and availability of life insurance policies. Younger and healthier individuals generally qualify for lower premiums than older or less healthy individuals. Your income level also plays a role, as it determines your ability to afford premiums and the amount of coverage you need.

Financial Strength and Reputation of Insurance Companies

Choosing a financially sound and reputable insurance company is crucial when investing in cash value life insurance. You want to ensure that the company will be around to fulfill its obligations when you need it most. Here are some factors to consider:

- Financial Ratings:Look for companies with strong financial ratings from reputable agencies like A.M. Best, Standard & Poor’s, and Moody’s. These ratings assess the company’s financial stability and ability to meet its obligations.

- Company History:Research the company’s history and track record. Look for companies with a long history of financial stability and a reputation for fair claims handling.

- Customer Reviews:Read customer reviews and testimonials to get an idea of the company’s customer service and overall satisfaction levels.

- Regulatory Compliance:Ensure the company is licensed and regulated in your state. This helps protect your interests and ensures the company is adhering to industry standards.

Key Features to Look for

When choosing a cash value life insurance policy, it’s crucial to understand the key features that influence its value and suitability for your needs. These features directly impact your financial outcomes and long-term benefits.

Cash Value Growth Potential

The cash value component of your policy accumulates over time, potentially earning interest or dividends. This growth potential is a key factor to consider, as it determines how much you can access as a loan or withdrawal.

- Interest Rates:Policies often offer variable interest rates tied to market performance. Understanding the potential for interest rate fluctuations is important, as it directly affects the growth of your cash value.

- Dividends:Some policies may offer dividends, which are a share of the insurer’s profits. Dividends can be used to increase your cash value, purchase additional insurance, or even withdraw in cash. However, dividends are not guaranteed and can vary based on the insurer’s financial performance.

Tax Implications

Cash value life insurance policies have tax advantages, but it’s crucial to understand the potential tax implications.

So, you’re wondering about cash value life insurance? It’s like a financial Swiss Army knife – protection for your loved ones AND a savings account! But before you dive in, you gotta ask yourself, “What is the best life insurance policy for me?” That’s the real question, right?

Once you’ve figured out your needs, then you can start exploring the different cash value policies to find the perfect fit.

- Tax-Deferred Growth:The interest earned on your cash value grows tax-deferred, meaning you don’t pay taxes until you withdraw or borrow against it. This can lead to significant tax savings over time, especially if you hold the policy for a long period.

- Withdrawals:Withdrawals from your cash value are generally considered taxable income. However, there are exceptions, such as using the cash value to pay premiums or withdrawing it after you reach age 59 1/2. It’s essential to consult with a tax professional to understand the specific tax implications for your situation.

Riders and Add-ons

Riders and add-ons provide additional coverage and features, customizing your policy to meet your specific needs.

- Disability Income Rider:Provides income if you become disabled and unable to work. This can help replace lost income and cover expenses during a difficult time.

- Long-Term Care Rider:Covers long-term care expenses, such as assisted living or nursing home care. This can be particularly beneficial for those concerned about the rising costs of long-term care.

- Accidental Death Benefit Rider:Provides an additional death benefit if the insured dies in an accident. This can offer peace of mind and financial security for your loved ones.

Surrender Charges

Surrender charges are fees imposed by the insurer when you withdraw or surrender your policy before a certain period. These charges can significantly reduce your cash value payout, so it’s crucial to understand the surrender charge structure.

- Duration:Surrender charges typically decrease over time, eventually phasing out after a set period, often 10-15 years. The longer you hold the policy, the lower the surrender charge.

- Impact:Surrender charges can be substantial, especially in the early years of the policy. It’s important to consider the potential impact of surrender charges before making any withdrawals or surrendering your policy.

Practical Applications and Examples

Cash value life insurance isn’t just about death benefits. Its unique structure allows you to tap into the cash value component for various financial planning purposes, turning it into a versatile tool for achieving your financial goals.

Examples of Using Cash Value Life Insurance

Here are some practical ways individuals have leveraged cash value life insurance:

- Retirement Savings:Imagine a 40-year-old individual who wants to supplement their retirement income. By regularly paying premiums into a cash value life insurance policy, they can accumulate a substantial cash value over time. This accumulated cash value can be accessed tax-advantaged during retirement, providing a source of income alongside other retirement savings.

- College Funding:Parents can use cash value life insurance to secure their children’s education. By making regular premium payments, they can build up a substantial cash value that can be withdrawn tax-free to cover college tuition, books, and living expenses. This strategy provides a reliable source of funding for education, mitigating the financial burden of college.

- Debt Management:Individuals can use cash value life insurance to manage debt. Borrowing against the accumulated cash value can provide a low-interest loan, allowing them to consolidate high-interest debt or pay off loans with lower monthly payments. This can significantly improve their overall financial health by reducing interest payments and freeing up cash flow.

Real-World Examples

* John, a 35-year-old entrepreneur, wanted to secure his family’s financial future while building wealth.He chose a cash value life insurance policy with a death benefit of $1 million and a projected cash value of $500,000 in 20 years. John planned to use the cash value to supplement his retirement income and potentially cover his children’s college expenses.

- Sarah, a 40-year-old single mother, was struggling with high-interest credit card debt.She opted for a cash value life insurance policy with a death benefit of $250,000. After a few years, she borrowed against the accumulated cash value to consolidate her high-interest debt at a lower rate. This strategy reduced her monthly debt payments and improved her credit score.

- David, a 50-year-old teacher, wanted to ensure his family’s financial security and save for retirement.He chose a cash value life insurance policy with a death benefit of $500,000 and a projected cash value of $200,000 in 10 years. David planned to use the cash value to supplement his retirement income and potentially fund his grandchildren’s college education.

Scenarios and Applications of Cash Value Life Insurance

| Scenario | Financial Goal | How Cash Value Life Insurance Can Help |

|---|---|---|

| Retirement Savings | Supplement retirement income | Accumulate cash value over time, which can be withdrawn tax-advantaged during retirement. |

| College Funding | Cover college expenses | Build up cash value that can be withdrawn tax-free to cover tuition, books, and living expenses. |

| Debt Management | Consolidate high-interest debt | Borrow against accumulated cash value to obtain a low-interest loan. |

| Emergency Fund | Provide a safety net for unexpected expenses | Access cash value in case of emergencies, such as job loss or medical bills. |

| Estate Planning | Transfer wealth to heirs | Cash value can be passed on to beneficiaries tax-free upon death. |

Final Conclusion

Cash value life insurance offers a compelling approach to financial planning, combining life insurance protection with investment potential. Understanding the nuances of each policy type, considering your individual circumstances, and carefully evaluating the insurer’s financial strength are crucial steps in finding the best fit.

By carefully navigating these considerations, you can unlock the benefits of cash value life insurance and build a secure future for yourself and your loved ones.

Detailed FAQs: What Are The Best Life Insurance Policies With Cash Value?

What is the minimum amount of cash value I can have in a policy?

The minimum cash value varies depending on the policy type and the insurer. Some policies may have a minimum cash value requirement before you can access it. It’s important to check the policy details to understand these limitations.

Can I withdraw my cash value whenever I want?

While you can typically access your cash value, there might be restrictions or penalties associated with withdrawals. These can include surrender charges, which are fees imposed for withdrawing the cash value early. It’s crucial to understand the terms of your policy regarding withdrawals and potential penalties.

Is cash value life insurance suitable for everyone?

Cash value life insurance is not a one-size-fits-all solution. It’s best suited for individuals with long-term financial goals who are willing to pay higher premiums for the investment component. If you prioritize affordable coverage and need a policy primarily for death benefit protection, term life insurance might be a better option.