What are the best health insurance plans with low premiums? It’s a question many of us ask, especially when healthcare costs seem to be rising faster than our paychecks. Navigating the world of health insurance can feel like deciphering a foreign language, but don’t worry – we’re here to break it down.

From understanding the factors that affect premiums to exploring different plan types, we’ll equip you with the knowledge to make informed decisions about your health coverage.

Whether you’re a young adult just starting out, a family with growing healthcare needs, or a seasoned individual looking for more affordable options, finding the right health insurance plan is crucial. This guide will walk you through the process, highlighting key considerations and providing resources to help you find the best plan for your unique circumstances.

Understanding Health Insurance Premiums: What Are The Best Health Insurance Plans With Low Premiums?

Health insurance premiums are the monthly payments you make to your insurance company in exchange for coverage. They are a crucial aspect of your health insurance plan, and understanding how they are determined is essential for making informed decisions.

Factors Influencing Premiums

Several factors influence the cost of your health insurance premiums. These factors are analyzed by insurance companies to calculate your individual premium.

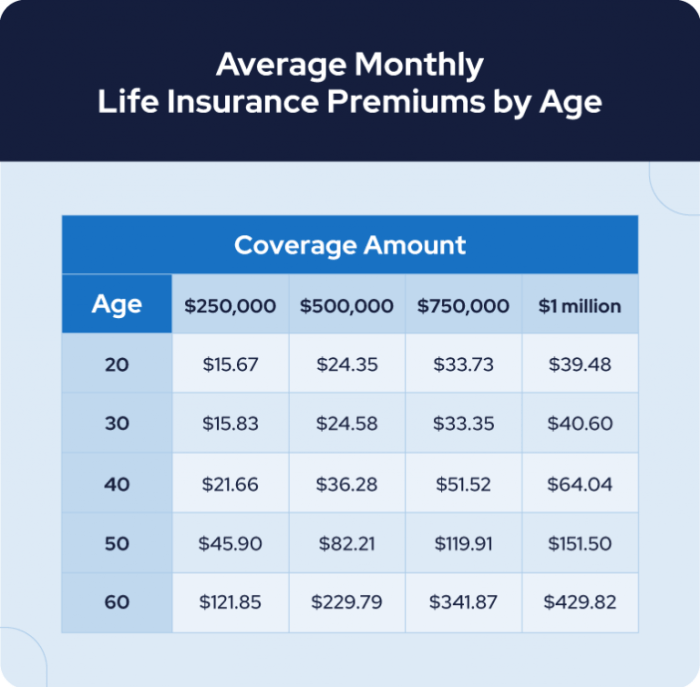

- Age:Generally, older individuals tend to have higher premiums than younger individuals. This is because they are more likely to require medical care.

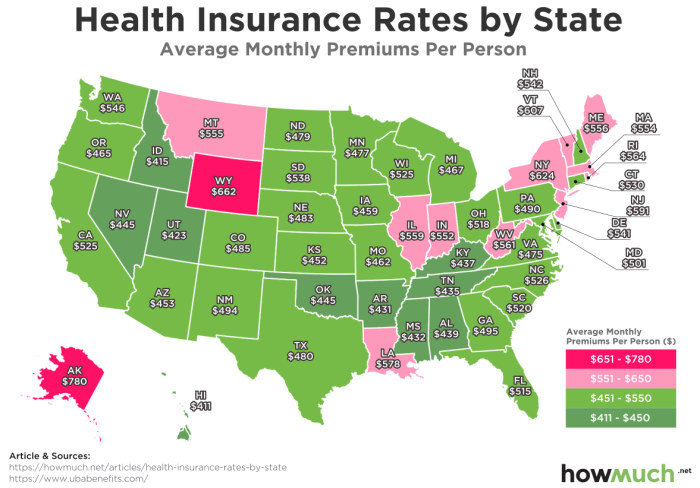

- Location:Premiums can vary depending on your geographic location. This is due to differences in healthcare costs and the prevalence of certain health conditions in different areas.

- Health Status:Individuals with pre-existing health conditions may have higher premiums. This is because they are more likely to require medical care.

- Tobacco Use:Smokers typically pay higher premiums than non-smokers. This is because smoking is a significant risk factor for various health problems.

- Plan Type:The type of health insurance plan you choose can also affect your premium. For instance, plans with higher deductibles and copayments usually have lower premiums.

- Family Size:Premiums can increase with the number of people covered under your plan.

- Employer Contribution:If your employer offers health insurance, the amount they contribute to your premium can influence your out-of-pocket costs.

Relationship Between Premium Cost and Coverage

There is a direct relationship between premium cost and coverage. This means that plans with more comprehensive coverage typically have higher premiums. For example, a plan with a lower deductible and lower copayments will generally have a higher premium than a plan with a higher deductible and higher copayments.

Common Premium Variations

- Age:A 30-year-old individual may pay a premium of $300 per month, while a 60-year-old individual may pay $500 per month for a similar plan.

- Location:A person living in a metropolitan area with high healthcare costs may pay $400 per month, while someone in a rural area with lower healthcare costs may pay $300 per month for the same plan.

- Health Status:A person with a pre-existing condition like diabetes may pay $450 per month, while a healthy individual may pay $350 per month for the same plan.

Types of Health Insurance Plans

Navigating the world of health insurance can be overwhelming, especially when you’re faced with various plan options. Understanding the different types of plans available is crucial to finding the best fit for your needs and budget.

Health Maintenance Organization (HMO)

HMO plans emphasize preventative care and managing healthcare costs by providing a network of healthcare providers.

- Lower Premiums:HMOs typically offer lower premiums compared to other plans due to their restricted network.

- Primary Care Physician (PCP) Gatekeeper:You need a referral from your PCP to see specialists or access certain services.

- Limited Out-of-Network Coverage:HMOs generally don’t cover out-of-network services, except for emergencies.

- Focus on Preventative Care:HMOs encourage regular checkups and screenings to prevent health issues from escalating.

Preferred Provider Organization (PPO)

PPO plans provide more flexibility in choosing healthcare providers, offering both in-network and out-of-network options.

- Higher Premiums:PPOs usually have higher premiums than HMOs due to their broader network and coverage.

- No PCP Gatekeeper:You can see specialists directly without a referral from your PCP.

- Out-of-Network Coverage:PPOs offer coverage for out-of-network services, but at a higher cost.

- Flexibility in Provider Choice:PPOs allow you to choose from a wider range of providers, including specialists and hospitals.

Point of Service (POS)

POS plans combine elements of HMOs and PPOs, offering a hybrid approach to healthcare coverage.

- Premiums:POS premiums typically fall between HMO and PPO premiums.

- PCP Gatekeeper:Like HMOs, POS plans require a referral from your PCP for most specialist visits.

- Out-of-Network Coverage:POS plans offer some out-of-network coverage, but at a higher cost than in-network services.

- Hybrid Approach:POS plans provide a balance between cost-effectiveness and provider flexibility.

High Deductible Health Plan (HDHP)

HDHPs feature lower premiums and higher deductibles, making them suitable for individuals who are healthy and expect minimal healthcare needs.

- Lower Premiums:HDHPs offer significantly lower premiums compared to traditional plans.

- High Deductible:You pay a substantial deductible before your insurance kicks in to cover medical expenses.

- Health Savings Account (HSA):HDHPs are often paired with HSAs, allowing you to save pre-tax money for healthcare expenses.

- Suitable for Low Healthcare Utilization:HDHPs are ideal for individuals who are healthy and anticipate minimal healthcare needs.

Identifying Affordable Plans

Finding affordable health insurance plans can be challenging, but it’s essential for securing financial stability and peace of mind. With so many options available, understanding your needs and comparing plans is crucial. This section will guide you through the process of identifying affordable plans that meet your specific requirements.

Comparing Affordable Plans

The best way to find an affordable health insurance plan is to compare different options from various providers. Here’s a table showcasing some plans with low premiums, their monthly costs, and coverage details:

| Plan Name | Monthly Premium | Deductible | Co-insurance | Out-of-Pocket Maximum | Provider |

|---|---|---|---|---|---|

Silver Plan

|

$350 | $2,000 | 20% | $5,000 | Blue Cross Blue Shield |

Bronze Plan

|

$280 | $3,000 | 30% | $6,000 | UnitedHealthcare |

Catastrophic Plan

|

$150 | $7,150 | 40% | $7,150 | Humana |

Remember, these are just examples, and the actual premiums and coverage details can vary based on factors like your age, location, and health status. It’s crucial to get personalized quotes from multiple insurance providers to compare plans and find the best fit for your needs and budget.

Factors to Consider When Choosing a Plan

Finding a health insurance plan with low premiums is only the first step. You also need to consider the plan’s coverage and how it aligns with your individual healthcare needs and budget. After all, a plan with a low premium might not be the best value if it leaves you with high out-of-pocket costs when you need care.

Understanding Deductibles, Co-pays, and Out-of-Pocket Maximums

These terms represent the financial responsibility you bear when accessing healthcare services. Understanding their implications is crucial when comparing plans.

- Deductible:The amount you pay out-of-pocket before your insurance kicks in to cover your healthcare expenses. A higher deductible generally means a lower premium, but you’ll pay more upfront before your insurance starts paying.

- Co-pay:A fixed amount you pay for each doctor’s visit, prescription, or other healthcare service. Co-pays are usually lower than deductibles and can vary depending on the service.

- Out-of-pocket maximum:The maximum amount you’ll pay for covered healthcare expenses in a year. Once you reach this limit, your insurance covers 100% of your eligible expenses for the rest of the year. A lower out-of-pocket maximum can provide greater financial protection.

Considering Individual Healthcare Needs and Usage Patterns

Your healthcare needs and usage patterns are unique. A plan that suits someone with chronic health conditions might not be ideal for someone who is generally healthy. Consider factors such as:

- Age and health status:Older individuals or those with pre-existing conditions may require more extensive coverage.

- Prescription drug needs:If you take multiple medications, consider plans with comprehensive prescription drug coverage.

- Expected healthcare utilization:If you anticipate needing frequent doctor visits or hospital stays, a plan with lower out-of-pocket costs might be more beneficial.

Tips for Minimizing Healthcare Costs and Maximizing Coverage, What are the best health insurance plans with low premiums?

While choosing a plan with low premiums is essential, there are additional strategies to minimize healthcare costs and maximize coverage.

Finding the best health insurance plans with low premiums is like searching for a unicorn in a haystack – it can be tricky! But just like those mythical creatures, there are gems out there. Maybe you’re thinking about the bigger picture too, like, “What are the best high-value life insurance policies?” What are the best high-value life insurance policies?

That’s a smart move, but remember, even with a solid life insurance plan, you still need to keep those monthly health insurance premiums manageable! So, keep searching for that unicorn – you’ll find a plan that fits your needs and your budget.

- Take advantage of preventive care:Many plans cover preventive services like screenings and vaccinations at no cost. These services can help detect health issues early, potentially preventing more expensive treatments later.

- Use in-network providers:Generally, healthcare services from in-network providers are covered at a lower cost than those from out-of-network providers. Check your plan’s provider directory to ensure you’re seeing in-network doctors and specialists.

- Negotiate prices for medical services:Don’t be afraid to negotiate with healthcare providers about their fees, especially for elective procedures. Many hospitals and clinics are willing to work with patients to make healthcare more affordable.

Resources for Finding Affordable Plans

Navigating the world of health insurance can be overwhelming, especially when searching for affordable options. Thankfully, several resources can guide you towards plans that fit your budget and needs. These resources offer tools, information, and support to make the process smoother and less stressful.

Online Resources and Tools

Online platforms provide valuable tools and information to compare health insurance plans and find affordable options. These platforms offer a centralized location to browse plans from different insurers, compare coverage details, and estimate costs.

- Healthcare.gov:The official website for the Affordable Care Act (ACA) marketplace, offering a comprehensive platform to compare plans, estimate costs, and enroll in coverage. It also provides information on eligibility for subsidies and financial assistance.

- eHealth:A private marketplace that allows you to compare plans from multiple insurers and get personalized quotes. They offer a user-friendly interface and provide helpful tools for understanding coverage details.

- HealthPocket:This website provides a comprehensive comparison tool for health insurance plans, allowing you to analyze costs, coverage, and provider networks. They also offer educational resources to help you make informed decisions.

- Insurify:This platform allows you to compare quotes from various insurance companies and provides personalized recommendations based on your needs and budget. They also offer tools for managing your insurance policy and making claims.

State and Federal Health Insurance Marketplaces

State and federal marketplaces are designed to connect individuals and families with affordable health insurance plans. They offer a wide range of plans from different insurance companies, with varying levels of coverage and costs.

- Federal Marketplace (Healthcare.gov):The federal marketplace serves as a central hub for individuals in states that do not have their own marketplace. It provides a platform to compare plans, estimate costs, and enroll in coverage.

- State Marketplaces:Several states have their own marketplaces, often called “state-based marketplaces,” which offer similar services to the federal marketplace. They may have additional features or programs tailored to the specific needs of their residents. To find your state’s marketplace, you can visit Healthcare.gov and select your state from the dropdown menu.

Eligibility Requirements and Enrollment Procedures

Understanding the eligibility requirements and enrollment procedures for various health insurance programs is crucial for accessing affordable coverage.

- Medicaid:This government-funded program provides health insurance to low-income individuals and families. Eligibility requirements vary by state, but generally include income, assets, and family size. You can apply for Medicaid through your state’s website or local social services agency.

- Children’s Health Insurance Program (CHIP):This program provides health insurance to children in families with modest incomes. Eligibility requirements are similar to Medicaid but may vary by state. You can apply for CHIP through your state’s website or local social services agency.

- Affordable Care Act (ACA) Marketplace:The ACA marketplace offers subsidies and financial assistance to individuals and families who meet certain income requirements. Eligibility for subsidies is based on your household income and size. You can apply for coverage through Healthcare.gov or your state’s marketplace.

Final Conclusion

Finding affordable health insurance with low premiums is a journey, not a destination. It requires understanding your needs, exploring different plan options, and comparing prices from reputable providers. Remember, you’re not alone in this quest. Utilize the resources available, ask questions, and don’t be afraid to seek guidance from experts.

By taking a proactive approach, you can secure a health insurance plan that fits your budget and provides the peace of mind you deserve.

Popular Questions

What are the most common factors that influence health insurance premiums?

Premiums are typically influenced by factors such as age, location, health status, plan type, and coverage options. Younger and healthier individuals often have lower premiums, while those with pre-existing conditions may face higher costs.

How can I lower my health insurance premiums?

Consider exploring plans with higher deductibles or co-pays, opting for a plan with a narrower network, or enrolling in a health savings account (HSA). Additionally, maintaining a healthy lifestyle and seeking preventive care can help reduce your overall healthcare costs.

What are some reputable online resources for finding affordable health insurance?

Check out websites like Healthcare.gov, eHealth, and HealthSherpa. These platforms offer tools to compare plans, calculate costs, and enroll in coverage.