Navigating the healthcare system can be a daunting task, especially for low-income individuals. “What are the best health insurance plans for low-income individuals?” is a question many ask, and finding the right answer can feel like searching for a needle in a haystack.

Fortunately, there are programs and options designed to make healthcare more accessible. This guide will explore the various paths to affordable health insurance, providing clarity and guidance for those who need it most.

From government-funded programs like Medicaid and CHIP to subsidies offered through the Affordable Care Act Marketplace, we’ll delve into the intricacies of each option. We’ll also examine the potential for employer-sponsored health insurance and offer tips for navigating the healthcare system effectively.

Whether you’re a single parent, a young adult, or a senior citizen, this information can empower you to make informed decisions about your health and well-being.

Eligibility and Qualification Requirements

Navigating the world of health insurance can be daunting, especially for individuals with limited financial resources. Understanding eligibility and qualification requirements for government-funded and subsidized programs is crucial to accessing affordable healthcare. This section delves into the income thresholds, eligibility criteria, and documentation needed to qualify for these programs.

Income Thresholds and Eligibility Criteria

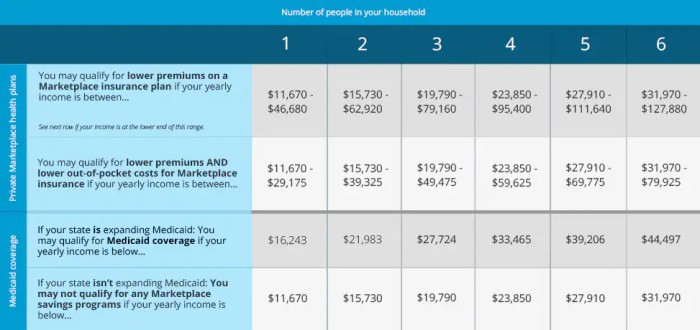

Eligibility for government-funded and subsidized health insurance programs is primarily determined by income levels. These programs aim to provide healthcare access to individuals and families who cannot afford private insurance. The specific income thresholds vary depending on the program and the state of residence.

Here’s a breakdown of some common programs:

- Medicaid:Medicaid is a federal-state partnership providing health coverage to low-income individuals and families. Income eligibility is determined by the state, and it generally covers individuals with incomes below a certain percentage of the federal poverty level (FPL).

For example, in 2023, a single adult in Texas would need an income below $1,774 per month to qualify for Medicaid.

- Children’s Health Insurance Program (CHIP):CHIP provides health coverage to children in families with incomes above the Medicaid eligibility level but still too low to afford private insurance. The income limits for CHIP also vary by state.

- Marketplace Subsidies:The Affordable Care Act (ACA) created health insurance marketplaces where individuals can purchase subsidized health plans. The subsidies are available to individuals and families with incomes between 100% and 400% of the FPL. The amount of the subsidy depends on the individual’s income and family size.

Documentation Requirements

To verify income and eligibility for government-funded and subsidized health insurance programs, individuals typically need to provide documentation. This documentation may include:

- Proof of income:This can include pay stubs, tax returns, Social Security statements, unemployment benefits statements, and other documentation demonstrating income levels.

- Proof of identity:This can include a driver’s license, passport, or other government-issued ID.

- Proof of residency:This can include a utility bill, lease agreement, or other documentation showing proof of residence.

- Proof of citizenship or immigration status:This can include a birth certificate, green card, or other documentation confirming citizenship or legal residency.

Income Levels and Corresponding Health Insurance Options

The following table provides a simplified overview of income levels and corresponding health insurance options:

| Income Level | Health Insurance Options |

|---|---|

| Below 100% FPL | Medicaid |

| Between 100% and 400% FPL | Medicaid (in some states), Marketplace Subsidies |

| Above 400% FPL | Marketplace Plans (without subsidies), Private Insurance |

It’s important to note that these are general guidelines, and specific eligibility requirements may vary based on individual circumstances and state regulations. Individuals should contact their state’s health insurance marketplace or Medicaid office for accurate information and assistance.

Government-Funded and Subsidized Programs: What Are The Best Health Insurance Plans For Low-income Individuals?

For low-income individuals, government-funded and subsidized health insurance programs offer a lifeline to affordable healthcare. These programs provide essential medical coverage, helping individuals access crucial medical services without facing financial strain. Let’s delve into some of the key programs available in the United States.

Medicaid

Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families, pregnant women, children, seniors, and people with disabilities. Eligibility for Medicaid varies by state, but generally, individuals must meet income and asset requirements.

Medicaid offers a comprehensive range of benefits, including:

- Inpatient and outpatient hospital services

- Doctor’s visits and preventive care

- Prescription drugs

- Mental health and substance abuse services

- Dental and vision care

The enrollment process for Medicaid typically involves applying through your state’s Medicaid agency. You can apply online, by phone, or in person at a local office.

Children’s Health Insurance Program (CHIP)

CHIP is a program designed to provide health coverage to children from families who earn too much to qualify for Medicaid but cannot afford private health insurance. CHIP offers a range of benefits similar to Medicaid, including:

- Inpatient and outpatient hospital services

- Doctor’s visits and preventive care

- Prescription drugs

- Dental and vision care

To enroll in CHIP, you must apply through your state’s CHIP agency. The application process is similar to Medicaid, and you can apply online, by phone, or in person.

Medicare

Medicare is a federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities. While primarily for seniors, Medicare also offers coverage for low-income individuals under specific programs:

- Medicare Savings Programs (MSPs): MSPs help eligible low-income individuals pay for Medicare premiums, deductibles, and coinsurance.

- Qualifying Individuals (QI) Program: This program provides Medicare Part A (hospital insurance) coverage to individuals who are eligible for both Medicare and Medicaid.

To enroll in Medicare, you can apply online through the Social Security Administration website or by phone.

Important Note:Eligibility requirements and benefits for these programs can vary by state. It’s essential to contact your state’s relevant agency to determine your eligibility and understand the specific benefits offered in your area.

Affordable Care Act (ACA) Marketplace Options

The Affordable Care Act (ACA) Marketplace, also known as HealthCare.gov, provides a platform for individuals and families to compare and enroll in health insurance plans. For low-income individuals, the Marketplace offers a lifeline of affordability through subsidies and tax credits, making quality healthcare more accessible.

Subsidies and Tax Credits

The ACA Marketplace offers subsidies and tax credits to help low-income individuals afford health insurance premiums. These financial assistance programs are based on income and family size.

- Premium Tax Credits: These credits reduce the monthly cost of your health insurance premiums. The amount of the credit is based on your income and the cost of the plan you choose. You can receive this credit either as a reduction in your monthly premium or as a tax refund when you file your taxes.

- Cost-Sharing Reductions: These reductions lower your out-of-pocket costs, such as deductibles, copayments, and coinsurance. They are available to individuals with lower incomes and help make healthcare more affordable at the point of service.

Navigating the Marketplace Website

The Marketplace website is designed to be user-friendly and offers tools to help you find affordable plans. Here’s how to navigate the website:

- Create an Account: Start by creating an account on the Marketplace website. This allows you to save your information and track your progress.

- Provide Your Information: You’ll need to provide basic information about yourself and your family, including income, household size, and location. This information helps determine your eligibility for subsidies and tax credits.

- Compare Plans: The Marketplace website allows you to compare plans based on cost, coverage, and network availability. You can use filters to narrow down your options and find the plan that best suits your needs.

- Enroll in a Plan: Once you’ve chosen a plan, you can enroll online or by phone. You’ll need to provide your payment information to start your coverage.

Comparing Plan Options

When comparing health insurance plans, it’s important to consider the following factors:

- Cost: The monthly premium is the most obvious cost factor. Consider your budget and how much you can afford to pay each month.

- Coverage: Different plans offer different levels of coverage. Some plans have lower premiums but higher deductibles and out-of-pocket costs. Others have higher premiums but lower out-of-pocket costs. Choose a plan that balances your budget with your healthcare needs.

- Network Availability: Ensure that your chosen plan includes your preferred doctors and hospitals in its network. You can use the Marketplace website to search for doctors and hospitals in your area.

Employer-Sponsored Health Insurance

While often associated with larger companies, some small businesses also offer health insurance plans to their employees. This can be a valuable option for low-income individuals, as employer-sponsored plans often come with lower premiums and wider coverage than individual plans.

Determining Employer-Sponsored Health Insurance Options

To determine if an employer offers subsidized or discounted health insurance options, individuals can directly inquire with their human resources department or review their employee handbook. This information is typically Artikeld in the benefits package section.

Negotiating Health Insurance Benefits

When negotiating health insurance benefits with an employer, individuals can leverage the following strategies:

- Highlight the importance of health insurance:Emphasize the positive impact of offering health insurance on employee morale, productivity, and retention.

- Research industry standards:Compare the employer’s current offerings to those provided by similar companies in the industry. This can serve as a basis for negotiation.

- Explore alternative options:If the employer’s current plan is not affordable or does not meet individual needs, consider suggesting alternative options such as a Health Savings Account (HSA) or a Flexible Spending Account (FSA).

- Focus on cost-saving measures:Suggest ways to reduce the cost of the health insurance plan, such as negotiating with insurance providers or offering wellness programs to employees.

Navigating the Healthcare System

Navigating the healthcare system, especially when you’re on a limited budget, can feel overwhelming. However, with a little knowledge and some planning, you can access the care you need without breaking the bank. This section provides tips and resources to help you navigate the healthcare system effectively.

Accessing Affordable Healthcare Services

You can access affordable healthcare services by taking advantage of preventive care, utilizing primary care providers, and strategically scheduling specialist appointments.

- Preventive Care: Preventive care, such as regular checkups, screenings, and immunizations, can help prevent serious health problems and save you money in the long run. Many health insurance plans cover preventive services with no co-pay or deductible. Utilize these benefits to stay healthy and avoid expensive treatments later.

- Primary Care Providers: Primary care providers (PCPs), such as family doctors or general practitioners, are your first point of contact for most healthcare needs. They can diagnose and treat common illnesses, provide preventive care, and refer you to specialists when necessary.

- Specialist Appointments: Specialist appointments can be expensive, so it’s important to schedule them strategically. Before scheduling an appointment, ask your PCP if the specialist visit is truly necessary. If so, explore options like telehealth appointments, which can be more affordable than in-person visits.

Navigating the world of health insurance can be a maze, especially if you’re on a tight budget. Thankfully, there are programs like Medicaid and CHIP designed to help low-income individuals access affordable coverage. But what about life insurance? If you’re looking for a way to protect your loved ones financially, you might wonder, “Where can I buy life insurance online?” This article offers some great insights on finding online life insurance options.

Remember, while securing affordable health insurance is crucial, planning for the future with life insurance can provide peace of mind for you and your family.

Finding Affordable Prescription Medications, What are the best health insurance plans for low-income individuals?

Finding affordable prescription medications is crucial for managing health conditions. Several strategies can help you save money on your prescriptions.

- Generic Medications: Generic medications are often significantly cheaper than brand-name drugs and have the same active ingredients. Ask your doctor if a generic version of your medication is available.

- Prescription Discount Cards: Prescription discount cards can help you save money on your medications, even if you don’t have insurance. Many organizations, including AARP, GoodRx, and Walmart, offer discount cards.

- Manufacturer Coupons and Rebates: Pharmaceutical companies often offer coupons and rebates to help lower the cost of their medications. Check with your doctor or pharmacist about available options.

- Patient Assistance Programs: Pharmaceutical companies may offer patient assistance programs (PAPs) to help low-income individuals afford their medications. These programs typically have income and eligibility requirements.

Resources to Assist with Healthcare Costs

Various resources can help you manage healthcare costs, including financial assistance programs and community health centers.

- Financial Assistance Programs: Many hospitals and healthcare providers offer financial assistance programs to patients who meet certain income requirements. Contact the financial assistance office of the hospital or healthcare provider for more information.

- Community Health Centers: Community health centers provide affordable healthcare services to low-income individuals and families. They often offer a sliding-fee scale based on income.

- State and Local Resources: Many states and local governments offer programs to help low-income individuals afford healthcare. Contact your local health department or social services agency for information about available programs.

Outcome Summary

Securing affordable health insurance can be a complex journey, but it’s a journey worth taking. By understanding your options and navigating the available resources, you can access the healthcare you need without breaking the bank. Remember, you’re not alone in this process.

There are organizations and professionals dedicated to helping you find the best path forward. So, take the first step, explore your options, and prioritize your health and well-being.

Q&A

What are the income limits for Medicaid?

Medicaid income limits vary by state. You can find the specific income limits for your state on the official Medicaid website.

How do I apply for CHIP?

You can apply for CHIP through your state’s health insurance marketplace or directly through the CHIP program. You’ll need to provide information about your income and family size.

What is the difference between Medicaid and CHIP?

Medicaid is a federal-state program for low-income individuals and families, while CHIP is a program for children from low-income families.

Can I get health insurance through my employer if I have a low income?

Some employers offer subsidized or discounted health insurance plans to their employees, regardless of income. It’s best to check with your employer to see if they have any such programs.

What are some resources available to help with healthcare costs?

There are several resources available to help with healthcare costs, including financial assistance programs, community health centers, and patient advocacy groups. You can find information about these resources online or by contacting your local health department.