What are private health insurance plans? They’re like a safety net for your health, providing financial protection and access to specialized care when you need it most. Imagine a world where unexpected medical bills could cripple your finances.

Private health insurance steps in, offering a shield against those potentially devastating costs, allowing you to focus on getting better without the added stress of financial burdens. But it’s not just about avoiding financial ruin; private health insurance can open doors to a wider range of medical options, giving you more choices when it comes to your health.

These plans come in various forms, each tailored to different needs and budgets. From HMOs to PPOs, there’s a plan out there for everyone. But before you jump in, it’s crucial to understand the key components: deductibles, co-payments, co-insurance, and out-of-pocket maximums.

These terms might sound intimidating, but they’re essential for understanding how much you’ll pay for healthcare services and how your insurance plan will work alongside you.

Introduction to Private Health Insurance

Private health insurance is a crucial aspect of healthcare systems worldwide, offering individuals and families an additional layer of protection against medical expenses. It is a financial agreement between an individual and an insurance company, where the individual pays a premium in exchange for the insurer’s promise to cover specific healthcare costs.

What is Private Health Insurance?

Private health insurance plans are contracts between individuals and insurance companies. These contracts Artikel the coverage provided by the insurer in exchange for regular premium payments. The plans can vary widely in terms of benefits, coverage limits, and costs, allowing individuals to choose a plan that best suits their needs and budget.

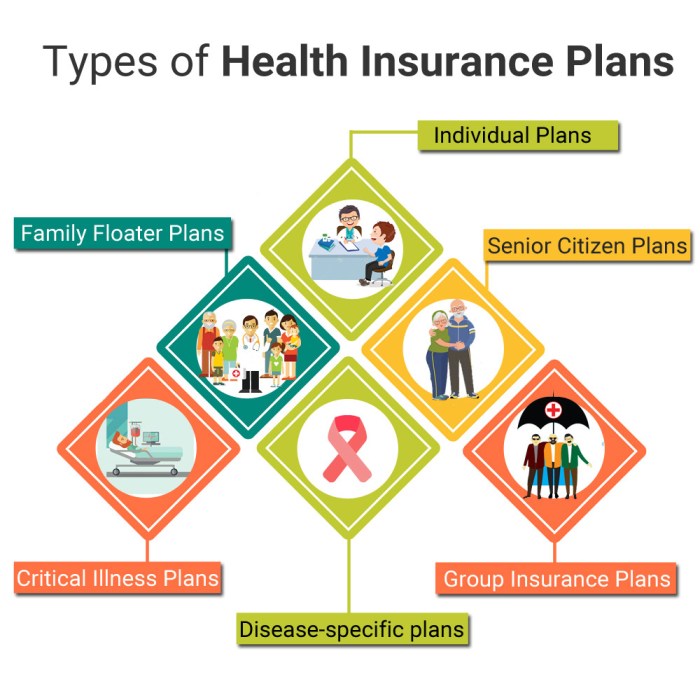

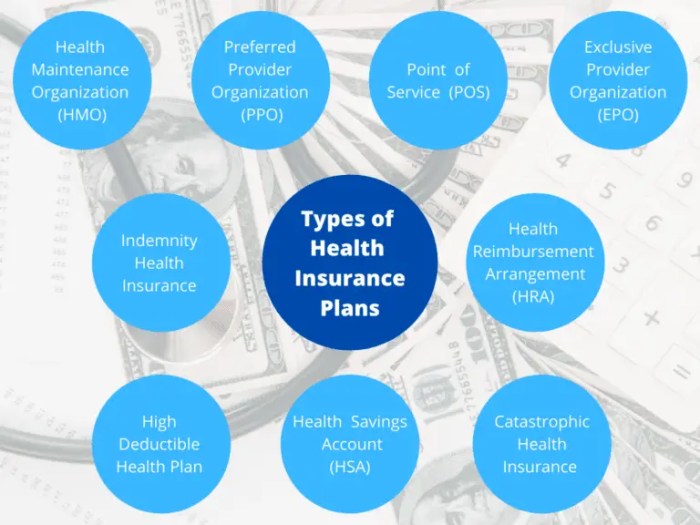

Types of Private Health Insurance Plans: What Are Private Health Insurance Plans?

Choosing the right private health insurance plan can feel like navigating a maze. There are many different types of plans, each with its own set of features, benefits, and costs. Understanding the various options available is crucial to finding a plan that best suits your individual needs and budget.

Health Maintenance Organization (HMO) Plans

HMO plans typically offer lower premiums than other types of plans, but they also have a more restrictive network of healthcare providers. This means you’ll need to choose a primary care physician (PCP) within the HMO network, and you’ll generally need a referral from your PCP to see specialists.

HMO plans emphasize preventive care and often require you to use in-network providers for all services. If you go outside the network, you’ll likely face significantly higher costs or even complete denial of coverage.

Preferred Provider Organization (PPO) Plans

PPO plans offer more flexibility than HMO plans. They typically have a wider network of healthcare providers, and you can see specialists without a referral from your PCP. However, you’ll generally pay lower costs if you stay within the network.

If you choose to go outside the network, you’ll pay higher copayments and coinsurance. PPO plans offer more flexibility in choosing healthcare providers, but they may come with higher premiums compared to HMO plans.

Point of Service (POS) Plans

POS plans combine elements of both HMO and PPO plans. They offer a network of providers, but you can also see out-of-network providers for an additional cost. POS plans usually require you to choose a PCP within the network, and you’ll generally need a referral to see specialists.

However, POS plans can be more expensive than HMO plans and may have higher deductibles.

Health Savings Account (HSA) Plans

HSA plans are often paired with high-deductible health plans (HDHPs), which have lower premiums than traditional plans. These plans allow you to contribute pre-tax dollars to a health savings account, which you can use to pay for qualified medical expenses.

HSAs offer tax advantages and can help you save money on healthcare costs. However, you’ll need to be comfortable with a higher deductible, which means you’ll need to pay more out-of-pocket for medical expenses before your insurance kicks in.

Key Components of Private Health Insurance Plans

Private health insurance plans, while offering financial protection against unexpected healthcare costs, often come with specific terms and conditions that influence how much you pay for healthcare services. Understanding these components is crucial for making informed decisions about your health insurance coverage.

Components of Private Health Insurance Plans

Understanding the key components of private health insurance plans is essential for navigating the healthcare system and managing your out-of-pocket expenses. These components work together to determine how much you pay for healthcare services and how much your insurer covers.

Let’s delve into the specifics:

| Feature | Explanation | Impact on Policyholders | Real-World Example |

|---|---|---|---|

| Deductible | The amount you must pay out-of-pocket for covered healthcare services before your insurance starts paying. | A higher deductible means you pay more out-of-pocket before your insurance kicks in. | Imagine your annual deductible is $1,000. If you incur $500 in medical expenses, you pay the entire $500. However, if your expenses reach $1,500, you pay the first $1,000 (deductible) and your insurance covers the remaining $500. |

| Co-pay | A fixed amount you pay for each covered healthcare service, such as a doctor’s visit or prescription. | Co-pays are predictable and help manage costs for routine services. | Your health plan might have a $20 co-pay for a doctor’s visit. Each time you visit a doctor, you pay $20, regardless of the actual cost of the visit. |

| Co-insurance | A percentage of the cost of covered healthcare services that you pay after your deductible is met. | Co-insurance helps share the cost of expensive healthcare services. | If your co-insurance is 20%, and your medical bill is $1,000 after meeting your deductible, you pay $200 (20% of $1,000) and your insurance covers the remaining $800. |

| Out-of-Pocket Maximum | The maximum amount you will pay for covered healthcare services in a year. | The out-of-pocket maximum provides a safety net, limiting your total healthcare expenses. | If your out-of-pocket maximum is $5,000, you won’t pay more than $5,000 in deductibles, co-pays, and co-insurance for covered services in a year. |

Deductibles, co-payments, co-insurance, and out-of-pocket maximums play a significant role in managing the cost of healthcare for policyholders. These components work together to balance the cost of coverage with the benefits received.

Lower deductibles and out-of-pocket maximums often come with higher monthly premiums.

While a higher deductible might seem appealing initially, it could lead to substantial out-of-pocket expenses for unexpected medical events. Conversely, lower deductibles might result in higher monthly premiums. Understanding these trade-offs is essential for choosing a health insurance plan that aligns with your individual needs and financial situation.

Benefits of Private Health Insurance Plans

Private health insurance offers numerous advantages that can significantly enhance your overall well-being and financial security. By providing financial protection, access to specialized care, and peace of mind, private health insurance empowers individuals to navigate the complexities of healthcare with greater confidence.

Financial Protection

Private health insurance acts as a financial safety net, shielding you from the potentially devastating costs associated with unexpected illnesses or injuries.

- Reduced Out-of-Pocket Expenses:Private health insurance plans typically cover a significant portion of healthcare costs, reducing your out-of-pocket expenses for doctor’s visits, hospital stays, surgeries, and other medical treatments. This financial protection helps you avoid unexpected financial burdens and maintain your financial stability even during challenging times.

- Predictable Healthcare Costs:With a private health insurance plan, you can generally expect to pay a fixed monthly premium, providing you with predictable healthcare costs. This predictability allows you to budget for healthcare expenses more effectively and avoid surprises, helping you plan for your financial future with greater certainty.

- Protection Against Catastrophic Expenses:In the event of a serious illness or injury, private health insurance can help you manage the potentially catastrophic expenses associated with prolonged hospital stays, complex treatments, and long-term care. This financial protection can prevent you from facing overwhelming medical debt and ensure you receive the necessary care without compromising your financial security.

Access to Specialized Care

Private health insurance plans often provide access to a wider network of healthcare providers, including specialists, allowing you to receive specialized care when needed.

- Faster Access to Specialists:With private health insurance, you can typically access specialists more quickly than relying solely on public healthcare systems. This faster access can be crucial for timely diagnosis and treatment, particularly for complex medical conditions.

- Choice of Healthcare Providers:Private health insurance plans generally offer a wider choice of healthcare providers, allowing you to select specialists based on your specific needs and preferences. This flexibility ensures you receive care from providers who are best suited to your medical condition and healthcare goals.

- Access to Advanced Treatments:Private health insurance plans often cover advanced medical treatments and technologies that may not be readily available through public healthcare systems. This access to cutting-edge treatments can significantly improve your chances of successful recovery and enhance your overall health outcomes.

Peace of Mind

Private health insurance provides peace of mind by alleviating the financial and emotional stress associated with unexpected healthcare needs.

- Reduced Anxiety:Knowing that you have a private health insurance plan can reduce anxiety about unexpected illnesses or injuries, allowing you to focus on your health and recovery without worrying about the financial implications. This peace of mind can contribute to a more positive and supportive environment for your overall well-being.

- Financial Security:Private health insurance offers financial security, knowing that you are protected from the potentially overwhelming costs associated with serious medical conditions. This financial stability can reduce stress and anxiety, allowing you to focus on your health and recovery without financial worries.

- Freedom to Choose:Private health insurance empowers you to choose the healthcare providers and treatments that best meet your needs and preferences. This freedom of choice provides a sense of control and autonomy over your healthcare decisions, contributing to a greater sense of peace of mind.

Considerations for Choosing a Private Health Insurance Plan

Choosing the right private health insurance plan can be a daunting task, especially with the wide array of options available. It’s crucial to consider several factors to ensure you select a plan that meets your individual needs and financial situation.

This section will guide you through the process, providing a framework for making an informed decision.

Factors to Consider

Before diving into specific plan options, it’s essential to reflect on your individual circumstances. Here’s a breakdown of key factors and how to approach them:

| Factor | Questions to Ask Yourself | Strategies for Evaluating Plans | Resources and Tools |

|---|---|---|---|

| Coverage Needs | What types of medical services do I anticipate needing? (e.g., doctor visits, hospital stays, prescription drugs, mental health care) | Compare plans based on their coverage for specific services and conditions. Pay attention to deductibles, copayments, and out-of-pocket maximums. | Health insurance comparison websites, consumer guides, and insurance brokers. |

| Budget | How much am I willing to spend on health insurance premiums each month? What is my overall risk tolerance? | Analyze premium costs, deductibles, copayments, and out-of-pocket maximums to determine the total annual cost. Consider plans with different premium and coverage levels to find a balance. | Insurance company websites, online calculators, and financial advisors. |

| Health Status | Do I have any pre-existing conditions? How often do I typically seek medical care? | Evaluate plans based on their coverage for pre-existing conditions, as some plans may have limitations or exclusions. Consider plans with higher coverage levels if you anticipate frequent medical needs. | Health insurance comparison websites, doctors, and health insurance brokers. |

| Location | Where do I live and work? Do I need coverage in specific geographic areas? | Ensure the plan covers providers and hospitals in your area. Check for networks and coverage limitations. | Insurance company websites, provider directories, and online maps. |

Comparing Plans and Understanding Terms

Once you’ve considered these factors, it’s time to compare different plan options. This involves understanding key terms and conditions, such as:* Deductible:The amount you pay out-of-pocket before your insurance coverage kicks in.

Copayment

A fixed amount you pay for each medical service.

Coinsurance

A percentage of the cost of a medical service you pay.

Out-of-pocket maximum

The maximum amount you’ll pay out-of-pocket for covered medical services in a year.

Network

The group of healthcare providers (doctors, hospitals, etc.) that are covered by your plan.Comparing plans side-by-side allows you to identify the best value for your money. Remember to read the plan documents carefully to understand all the terms and conditions.

Common Misconceptions about Private Health Insurance

Private health insurance is a significant financial commitment, and it’s natural to have questions and concerns. However, many misconceptions surrounding private health insurance can deter individuals from exploring its potential benefits. Let’s address some of these common misconceptions and shed light on the realities of private health insurance.

Private Health Insurance is Too Expensive, What are private health insurance plans?

The perception that private health insurance is unaffordable is a common misconception. While premiums can vary depending on factors like age, health status, and coverage options, there are affordable plans available for individuals and families.

- Individualized Plans:Many insurance companies offer a range of plan options with varying premium levels. You can choose a plan that aligns with your budget and health needs.

- Employer-Sponsored Plans:Many employers offer group health insurance plans to their employees, often at discounted rates.

- Government Subsidies:In some countries, the government provides subsidies or tax credits to help individuals afford private health insurance.

It’s important to research and compare different plans from multiple insurance providers to find the most cost-effective option.

Private Health Insurance Offers Limited Coverage

Another misconception is that private health insurance provides limited coverage. While the scope of coverage can vary between plans, many comprehensive private health insurance plans offer extensive benefits, including:

- Hospitalization Coverage:This covers the costs of inpatient care, including room and board, surgery, and medical supplies.

- Outpatient Coverage:This covers the costs of doctor’s visits, diagnostic tests, and other outpatient services.

- Prescription Drug Coverage:This covers the costs of prescription medications.

- Dental and Vision Coverage:Some plans offer coverage for dental and vision care.

It’s crucial to carefully review the policy documents to understand the specific coverage details and limitations of any plan you’re considering.

Private Health Insurance is Not Worth It

The perception that private health insurance is not worth the investment is another common misconception. Private health insurance can provide peace of mind and financial protection in the event of a health crisis.

“A comprehensive private health insurance plan can help you avoid substantial out-of-pocket expenses and ensure you receive the best possible medical care.”

Private health insurance plans are like a safety net for your health, offering coverage for medical expenses. But what about protecting your loved ones financially? That’s where life insurance comes in, and you might be wondering, how much does term life insurance cost?

Understanding the cost of life insurance can help you make informed decisions about your financial security and ensure your family is taken care of in the event of your passing. Back to private health insurance, remember it’s a valuable tool for managing healthcare costs and peace of mind.

For example, consider a situation where someone needs a major surgery. Without private health insurance, they could face significant medical bills, potentially leading to financial hardship. With private health insurance, a portion or all of these costs could be covered, reducing the financial burden and allowing the individual to focus on their recovery.

Closing Summary

Navigating the world of private health insurance can feel like deciphering a complex code. But by understanding the different plan types, key components, and the factors to consider when choosing a plan, you can find the perfect fit for your individual needs and budget.

Remember, private health insurance is not just about financial protection; it’s about peace of mind, knowing you have a partner in your healthcare journey, empowering you to make informed decisions and access the care you deserve.

FAQ Insights

What are the common types of private health insurance plans?

There are several types, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), POS (Point of Service), and HSA (Health Savings Account) plans. Each offers different levels of coverage and cost considerations.

How do I choose the right private health insurance plan?

Consider your budget, health status, coverage needs, and location. Research different plans, compare costs and benefits, and consult with a healthcare professional or insurance broker for personalized advice.

Is private health insurance worth it?

It depends on your individual circumstances. If you’re concerned about unexpected medical costs or want access to specialized care, private health insurance can provide peace of mind and financial security.