What are no deductible health insurance plans? They sound like a dream come true, right? Imagine getting medical care without having to pay a hefty sum out of pocket before your insurance kicks in. No deductible plans are indeed attractive, offering a level of financial security that traditional plans might not.

But like everything in life, there’s a trade-off. These plans often come with higher premiums, and understanding the nuances is key to making an informed decision.

Think of it this way: a deductible is like a “gatekeeper” for your insurance coverage. You have to pay a certain amount out of pocket before your insurance starts covering the costs. No deductible plans essentially remove that gatekeeper, allowing you to access coverage from day one.

But, like a bouncer at a fancy club, they might charge a higher entry fee (premium) to let you in.

What are No Deductible Health Insurance Plans?

Imagine you’re at a restaurant, and the bill comes. You have to pay a certain amount before you can start enjoying your meal, right? That’s kind of like a deductible in health insurance. It’s the amount you need to pay out of pocket before your insurance kicks in and starts covering your medical expenses.

No-deductible health insurance plans, as the name suggests, are plans where you don’t have to pay a deductible. You can start using your insurance coverage right away, without having to reach a certain threshold first.

Advantages of No-Deductible Plans

No-deductible plans offer several advantages:

- Peace of Mind:Knowing you don’t have to pay a hefty sum upfront can provide significant peace of mind, especially when facing unexpected medical expenses.

- Lower Out-of-Pocket Costs:Since you don’t have a deductible, your out-of-pocket costs for medical care are generally lower. This can be particularly beneficial for individuals with chronic conditions or those who anticipate frequent healthcare needs.

- Easier Budgeting:Predictable medical expenses make budgeting easier. You can plan your finances without worrying about a large deductible looming over you.

Potential Drawbacks of No-Deductible Plans

While no-deductible plans have their advantages, there are also some potential drawbacks:

- Higher Premiums:The convenience of no deductible usually comes at a cost. No-deductible plans often have higher monthly premiums compared to plans with deductibles.

- Limited Availability:No-deductible plans may not be widely available in all regions or through all insurance providers. It’s important to check with your insurer to see if they offer such plans.

- Potential for Overuse:Since there’s no deductible, some individuals might be tempted to use healthcare services more frequently, which could lead to higher overall healthcare costs.

Types of No-Deductible Health Insurance Plans

No-deductible health insurance plans are a great way to protect yourself from high medical expenses. These plans cover all your medical costs from the first dollar, eliminating the need to pay a deductible before your insurance kicks in. But not all no-deductible plans are created equal.

There are several types of plans available, each with its own features, benefits, and drawbacks. Let’s explore some of the most common types.

Health Maintenance Organizations (HMOs), What are no deductible health insurance plans?

HMOs are a type of managed care plan that typically offer no-deductible coverage. HMOs have a network of doctors and hospitals that you must use for your care. You’ll usually need a referral from your primary care physician to see a specialist.

HMOs often have lower premiums than other types of plans, but they may have more restrictions on your choice of providers.

Example:Kaiser Permanente is a well-known HMO that offers no-deductible plans in many states.

Preferred Provider Organizations (PPOs)

While PPOs are not always no-deductible, they can be. PPOs are more flexible than HMOs. They have a wider network of providers, and you don’t always need a referral to see a specialist. PPOs typically have higher premiums than HMOs, but they offer more flexibility in your healthcare choices.

Example:Blue Cross Blue Shield offers PPO plans with no deductibles in some regions.

Exclusive Provider Organizations (EPOs)

EPOs are similar to HMOs in that they have a limited network of providers. However, unlike HMOs, EPOs do not require referrals for specialists. EPOs typically have lower premiums than PPOs but may have fewer provider options.

Example:Humana offers EPO plans with no deductibles in several states.

High-Deductible Health Plans (HDHPs)

While HDHPs typically have high deductibles, they can be paired with a Health Savings Account (HSA). HSAs allow you to contribute pre-tax dollars to an account that you can use to pay for healthcare expenses. If you have an HDHP with an HSA, you may be able to use the HSA funds to pay for medical expenses before you reach your deductible, effectively creating a no-deductible plan.

Example:Many insurance companies offer HDHPs that are eligible for HSAs.

Eligibility and Availability of No-Deductible Plans

No-deductible health insurance plans, while offering the benefit of immediate coverage, are not readily available to everyone. Factors like your age, health status, and location play a significant role in determining your eligibility for such plans.

No deductible health insurance plans are a dream for many, but remember, even with zero out-of-pocket costs, you still need to consider the bigger picture! If you’re also thinking about life insurance, How to compare life insurance policies? is a great resource to get you started.

It’s like a financial puzzle – you want the right pieces in place to protect yourself and your loved ones, whether it’s a health crisis or life’s inevitable changes.

Factors Determining Eligibility

The availability of no-deductible plans is influenced by a combination of factors:

- Age:No-deductible plans are often associated with older individuals who may have higher healthcare needs. This is because these plans typically have higher premiums to cover the potential for greater healthcare utilization.

- Health Status:Individuals with pre-existing conditions may find it more challenging to secure no-deductible plans. Insurance companies often assess health risks and adjust premiums accordingly, which could make no-deductible plans less feasible for those with higher health risks.

- Location:The availability of no-deductible plans can vary depending on the state or region. Some areas may have a higher concentration of insurers offering these plans, while others may have limited options.

Specific Situations for Availability

While no-deductible plans are not universally available, certain situations increase the likelihood of finding them:

- Employer-Sponsored Plans:Some employers, particularly those with a large workforce, may offer no-deductible plans as part of their benefits package. These plans are often negotiated collectively, allowing for greater bargaining power and potentially lower premiums.

- Union Membership:Union members may have access to negotiated health insurance plans, including no-deductible options, through their union’s collective bargaining agreements.

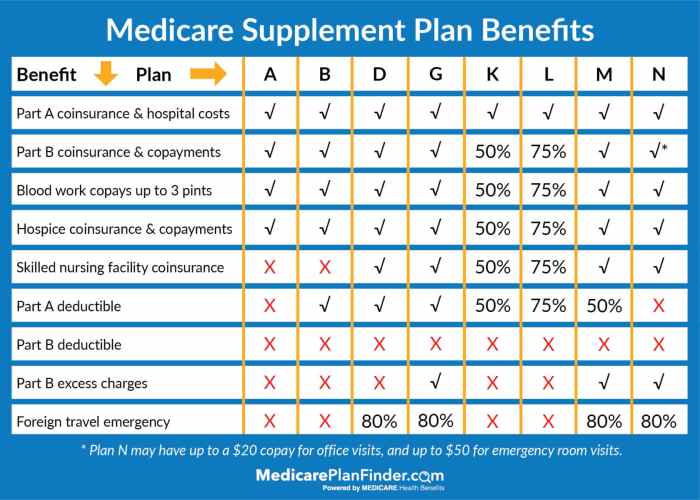

- Medicare Advantage Plans:Medicare Advantage plans, which are offered by private insurance companies, sometimes include no-deductible options. These plans may offer additional benefits and services compared to traditional Medicare.

Resources for Information on Plan Availability

To explore the availability of no-deductible plans in your area, you can consult the following resources:

- Health Insurance Marketplace:The Health Insurance Marketplace, also known as Healthcare.gov, allows you to compare plans from different insurers and assess their features, including deductible amounts.

- State Insurance Departments:Your state’s insurance department can provide information on available health insurance plans and help you navigate the enrollment process.

- Independent Insurance Agents:Independent insurance agents can provide personalized advice and help you find plans that meet your specific needs and budget.

Cost and Premiums of No-Deductible Plans

No-deductible health insurance plans offer the advantage of covering medical expenses from the first dollar, but this convenience comes at a cost. Understanding the premium structure and factors influencing it is crucial for making informed decisions.

Premium Determination and Influencing Factors

Premiums for no-deductible plans are determined by a combination of factors, including:

- Age:Older individuals generally have higher premiums due to increased healthcare needs.

- Location:Premiums vary based on the cost of healthcare in a particular geographic area.

- Health Status:Individuals with pre-existing conditions may face higher premiums.

- Plan Coverage:Comprehensive plans with extensive benefits typically have higher premiums.

- Tobacco Use:Smokers usually pay higher premiums than non-smokers.

- Family Size:Premiums increase with the number of dependents covered under the plan.

Comparison to Other Health Insurance Plans

No-deductible plans generally have higher premiums compared to plans with deductibles. This is because they provide immediate coverage without any out-of-pocket expenses, making them more expensive for insurance providers.

Examples of Potential Premium Ranges

- Individual Plan:A 40-year-old individual in a moderate-cost area with no pre-existing conditions might pay a monthly premium of $500-$800 for a comprehensive no-deductible plan.

- Family Plan:A family of four in a high-cost area with one parent having a pre-existing condition could expect monthly premiums in the range of $1,200-$2,000 for a no-deductible plan.

It’s important to note that these are just estimates, and actual premiums will vary based on individual circumstances.

Coverage and Benefits of No-Deductible Health Insurance Plans

No-deductible health insurance plans offer comprehensive coverage, meaning you don’t have to pay anything out of pocket before your insurance starts covering your medical expenses. This can be a significant advantage, especially for individuals who are concerned about the high cost of healthcare.

Types of Medical Services and Treatments Covered

No-deductible health insurance plans typically cover a wide range of medical services and treatments, including:

- Preventive care:This includes routine checkups, screenings, and immunizations.

- Hospitalization:This covers inpatient care, surgery, and other medical services provided in a hospital setting.

- Outpatient care:This includes doctor’s visits, lab tests, and other medical services provided outside of a hospital.

- Prescription drugs:This covers the cost of prescription medications.

- Mental health services:This includes therapy, counseling, and medication for mental health conditions.

- Dental care:Some no-deductible plans may include dental coverage, although this is not always the case.

- Vision care:Similarly, some plans may offer vision coverage, but it is not always included.

Limits and Exclusions of Coverage

While no-deductible plans offer comprehensive coverage, there are some limits and exclusions to be aware of:

- Pre-existing conditions:Some plans may have limitations on coverage for pre-existing conditions, meaning conditions you had before enrolling in the plan.

- Out-of-network providers:You may have to pay a higher copay or coinsurance if you receive care from a provider who is not in your plan’s network.

- Certain procedures or treatments:Some plans may exclude coverage for certain procedures or treatments, such as cosmetic surgery or experimental treatments.

- Maximum benefit limits:Some plans may have maximum benefit limits, meaning they will only pay a certain amount for your medical expenses each year.

Process for Accessing and Utilizing Benefits

To access and utilize your benefits, you will need to follow the plan’s specific procedures:

- Pre-authorization:For some procedures or treatments, you may need to obtain pre-authorization from your insurance company before receiving care. This ensures that the procedure is covered by your plan and that you will not be responsible for the costs.

- Filing claims:After receiving care, you will need to file a claim with your insurance company to receive reimbursement for your medical expenses.

- Copays and coinsurance:You may be responsible for paying a copay or coinsurance for some services, even with a no-deductible plan. These costs are typically a fixed amount or a percentage of the total cost of the service.

Examples of Specific Benefits Offered by No-Deductible Plans

Here are some examples of specific benefits that may be offered by no-deductible plans:

- Comprehensive coverage for hospitalization:This includes inpatient care, surgery, and other medical services provided in a hospital setting. For example, a no-deductible plan may cover the full cost of a hospital stay for a heart attack, including the cost of surgery, medication, and rehabilitation.

- Coverage for outpatient care:This includes doctor’s visits, lab tests, and other medical services provided outside of a hospital. For example, a no-deductible plan may cover the full cost of a doctor’s visit for a routine checkup or a visit to a specialist for a specific condition.

- Coverage for prescription drugs:This includes the cost of prescription medications, both brand-name and generic. For example, a no-deductible plan may cover the full cost of prescription medications for chronic conditions such as diabetes or high blood pressure.

Considerations for Choosing a No-Deductible Plan

No-deductible health insurance plans offer the advantage of covering medical expenses from the first dollar, eliminating the need to pay a deductible before coverage kicks in. However, choosing a no-deductible plan requires careful consideration to ensure it aligns with your individual needs and financial situation.

Key Factors to Consider

When evaluating no-deductible plans, several key factors should be carefully considered to make an informed decision.

- Premium Costs:No-deductible plans typically have higher premiums compared to plans with deductibles. This is because the insurer assumes a greater financial risk by covering expenses from the outset. Before committing to a no-deductible plan, it’s crucial to assess your budget and determine if you can comfortably afford the higher premiums.

- Coverage and Benefits:While no-deductible plans eliminate the deductible, they may have limitations on other aspects of coverage, such as copayments, coinsurance, or coverage for specific services. It’s essential to thoroughly review the plan’s coverage details and compare them to your healthcare needs.

- Health Status and Usage:If you have a pre-existing condition or anticipate frequent medical expenses, a no-deductible plan might be a worthwhile investment. However, if you are generally healthy and expect minimal healthcare utilization, a plan with a deductible might be more cost-effective.

- Network Availability:No-deductible plans may have narrower networks of healthcare providers compared to plans with deductibles. Ensure that your preferred doctors and hospitals are included in the plan’s network.

Potential Risks and Benefits

No-deductible plans present both potential risks and benefits that must be weighed carefully.

- Risk:The primary risk associated with no-deductible plans is the higher premium cost. If your healthcare utilization is low, you might end up paying significantly more in premiums than you would with a plan that has a deductible.

- Benefit:The primary benefit of no-deductible plans is the peace of mind that comes with knowing your medical expenses will be covered from the first dollar. This can be particularly valuable for individuals with pre-existing conditions or those who anticipate frequent medical expenses.

Comparing Plans and Providers

It is essential to compare different no-deductible plans and providers before making a decision.

- Compare Premiums:Get quotes from multiple insurers and compare the premium costs for similar plans.

- Review Coverage Details:Thoroughly review the plan’s coverage details, including copayments, coinsurance, and limitations on specific services.

- Check Network Availability:Ensure that your preferred doctors and hospitals are included in the plan’s network.

- Consider Customer Service:Research the insurer’s reputation for customer service and responsiveness.

Questions to Ask When Researching No-Deductible Plans

- What are the monthly premiums for the plan?

- What is the plan’s coverage for specific services, such as doctor visits, hospital stays, and prescription drugs?

- What are the copayments and coinsurance amounts for various services?

- What is the plan’s network of healthcare providers?

- What are the plan’s limitations or exclusions?

- What are the insurer’s customer service policies and procedures?

Epilogue

So, are no deductible plans right for you? The answer depends on your individual circumstances, health needs, and budget. If you anticipate high medical expenses or value peace of mind, a no deductible plan might be worth considering.

However, if you’re relatively healthy and prioritize lower monthly premiums, a plan with a deductible could be more financially feasible. Ultimately, it’s all about finding the right balance between cost and coverage to ensure you’re protected when you need it most.

Answers to Common Questions: What Are No Deductible Health Insurance Plans?

What are the main types of no deductible health insurance plans?

There are several types, including plans offered through employers, individual plans purchased on the marketplace, and even specialized plans for specific groups like seniors or those with pre-existing conditions.

Do no deductible plans cover all medical expenses?

While they eliminate the deductible, most plans still have limitations on coverage, such as copayments or coinsurance for certain services.

Are no deductible plans always more expensive?

Not necessarily. Some plans might have lower premiums than others, even with no deductibles. It’s crucial to compare plans and their features to find the best value for your needs.

How can I find out if a no deductible plan is right for me?

Consult with a licensed insurance agent or broker who can help you assess your individual needs and compare different plan options.