What are joint life insurance policies? They’re a unique type of life insurance designed for couples, offering a safety net for both partners. Unlike individual policies, joint life insurance covers two lives simultaneously, providing a payout when either insured person passes away.

This can be a valuable tool for couples with shared financial goals, like paying off a mortgage or ensuring a comfortable retirement for the surviving spouse.

Joint life insurance offers a range of benefits, including the potential for lower premiums, simplified estate planning, and a guaranteed payout upon the death of either insured individual. But it’s important to understand the different types of joint life insurance policies available and carefully consider whether it’s the right choice for your specific situation.

What is Joint Life Insurance?

Joint life insurance, also known as second-to-die life insurance, is a type of permanent life insurance policy that covers two individuals. It pays out a death benefit when the second insured person passes away. This type of insurance is often used by couples who want to ensure that their surviving spouse has financial security after the death of the first spouse.

Comparison of Joint Life Insurance and Individual Life Insurance Policies

Joint life insurance differs significantly from individual life insurance policies in terms of coverage and payout structure. Here’s a breakdown:

- Coverage:Individual life insurance policies cover only one person, while joint life insurance covers two individuals simultaneously. The death benefit is paid out only when the second insured person passes away.

- Payout:In individual life insurance, the death benefit is paid out upon the death of the insured individual. In joint life insurance, the death benefit is paid out upon the death of the second insured individual.

- Premiums:Joint life insurance premiums are typically higher than individual life insurance premiums because they cover two individuals. However, the premiums are often lower than the combined cost of two individual life insurance policies.

Benefits of Joint Life Insurance for Couples

Joint life insurance offers several benefits for couples, making it a valuable tool for financial planning.

- Estate Planning:Joint life insurance can be a valuable tool for estate planning, as it can help to ensure that the surviving spouse has enough funds to cover expenses such as funeral costs, outstanding debts, and living expenses. For example, a couple could use joint life insurance to pay off their mortgage or other debts after the death of the first spouse.

- Financial Security:Joint life insurance can provide financial security for the surviving spouse after the death of the first spouse. This can be especially important for couples who rely on two incomes. For instance, if one spouse passes away, the surviving spouse may need to rely on the death benefit from the joint life insurance policy to cover their living expenses.

- Tax Advantages:Death benefits from joint life insurance policies are generally tax-free, which can be a significant advantage for the surviving spouse. This means that the surviving spouse can receive the full death benefit without having to pay any taxes on it.

Scenarios Where Joint Life Insurance is Beneficial

Joint life insurance can be beneficial in various scenarios, including:

- Couples with young children:Joint life insurance can provide financial security for young children if both parents pass away. The death benefit can be used to cover expenses such as education, housing, and living expenses.

- Couples with a large mortgage:Joint life insurance can be used to pay off a mortgage after the death of the first spouse. This can help to ensure that the surviving spouse does not have to sell their home to cover the mortgage debt.

- Couples with a business:Joint life insurance can be used to provide funds for the surviving spouse to buy out the deceased spouse’s share of the business. This can help to ensure that the business remains in operation after the death of one of the owners.

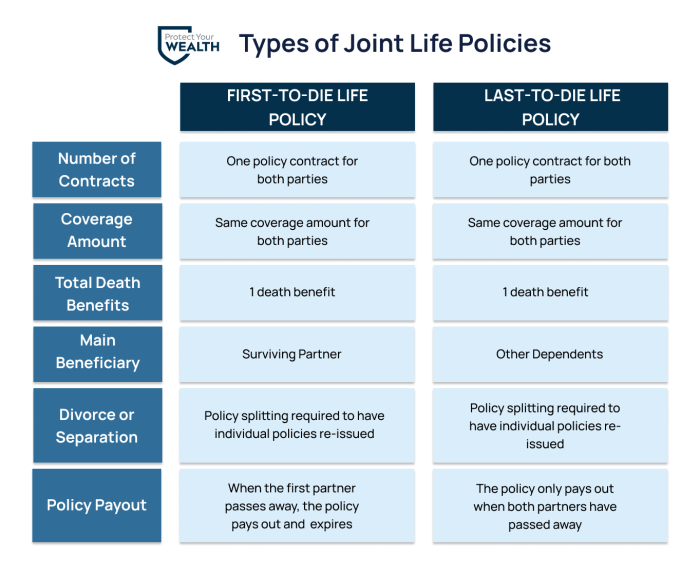

Types of Joint Life Insurance Policies

Joint life insurance policies come in different forms, each designed to meet specific needs and financial goals. The two most common types are first-to-die and second-to-die policies. Understanding the coverage, payout structure, and cost implications of each type is crucial for making informed decisions.

First-to-Die Life Insurance

First-to-die life insurance, also known as joint first-to-die life insurance, provides coverage until the first insured individual passes away. The policy pays out a death benefit upon the death of the first insured person. This type of policy is often used for estate planning purposes, particularly for couples who want to ensure that their surviving spouse has sufficient funds to cover expenses and maintain their lifestyle after the death of the first spouse.

The death benefit is paid out to the designated beneficiary upon the death of the first insured person. The policy then terminates, and there is no further coverage for the surviving insured person.

Benefits of First-to-Die Life Insurance

- Provides a lump sum death benefit to the surviving spouse, ensuring financial security after the death of the first spouse.

- Can be used to cover estate taxes, funeral expenses, and other outstanding debts.

- May be more affordable than purchasing two individual life insurance policies.

Costs of First-to-Die Life Insurance

- Premiums are typically lower than purchasing two individual policies, as the insurer is only obligated to pay out the death benefit once.

- The policy terminates upon the death of the first insured person, leaving the surviving spouse without coverage.

Examples of First-to-Die Life Insurance

- A couple with young children purchases a first-to-die policy to ensure that the surviving parent has sufficient funds to raise their children.

- A couple with a mortgage uses a first-to-die policy to ensure that the mortgage is paid off in the event of the death of one spouse.

Second-to-Die Life Insurance

Second-to-die life insurance, also known as survivor life insurance, provides coverage until the death of the second insured individual. The policy pays out a death benefit upon the death of the second insured person. This type of policy is often used for estate planning purposes, particularly for couples who want to minimize estate taxes.The death benefit is paid out to the designated beneficiary upon the death of the second insured person.

The policy then terminates.

Benefits of Second-to-Die Life Insurance

- Provides a lump sum death benefit to the beneficiary upon the death of the second insured person.

- Can be used to cover estate taxes and other financial obligations.

- May be a more cost-effective way to minimize estate taxes than purchasing individual life insurance policies.

Costs of Second-to-Die Life Insurance

- Premiums are typically higher than first-to-die policies, as the insurer is obligated to pay out the death benefit only after the death of both insured individuals.

- The policy terminates upon the death of the second insured person.

Examples of Second-to-Die Life Insurance

- A wealthy couple purchases a second-to-die policy to minimize estate taxes and ensure that their heirs receive a larger inheritance.

- A couple with a large estate uses a second-to-die policy to cover the cost of estate taxes and avoid the need to sell assets to pay the taxes.

Who Should Consider Joint Life Insurance?: What Are Joint Life Insurance Policies?

Joint life insurance can be a valuable tool for couples who want to ensure financial security for their loved ones in the event of the death of one or both partners. It’s particularly relevant for couples who rely on each other’s income, have shared financial obligations, or want to leave a legacy for their heirs.

Factors to Consider When Deciding on Joint Life Insurance

When deciding whether joint life insurance is right for you, consider these key factors:

- Financial Dependence:If you and your partner rely heavily on each other’s income, joint life insurance can provide financial protection if one of you passes away. This can help cover expenses like mortgage payments, living costs, and outstanding debts.

- Shared Financial Obligations:If you have joint debts or assets, such as a mortgage, business, or investments, joint life insurance can help ensure these obligations are met in the event of a death. The proceeds can be used to pay off debts, cover taxes, or maintain the assets.

- Estate Planning:Joint life insurance can be a valuable tool for estate planning, as it can provide liquidity for estate taxes or other expenses. This can help prevent the need to sell assets to cover these costs, ensuring your beneficiaries receive the full value of your estate.

- Legacy Planning:If you want to leave a financial legacy for your children, grandchildren, or other loved ones, joint life insurance can provide a lump sum payment that can be used for education, starting a business, or other purposes.

- Age and Health:Your age and health can significantly impact the cost of joint life insurance. Younger, healthier couples generally qualify for lower premiums. It’s important to consider your long-term health prospects and potential changes in health that could impact premiums.

- Financial Situation:Your overall financial situation is crucial when considering joint life insurance. Ensure you can afford the premiums and that the coverage aligns with your financial goals.

Pros and Cons of Joint Life Insurance

Here’s a comparison of the advantages and disadvantages of joint life insurance:

| Pros | Cons |

|---|---|

| Provides financial protection for both partners | Premiums can be higher than individual policies |

| Can be more cost-effective than two individual policies | Coverage ends when either partner dies |

| Offers a lump sum payout that can be used for various purposes | Can be difficult to adjust coverage if one partner’s needs change |

| Simplifies estate planning and ensures beneficiaries receive a specific amount | May not be suitable for couples with different financial needs or goals |

Flowchart to Determine if Joint Life Insurance is Right for You

StartDo you and your partner rely on each other’s income?Yes:Proceed to “Do you have shared financial obligations?” No:Joint life insurance may not be necessary. Do you have shared financial obligations?Yes:Proceed to “Do you want to leave a legacy for your heirs?” No:Joint life insurance may not be necessary. Do you want to leave a legacy for your heirs?Yes:Consider joint life insurance. No:Joint life insurance may not be necessary.

End

Key Considerations for Joint Life Insurance

Joint life insurance is a powerful tool for financial planning, but like any financial product, careful consideration is crucial before making a decision. Understanding the key aspects of joint life insurance will help you make informed choices that align with your needs and goals.

Coverage Amount

The coverage amount is the core of any life insurance policy, and choosing the right amount for a joint life policy is critical. The coverage amount should be sufficient to cover the financial obligations and needs of the surviving spouse or partner in the event of the death of one or both insured individuals.

Factors to consider when determining the coverage amount include:

- Outstanding debts:Mortgages, loans, and credit card debt should be factored in to ensure the surviving spouse can manage these obligations.

- Living expenses:The coverage should be enough to cover ongoing living expenses, such as housing, utilities, groceries, and transportation.

- Final expenses:Funeral costs, estate taxes, and legal fees should be included in the coverage amount.

- Income replacement:If one spouse is the primary income earner, the coverage should be sufficient to replace a portion of their lost income.

- Children’s education:If you have children, the coverage amount should consider their future education expenses.

It’s important to consult with a financial advisor to determine the appropriate coverage amount based on your individual circumstances.

Premiums and Beneficiaries

Premiums are the regular payments you make to maintain the joint life insurance policy. The premium amount is determined by factors such as the age, health, and coverage amount of the insured individuals.

- Premium payment options:You can typically choose to pay premiums monthly, quarterly, semi-annually, or annually. Consider your cash flow and payment preferences when making this decision.

- Beneficiaries:You need to designate the beneficiaries of the policy, who will receive the death benefit. This could be the surviving spouse, children, other family members, or even a charitable organization. Carefully consider who you want to receive the death benefit and ensure the beneficiaries are clearly named in the policy.

Riders and Add-ons

Joint life insurance policies can be customized with various riders and add-ons to enhance coverage and provide additional benefits.

- Waiver of premium:This rider waives premium payments if one of the insured individuals becomes disabled. This can provide financial security and peace of mind during a challenging time.

- Accidental death benefit:This rider provides an additional death benefit if the death is caused by an accident. This can be helpful for covering unexpected expenses associated with an accident.

- Living benefits:Some joint life policies offer living benefits that allow you to access a portion of the death benefit while you are still alive. This can be helpful for covering long-term care expenses or other significant financial needs.

Obtaining a Joint Life Insurance Policy

The process of obtaining a joint life insurance policy is similar to that of individual life insurance.

- Contact an insurance agent or broker:An agent or broker can help you compare policies from different insurance companies and find the best option for your needs.

- Provide personal information:You will need to provide information about your age, health, and financial situation.

- Complete a medical exam:You may be required to undergo a medical exam to assess your health and determine the premium rate.

- Review and sign the policy:Once the policy is issued, carefully review it to ensure you understand the terms and conditions before signing.

Joint Life Insurance vs. Individual Policies

Deciding between joint life insurance and individual policies is a crucial step in securing your family’s financial future. Both options offer coverage, but they differ in their structure, benefits, and suitability. Understanding these differences is key to making an informed choice that aligns with your unique circumstances.

Comparing Advantages and Disadvantages

Joint life insurance offers coverage for two individuals under a single policy, while individual policies provide coverage for each person separately.

- Joint Life Insurance Advantages:

- Lower Premiums:Joint life insurance policies typically have lower premiums compared to purchasing two individual policies with the same coverage amount. This is because the insurer calculates the premium based on the combined age and health of both individuals, which is generally lower than the average of two individual policies.

- Simplified Coverage:A single policy simplifies administration and eliminates the need to manage multiple policies.

- Guaranteed Death Benefit:The death benefit is paid out upon the death of either insured individual, ensuring a financial safety net for the surviving spouse or beneficiary.

- Joint Life Insurance Disadvantages:

- Limited Flexibility:Joint life policies typically have less flexibility than individual policies, as the death benefit is paid out upon the death of either insured individual. This means that the surviving spouse may not be able to access the full death benefit if they outlive their partner.

- Potential for Higher Premiums:If one insured individual has health issues or is significantly older than the other, the premiums could be higher than those of individual policies.

- Limited Coverage Options:Joint life policies may not offer the same range of coverage options as individual policies.

- Individual Life Insurance Advantages:

- Flexibility:Individual policies offer greater flexibility, allowing you to customize coverage amounts, beneficiaries, and policy terms. You can also choose different types of policies, such as term life insurance or permanent life insurance, based on your needs.

- Personalized Coverage:Individual policies are tailored to each individual’s specific needs and circumstances, such as age, health, and financial goals.

- Potential for Lower Premiums:If one individual has a lower risk profile than the other, individual policies may offer lower premiums compared to a joint life policy.

- Individual Life Insurance Disadvantages:

- Higher Premiums:Purchasing two individual policies with the same coverage amount as a joint life policy may result in higher premiums overall.

- Administrative Complexity:Managing multiple policies can be more complex and time-consuming.

Real-Life Scenarios

- Joint Life Insurance:A couple with a mortgage and young children may choose joint life insurance to ensure that the surviving spouse can continue to make mortgage payments and provide for their children’s education in the event of the death of one partner.

- Individual Life Insurance:A couple with a large estate and a desire to leave a legacy to their children may opt for individual policies. This allows them to customize coverage amounts and beneficiaries, ensuring that their estate is distributed according to their wishes.

Key Differences, What are joint life insurance policies?

| Feature | Joint Life Insurance | Individual Life Insurance |

|---|---|---|

| Coverage | Two individuals under a single policy | Each individual has a separate policy |

| Premiums | Typically lower than two individual policies | May be higher than a joint life policy, depending on individual risk profiles |

| Flexibility | Less flexible than individual policies | More flexible, allowing for customization of coverage amounts, beneficiaries, and policy terms |

| Death Benefit | Paid out upon the death of either insured individual | Paid out upon the death of the individual insured |

| Administration | Simplified with a single policy | May require managing multiple policies |

Factors to Consider

- Financial Goals:What are your financial goals for your family in the event of your death? Do you need to cover a mortgage, provide for your children’s education, or leave a legacy?

- Health and Age:Your age and health can significantly impact the cost of life insurance. If one individual has health issues or is significantly older than the other, individual policies may be more affordable.

- Budget:Consider your budget and how much you can afford to spend on life insurance premiums.

- Estate Planning:How will you distribute your assets upon your death? Joint life insurance can simplify estate planning, while individual policies offer more flexibility.

Alternatives to Joint Life Insurance

While joint life insurance provides coverage for multiple individuals, it may not be the most suitable option for every situation. Exploring alternatives can help you find a solution that aligns with your specific needs and financial goals.

Joint life insurance policies are a great way to ensure that your loved ones are financially protected in the event of the death of either you or your spouse. But what if you want to build up some cash value along the way?

That’s where life insurance policies with cash value come in. They can provide both death benefits and a growing savings component, offering a more flexible approach to your financial planning. So, when considering a joint life insurance policy, think about the benefits of cash value and how it can enhance your financial security.

Individual Policies with Joint Ownership

An alternative to joint life insurance is to purchase individual life insurance policies for each person and designate the other as the beneficiary. This approach offers flexibility in coverage amounts and allows you to tailor each policy to individual needs.

For instance, one person might require a larger death benefit than the other, reflecting their respective financial contributions or dependents.

Cost and Benefits Comparison

- Cost:Individual policies with joint ownership can be less expensive than a joint life insurance policy, especially if the individuals have different ages or health conditions. The premiums for each individual policy are calculated based on their individual risk profiles.

- Benefits:

- Flexibility:You can adjust the coverage amount and policy terms for each individual policy independently.

- Lower Premiums:If the individuals have different risk profiles, individual policies may result in lower premiums compared to a joint life insurance policy.

- Separate Coverage:Each policy provides separate coverage for the insured individual, which can be beneficial if one person’s health deteriorates and their insurability is affected.

Resources for Further Information

For individuals seeking more information about life insurance options, several resources are available:

- Life insurance companies:Most life insurance companies have websites and customer service representatives who can provide information and guidance on their products.

- Financial advisors:A financial advisor can help you assess your insurance needs and recommend suitable policies based on your individual circumstances.

- Independent insurance agents:Independent insurance agents represent multiple insurance companies and can compare policies from different providers.

- Consumer protection agencies:Organizations like the National Association of Insurance Commissioners (NAIC) provide information and resources on insurance-related matters.

Decision-Making Flowchart

[Flowchart]

Ultimate Conclusion

Joint life insurance can be a powerful tool for couples seeking financial security and peace of mind. By understanding the various types of policies, carefully considering the pros and cons, and exploring alternative options, you can make an informed decision that best suits your needs and goals.

Remember, consulting with a financial advisor can provide valuable insights and help you navigate the complexities of life insurance planning.

FAQ Overview

How does joint life insurance differ from individual life insurance?

Joint life insurance covers two lives simultaneously, paying out upon the death of either insured person. Individual life insurance covers only one person, with a payout upon their death.

What are the potential downsides of joint life insurance?

One potential downside is that premiums may be higher than individual policies. Additionally, if one insured person’s health deteriorates, the premiums could increase for both individuals. Lastly, if one insured person passes away, the surviving spouse may need to adjust their financial plans.

What are some alternative life insurance options for couples?

Alternatives include individual policies with joint ownership, where one person owns the policy but the other person is designated as a beneficiary. This allows the surviving spouse to receive the death benefit without having to pay taxes on it.