What are international health insurance plans? They’re like your trusty sidekick for navigating the healthcare systems of different countries. Unlike your regular domestic plan, which usually only covers you within your home country, international health insurance provides you with coverage across borders.

Imagine yourself exploring the world, knowing you’re protected in case of unexpected medical needs, whether it’s a sudden illness in a bustling metropolis or a minor injury while trekking through the Amazon rainforest.

Think of it as a safety net that ensures you can access quality medical care, no matter where your adventures take you. International health insurance plans come in various forms, each tailored to specific needs and lifestyles. Some plans focus on providing comprehensive coverage for travelers, while others cater to expats living abroad for extended periods.

With a bit of research and careful consideration, you can find the perfect plan to match your travel plans or expat lifestyle.

International Health Insurance

Imagine traveling the world, experiencing new cultures, and embarking on exciting adventures. But what if a medical emergency strikes? International health insurance can be your safety net, providing peace of mind and financial protection when you’re away from home.

International health insurance differs from domestic health insurance in several key ways.

Differences between Domestic and International Health Insurance

Domestic health insurance typically covers you within the boundaries of your home country. It may not provide coverage for medical expenses incurred abroad. International health insurance, on the other hand, is designed to protect you while you’re traveling or living outside your home country.

It provides coverage for medical emergencies, illnesses, and injuries, regardless of your location.

Benefits of International Health Insurance

- Global Coverage:International health insurance plans provide coverage in most countries worldwide, ensuring you have access to medical care wherever you may be.

- Financial Protection:Medical expenses can be incredibly high, especially in foreign countries. International health insurance helps cover these costs, protecting you from financial hardship.

- Peace of Mind:Knowing you have comprehensive medical coverage while traveling can reduce stress and allow you to enjoy your trip without worrying about unforeseen medical events.

- Access to Quality Care:International health insurance plans often provide access to a network of reputable hospitals and medical professionals worldwide, ensuring you receive quality care.

- Emergency Medical Evacuation:In case of a serious medical emergency, some international health insurance plans cover the cost of medical evacuation back to your home country or to a facility with specialized care.

Types of International Health Insurance Plans

International health insurance plans are designed to provide coverage for individuals and families living, working, or traveling abroad. These plans vary in terms of their coverage, benefits, and costs, and it’s crucial to choose a plan that aligns with your specific needs and circumstances.

Types of International Health Insurance Plans, What are international health insurance plans?

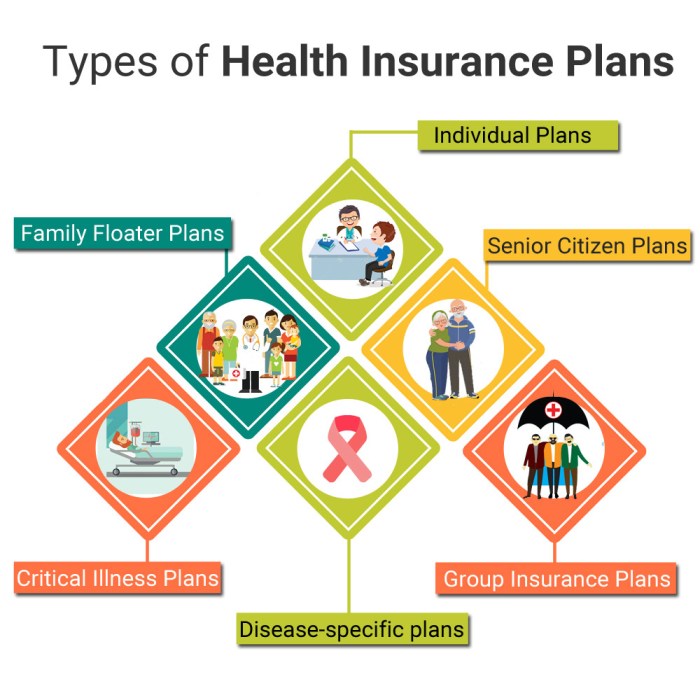

Understanding the different types of international health insurance plans is essential for making an informed decision. These plans can be broadly categorized based on their coverage structure and target audience.

- Individual Plans:These plans are designed for individuals seeking coverage for themselves, and they typically offer a wide range of customization options. You can choose the level of coverage, benefits, and deductibles that best suit your needs and budget. Individual plans provide flexibility and allow you to tailor the plan to your specific requirements.

For example, if you’re a young and healthy individual traveling for a short period, you might opt for a basic plan with lower premiums. However, if you’re a senior citizen with pre-existing conditions, you might choose a comprehensive plan with higher premiums but more extensive coverage.

- Family Plans:These plans are designed for families and provide coverage for multiple individuals under a single policy. Family plans typically offer discounts compared to purchasing individual plans for each family member. They are ideal for families who need coverage for all members while traveling or living abroad.

For instance, a family traveling to Europe for an extended period might choose a family plan to ensure everyone is covered in case of medical emergencies or unexpected health issues.

- Expatriate Plans:These plans are specifically designed for individuals who are living and working abroad. Expatriate plans often offer comprehensive coverage, including medical expenses, repatriation, and emergency evacuation. They also tend to have higher premiums than other types of international health insurance plans, reflecting the greater risks associated with living abroad.

For example, an expatriate working in a developing country might need a comprehensive plan that covers potential risks like infectious diseases, political instability, and access to specialized medical care.

- Travel Insurance Plans:These plans are designed for travelers who are going on short-term trips abroad. Travel insurance plans typically provide coverage for medical emergencies, trip cancellations, lost luggage, and other travel-related risks. They offer a more limited scope of coverage compared to other types of international health insurance plans but are more affordable for short trips.

For instance, a traveler going on a two-week vacation to Southeast Asia might choose a travel insurance plan to cover medical expenses and potential trip disruptions.

Key Considerations When Choosing an International Health Insurance Plan

Choosing the right international health insurance plan is crucial for your well-being and financial security while living or traveling abroad. With various plans available, carefully evaluating key considerations is essential to make an informed decision.

Coverage Areas

The coverage area of your international health insurance plan determines where you are insured. Some plans offer global coverage, while others restrict coverage to specific regions or countries.

- Global Coverage:This provides protection worldwide, ideal for frequent travelers or expats living in multiple countries.

- Regional Coverage:This limits coverage to a specific geographic region, such as Europe, Asia, or North America. It can be a cost-effective option for individuals traveling or residing within a particular area.

- Country-Specific Coverage:This provides coverage only within a specific country, suitable for expats or individuals with a fixed location.

It is crucial to select a plan with coverage areas that align with your travel or residency plans.

Pre-existing Conditions

Pre-existing conditions are health issues you had before purchasing your insurance plan. International health insurance plans may have limitations or exclusions regarding pre-existing conditions.

- Full Coverage:Some plans offer full coverage for pre-existing conditions, ensuring you receive comprehensive medical care.

- Waiting Periods:Other plans may have waiting periods before they cover pre-existing conditions, meaning you’ll need to wait a certain time before accessing benefits.

- Exclusions:Some plans may completely exclude coverage for specific pre-existing conditions.

It’s essential to carefully review the plan’s terms and conditions to understand how pre-existing conditions are handled.

Exclusions and Limitations

International health insurance plans typically have exclusions and limitations, which are specific situations or conditions not covered.

- War and Terrorism:Most plans exclude coverage for medical expenses incurred due to war or terrorism.

- Pre-existing Conditions:As mentioned earlier, plans may have limitations or exclusions for pre-existing conditions.

- Adventure Sports:Some plans may exclude coverage for activities considered high-risk, such as extreme sports or dangerous hobbies.

It’s crucial to understand the exclusions and limitations of the plan to avoid unexpected costs.

Premium Costs

Premium costs are the monthly or annual payments you make for your international health insurance plan.

- Coverage Level:The level of coverage you choose directly impacts the premium cost. Higher coverage levels typically come with higher premiums.

- Age and Health:Your age and health status can also influence premium costs. Younger and healthier individuals generally pay lower premiums.

- Coverage Area:Global coverage plans often have higher premiums than regional or country-specific plans.

Compare premiums from different insurers and choose a plan that offers a balance between affordability and adequate coverage.

Claims Process

The claims process involves filing a claim for reimbursement of medical expenses.

- Ease of Filing:A streamlined and user-friendly claims process is essential for a hassle-free experience.

- Response Time:The time it takes for the insurer to process and approve your claim is crucial.

- Payment Method:The insurer should offer convenient payment methods for reimbursement.

Consider the claims process when choosing a plan, as it can significantly impact your experience.

Benefits of International Health Insurance: What Are International Health Insurance Plans?

International health insurance plans offer a range of benefits that can be invaluable for individuals living, working, or traveling abroad. These plans provide financial protection and peace of mind, ensuring that you have access to quality healthcare services wherever you are in the world.

Financial Protection

International health insurance plans act as a financial safety net, shielding you from the potentially devastating costs of unexpected medical expenses.

- Coverage for a Wide Range of Medical Expenses:These plans typically cover a wide range of medical expenses, including hospitalization, surgery, emergency care, and outpatient treatment. This comprehensive coverage ensures that you are financially protected in case of an unforeseen medical event.

- Protection Against High Medical Costs:Medical costs can be significantly higher in some countries compared to others. International health insurance plans help mitigate these costs by providing coverage for expensive treatments and procedures.

- Avoidance of Out-of-Pocket Expenses:With international health insurance, you can avoid substantial out-of-pocket expenses for medical care. This financial security allows you to focus on your health and recovery without worrying about the financial burden.

Peace of Mind

International health insurance provides peace of mind, knowing that you have access to quality healthcare services when you need them.

- Access to Quality Healthcare:International health insurance plans often provide access to a network of reputable hospitals and medical professionals worldwide. This ensures that you receive high-quality care, regardless of your location.

- Reduced Stress and Anxiety:Having international health insurance eliminates the stress and anxiety associated with navigating unfamiliar healthcare systems and worrying about medical costs. This peace of mind allows you to focus on your well-being and enjoy your time abroad.

- Focus on Health and Recovery:With financial protection and access to quality care, you can focus on your health and recovery without the added burden of medical expenses. This allows you to get back on your feet quickly and efficiently.

Real-Life Examples

International health insurance has helped countless individuals navigate challenging medical situations abroad.

- Emergency Medical Evacuation:Imagine being on a business trip in a remote country and experiencing a sudden medical emergency. International health insurance can cover the costs of emergency medical evacuation, ensuring that you receive prompt and specialized care in a suitable medical facility.

- Long-Term Treatment Abroad:If you are diagnosed with a chronic condition while living or working abroad, international health insurance can cover the costs of ongoing treatment, medication, and rehabilitation. This provides financial security and peace of mind, allowing you to manage your condition effectively.

- Unexpected Medical Expenses:Even a minor medical incident, such as a broken bone or a severe infection, can lead to significant medical expenses. International health insurance can help cover these costs, preventing financial hardship and ensuring that you receive the necessary care.

Finding and Comparing International Health Insurance Plans

Navigating the world of international health insurance can feel like a daunting task. But fear not, because with the right approach, finding the perfect plan for your needs is entirely achievable. This section provides a step-by-step guide to help you confidently compare and choose the international health insurance plan that best suits your unique circumstances.

Resources and Tools for Research and Comparison

Several resources and tools can significantly aid your research and comparison process. These resources provide valuable information, allowing you to explore different plans, compare features, and make informed decisions.

- Insurance Comparison Websites:These websites act as online marketplaces where you can input your requirements and compare quotes from various insurance providers. They often include features like plan filters, allowing you to narrow down options based on your specific needs. Some popular examples include Expat Insurance, International Medical Group (IMG), and World Nomads.

- Insurance Provider Websites:Visiting the websites of individual insurance providers allows you to explore their plans in detail. You can often find information on coverage details, premiums, exclusions, and claims processes. Be sure to check for customer testimonials and reviews to get a sense of the provider’s reputation.

- Independent Insurance Broker Websites:Independent insurance brokers offer impartial advice and can help you navigate the complex world of international health insurance. They often have access to a wide range of plans from different providers, allowing them to tailor recommendations to your specific requirements.

International health insurance plans are like a safety net for your health when you’re traveling the world. They cover medical expenses, which can be a lifesaver in a foreign country. But what about your loved ones back home? That’s where life insurance comes in.

If you’re looking for the right policy to protect your family, check out this guide on what is the best life insurance policy for me?. Once you’ve got that sorted, you can focus on exploring the world with the peace of mind that your health and your family’s future are secure.

These brokers can also help you understand the nuances of different policies and ensure you have adequate coverage.

Ultimate Conclusion

International health insurance is a vital investment for anyone venturing beyond their home country. It’s more than just a policy; it’s a passport to peace of mind, knowing you’re covered when you need it most. Whether you’re a globetrotting adventurer or an expat building a new life abroad, understanding the nuances of international health insurance plans can make a world of difference.

So, before you embark on your next journey, take the time to explore your options, compare plans, and choose the one that aligns with your specific needs and budget. With the right coverage, you can truly embrace the world with confidence, knowing that your health is protected.

FAQ Overview

What are the main differences between domestic and international health insurance?

Domestic health insurance typically covers you within your home country, while international health insurance provides coverage across borders. International plans often offer broader coverage for medical emergencies, evacuations, and even repatriation.

Is international health insurance expensive?

The cost of international health insurance varies greatly depending on factors such as your age, health, coverage level, and destination. However, it’s generally more expensive than domestic plans, reflecting the broader scope of coverage and potential for higher medical costs abroad.

How do I find the right international health insurance plan?

You can find and compare international health insurance plans online through comparison websites, insurance brokers, or directly from insurance providers. It’s essential to consider your travel plans, medical needs, and budget when making your selection.