What are convertible life insurance policies? Imagine a life insurance policy that evolves with your needs, offering flexibility and adaptability. Convertible life insurance provides this very advantage, allowing you to switch gears and adjust your coverage as your life changes.

Think of it as a safety net that can be tailored to fit your evolving circumstances.

Essentially, convertible life insurance starts as a term life insurance policy, offering temporary coverage for a specific period. However, it comes with the unique feature of allowing you to convert it to a permanent life insurance policy, providing lifelong coverage, during a specified timeframe.

This conversion option can be incredibly valuable if your life insurance needs shift, such as when you start a family or take on more financial responsibilities.

Convertible Life Insurance

Convertible life insurance is a type of life insurance policy that allows you to convert your term life insurance policy to a permanent life insurance policy. This means that you can lock in a guaranteed premium for a permanent policy, even if your health has changed since you first purchased the term policy.

Convertible life insurance policies offer flexibility and security. They allow you to protect your family with affordable term life insurance while retaining the option to switch to a permanent policy later, providing lifelong coverage.

History of Convertible Life Insurance

Convertible life insurance policies have been around for many years. The concept of converting a temporary insurance policy to a permanent one was introduced in the early 20th century. Initially, these policies were primarily offered to military personnel, providing them with temporary coverage during their service and the option to convert to permanent policies afterward.

Over time, convertible life insurance policies became more widely available to the general public. Today, they are a common type of life insurance policy offered by many insurance companies.

Term Life Insurance and its Relationship to Convertible Life Insurance

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It is generally more affordable than permanent life insurance, but it does not offer lifetime coverage. If you die within the term, your beneficiaries will receive a death benefit.

However, if you outlive the term, the policy will expire, and you will no longer have coverage. Convertible life insurance policies are closely tied to term life insurance. They are essentially term life insurance policies with an added feature: the option to convert to a permanent policy.

This option provides you with the flexibility to adjust your coverage needs as your life changes. If you need permanent coverage later, you can convert your term policy to a permanent policy without undergoing a new medical exam or having to prove insurability.

Key Benefits of Convertible Life Insurance

Convertible life insurance offers several advantages that make it an attractive option for individuals seeking flexibility and adaptability in their life insurance coverage. This type of policy allows you to adjust your coverage needs as your life circumstances change, providing valuable protection throughout different stages of your life.

Flexibility and Adaptability

Convertible life insurance policies provide a high degree of flexibility, allowing policyholders to change their coverage needs as their life circumstances evolve. This is particularly beneficial for individuals whose life insurance requirements may fluctuate over time, such as those who:

- Are starting a family and need increased coverage for dependents.

- Are nearing retirement and may require a lower death benefit.

- Experience changes in income or financial obligations.

Potential for Lower Premiums

Convertible life insurance policies often offer lower premiums compared to permanent life insurance policies. This is because convertible policies are typically issued at a younger age, when individuals are considered lower risk.

The lower premiums can be a significant advantage, particularly for individuals seeking affordable life insurance coverage.

How Convertible Life Insurance Works

Convertible life insurance offers the flexibility to switch from temporary coverage to permanent protection. This means you can secure a permanent life insurance policy without undergoing a new medical exam. But how does this conversion process work?

Conversion Process

Converting a term life insurance policy to a permanent one involves a few steps. * Request Conversion:You must first contact your insurance provider and request to convert your policy.

Eligibility Requirements

Your insurance company may have specific eligibility requirements for conversion, such as age limits or health conditions.

Conversion Premium

The premium for your new permanent policy will be determined based on your age, health, and the type of permanent policy you choose.

Policy Issuance

Once the conversion process is complete, your insurance provider will issue you a new permanent life insurance policy.

Factors Influencing Conversion Premiums and Options

Several factors can influence the premiums and options available during conversion.* Age:Your age at the time of conversion is a significant factor. The older you are, the higher your premium will be.

Health

Your current health status can also impact your conversion options and premiums.

Policy Type

The type of permanent life insurance policy you choose (e.g., whole life, universal life) will influence your premium and coverage options.

Conversion Period

Most term life insurance policies have a specific conversion period during which you can convert your policy. This period typically starts when the policy is issued and ends at a specific age or after a certain number of years.

Conversion Scenarios and Implications

Let’s look at some common conversion scenarios and their implications:* Scenario 1: Early Conversion:You convert your term life insurance policy early in the term, while you are still relatively young and healthy. This will likely result in a lower premium for your permanent policy.

Scenario 2

Late Conversion: You convert your policy closer to the end of the term, when you are older and may have pre-existing health conditions. This will likely result in a higher premium for your permanent policy.

Scenario 3

Conversion to a Different Policy Type: You convert your term life insurance policy to a different type of permanent policy, such as universal life, which offers more flexibility in premium payments and death benefit options. The premium and coverage options will vary depending on the specific policy type.

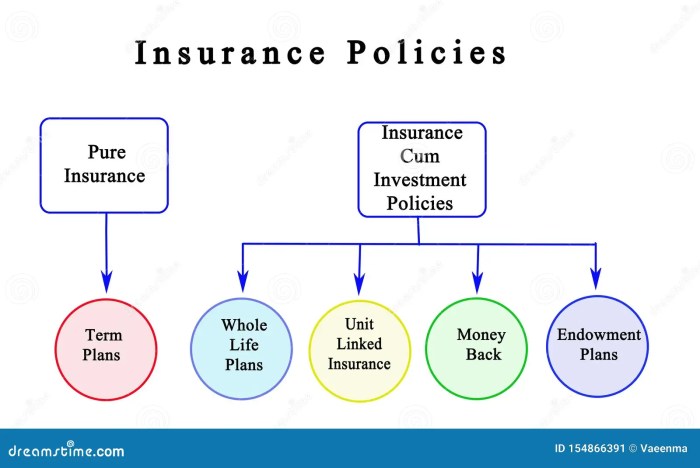

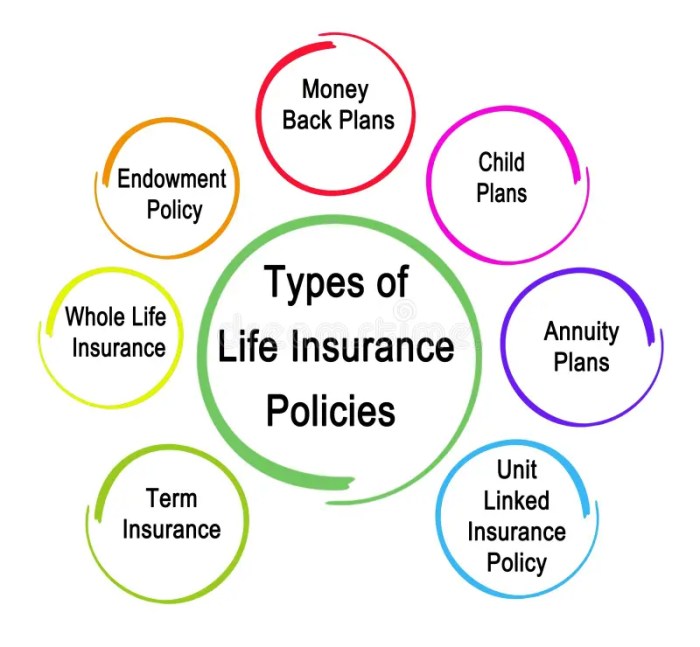

Types of Convertible Life Insurance

Convertible life insurance policies come in various forms, each offering unique features and benefits. Understanding the differences between these types can help you choose the best option for your specific needs.

Convertible life insurance policies are a bit like a chameleon – they can change with your needs. You start with a temporary policy, great for younger kids, but as they grow, you can switch it to permanent coverage. Want to know more about finding the right life insurance for your little ones?

Check out this helpful article on how to find life insurance for your children. Convertible policies are especially handy when you’re unsure about your long-term insurance needs – they give you the flexibility to adapt as your family grows.

Types of Convertible Life Insurance

Convertible life insurance policies can be categorized based on the type of coverage they offer and the options available for conversion. Here’s a breakdown of some common types:

- Term Life Insurance with a Conversion Option:This is the most common type of convertible life insurance. It offers temporary coverage for a specific term, typically 10, 20, or 30 years. The policy includes an option to convert to a permanent life insurance policy, such as whole life or universal life, within a specified period, usually before the policy expires.

- Convertible Term Life Insurance:This type of policy is similar to term life insurance with a conversion option, but it may offer more flexibility in terms of the conversion process. For instance, it might allow for conversion to a different type of permanent life insurance, or it might provide a guaranteed premium rate for the converted policy.

- Group Term Life Insurance with a Conversion Option:Offered through employers or organizations, group term life insurance provides coverage to a group of individuals. It may include a conversion option that allows employees to convert their group term life insurance to an individual permanent life insurance policy when they leave their job.

Conversion Options

The conversion process can vary depending on the policy. Here are some common conversion options:

- Guaranteed Conversion:This option ensures that you can convert your term life insurance policy to a permanent life insurance policy at a predetermined premium rate, regardless of your health status. This option provides peace of mind, as it protects you from potential premium increases due to age or health changes.

- Non-Guaranteed Conversion:With this option, the premium for the converted policy is based on your health and age at the time of conversion. If your health has deteriorated or you have aged significantly, the premium for the converted policy may be higher than the original term life insurance premium.

- Conversion to a Different Type of Permanent Life Insurance:Some convertible policies offer the flexibility to convert to different types of permanent life insurance, such as whole life, universal life, or indexed universal life. This allows you to choose the policy that best meets your needs and financial goals.

Considerations for Choosing Convertible Life Insurance

Convertible life insurance offers flexibility and potential savings, but choosing the right policy requires careful consideration of your individual needs and circumstances. It’s crucial to understand the factors that influence your decision and how to navigate the conversion process effectively.

Factors to Consider When Selecting a Convertible Life Insurance Policy

Selecting a convertible life insurance policy involves assessing several factors that can impact your long-term financial planning. Understanding these factors will help you make an informed decision.

- Your current and future financial needs:Evaluate your current financial situation and anticipated future needs, such as mortgage payments, dependents’ education, or retirement planning. This will determine the appropriate coverage amount and policy term. For instance, if you expect your income to increase in the future, a longer term policy with a higher coverage amount might be beneficial.

- Your health status and insurability:Your current health status plays a significant role in determining the premium you pay. A healthy individual with no pre-existing conditions generally qualifies for lower premiums. However, if you have health concerns, convertible life insurance can be a valuable option as it locks in your current insurability, ensuring you can convert to a permanent policy later without undergoing a medical exam.

- Your risk tolerance:Convertible life insurance offers flexibility but involves a potential trade-off. You might pay slightly higher premiums compared to a permanent policy initially. However, this flexibility allows you to adjust your coverage needs as your life changes. If you are risk-averse and prioritize long-term financial security, a permanent policy might be a better fit.

On the other hand, if you are comfortable with some uncertainty and value flexibility, convertible life insurance can be a suitable choice.

- The conversion options offered by the insurer:Different insurers offer various conversion options, including the conversion ratio, the period during which you can convert, and the types of permanent policies available for conversion. Carefully review these options to ensure they align with your future needs and financial goals.

Choosing the Right Type of Policy and Conversion Options

The type of convertible life insurance policy you choose and the conversion options available can significantly influence your financial outcomes. Understanding the key differences and factors to consider will help you make the right choice.

- Term life insurance with a conversion option:This is the most common type of convertible life insurance. It offers temporary coverage for a specific period, usually 10, 20, or 30 years. You have the option to convert the policy to a permanent policy within a specific timeframe, typically before the term expires.

The conversion ratio determines the premium you’ll pay for the permanent policy.

- Conversion ratio:The conversion ratio is a crucial factor to consider. It reflects the amount of permanent coverage you’ll receive for every $1,000 of term coverage you convert. A favorable conversion ratio ensures you get a substantial amount of permanent coverage at a reasonable premium.

For example, a conversion ratio of 1:1 means you’ll receive $1,000 of permanent coverage for every $1,000 of term coverage you convert.

- Conversion period:The conversion period specifies the timeframe within which you can convert your term life insurance policy to a permanent policy. This period typically ranges from a few years to the entire term of the policy. It’s essential to choose a policy with a conversion period that aligns with your long-term financial plans.

For example, if you anticipate needing permanent coverage in 10 years, ensure the conversion period extends beyond that timeframe.

Convertible Life Insurance vs. Other Life Insurance Options

Convertible life insurance offers a unique blend of flexibility and protection, but how does it compare to other common life insurance options? Understanding the key differences and advantages of each type can help you make the best decision for your needs.

Comparing Convertible Life Insurance to Traditional Term and Permanent Life Insurance, What are convertible life insurance policies?

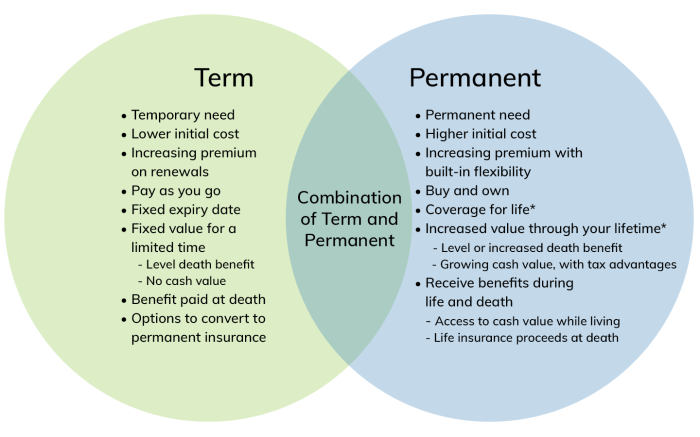

Convertible life insurance shares similarities with both term and permanent life insurance but also possesses distinct characteristics.

- Term Life Insuranceprovides coverage for a specific period, typically 10, 20, or 30 years. If you die within the term, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you no longer have coverage.

Term life insurance is generally the most affordable option, making it suitable for temporary needs, such as covering a mortgage or supporting a young family.

- Permanent Life Insurance, on the other hand, offers lifelong coverage. This means that your beneficiaries will receive a death benefit regardless of when you pass away. Permanent life insurance policies also build cash value, which you can borrow against or withdraw. While permanent life insurance offers greater security and potential for wealth accumulation, it is generally more expensive than term life insurance.

- Convertible Life Insurancebridges the gap between term and permanent life insurance. It provides temporary coverage like term life insurance but offers the option to convert to permanent life insurance without undergoing a medical exam, regardless of your health status at the time of conversion.

This flexibility allows you to lock in a guaranteed rate and avoid potential health issues that could hinder your ability to qualify for permanent life insurance later.

Advantages and Disadvantages of Each Option

Each type of life insurance offers unique advantages and disadvantages, which can be summarized as follows:

| Type | Advantages | Disadvantages |

|---|---|---|

| Term Life Insurance |

|

|

| Permanent Life Insurance |

|

|

| Convertible Life Insurance |

|

|

Choosing the Most Suitable Life Insurance Solution

The best life insurance option for you depends on your individual circumstances, including your age, health, financial situation, and insurance needs. Consider the following factors:

- Your financial goals and priorities: If you have a limited budget and need temporary coverage, term life insurance may be the most suitable option. If you prioritize long-term coverage and potential wealth accumulation, permanent life insurance might be a better choice. Convertible life insurance provides flexibility for those who are unsure about their future needs.

- Your health status: If you have pre-existing health conditions, convertible life insurance can be advantageous as it allows you to lock in a guaranteed rate and avoid potential health issues that could affect your eligibility for permanent life insurance later.

- Your age and family situation: Younger individuals with families may benefit from term life insurance due to its affordability. Older individuals with established financial security may prefer permanent life insurance. Convertible life insurance can be suitable for those who are unsure about their future needs and want to maintain flexibility.

Wrap-Up: What Are Convertible Life Insurance Policies?

Convertible life insurance is a versatile financial tool that provides a bridge between the temporary coverage of term life insurance and the permanent protection of whole life insurance. It offers flexibility, adaptability, and the potential for cost savings. By understanding the intricacies of convertible policies, you can make informed decisions about your life insurance needs and ensure you have the right coverage for every stage of your life.

Helpful Answers

How does the conversion process work?

Converting a term life insurance policy to a permanent policy usually involves contacting your insurance provider and requesting the conversion. The insurer will typically require a medical exam and may adjust your premium based on your current health and age.

Are there any limitations on conversion?

Yes, convertible policies often have limitations, such as a specific timeframe within which you can convert, a maximum age for conversion, and potentially higher premiums compared to purchasing a permanent policy directly.

What are the key considerations when choosing a convertible policy?

When selecting a convertible life insurance policy, it’s crucial to consider your current and future life insurance needs, your budget, the conversion timeframe, and the potential impact on premiums.

Is convertible life insurance right for everyone?

Convertible life insurance isn’t a one-size-fits-all solution. It’s best suited for individuals who anticipate their life insurance needs changing over time and want the flexibility to adjust their coverage.